-

REITs Outperform in the Long Run (Source: Morningstar)

For timeframes of more than ten years, REITs produced a higher net total return than opportunistic, value-added, or core private equity real estate funds.

-

Net Total Returns of Equity REITs and Private Equity Real Estate Funds (Source: Morningstar). Compound net total returns for periods ending December 2009

Over the course of the full real estate cycle, REITs produced a cumulative net return of 801 percent (13.4 percent annualized), exceeding the performance of core, value added and opportunity real estate funds.

-

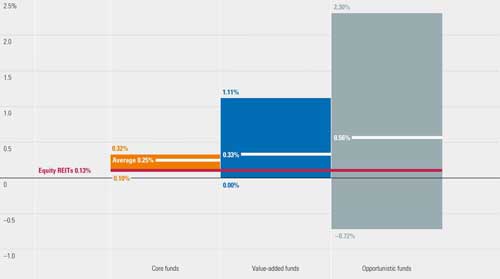

REIT Fees and expenses are lowest (Source: Morningstar)

Between 1989 and 2009, publicly traded REITs had average quarterly fees and expenses of 0.13 percent, compared with 0.25 percent for core, 0.33 percent for value-added, and 0.56 percent for opportunistic funds.

-

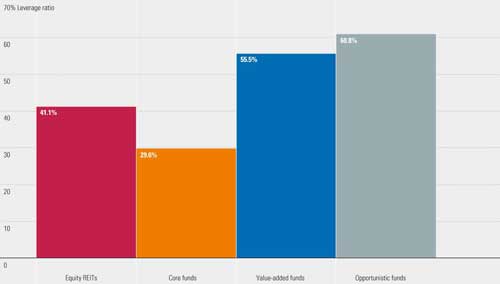

Leverage ratios as of Sept. 30 2010 (Source: Morningstar)

As of Sept. 30, 2010, REITs operate with less leverage than value-added and opportunistic funds. Higher leverage at value-added and opportunistic funds produced more volatility that was not always compensated by higher returns. Core funds had the lowest leverage, but also the lowest returns over the full real estate cycle.