By John Worth, Executive Vice President, Research & Investor Outreach, Nareit

July 2022

In this mid-year review and outlook, Nareit’s research team reviews the macroeconomic environment, REIT returns and operational performance at the halfway point of the year, including REIT historical performance during periods of high inflation, a new dimension of portfolio diversification, and insights on the evolution of REIT ESG activities.

The first half of 2022 has brought increased concerns about a slowing economy, inflation, and rising short- and long-term interest rates. The year has seen geopolitical risks increase and as a result of this climate, energy and food prices have risen. At the same time, the Federal Reserve is normalizing monetary policy and attempting to dampen inflation.

Disruptions to energy and food production and supply chain issues continue to drive inflation. CPI rose 9.1% over the 12 months through June 2022, and the core CPI (excluding food and energy) increased 5.9%. Concerningly, price increases in other services, which largely reflect labor costs, are continuing to rise suggesting that energy, food, and supply chain related inflation may be propagating throughout the economy.

Economists are increasingly skeptical that a soft landing is feasible; consensus growth forecasts for 2022 have fallen by one-third since January, while the probability of recession has more than doubled to over 35%. While labor markets continue to look strong with 2.7 million jobs created over the past three months and 1.7 job openings per unemployed worker, consumer sentiment is negative and retail sales are starting to sag reflecting high energy prices and concerns about the economy.

REIT and Commercial Real Estate Performance in Transition

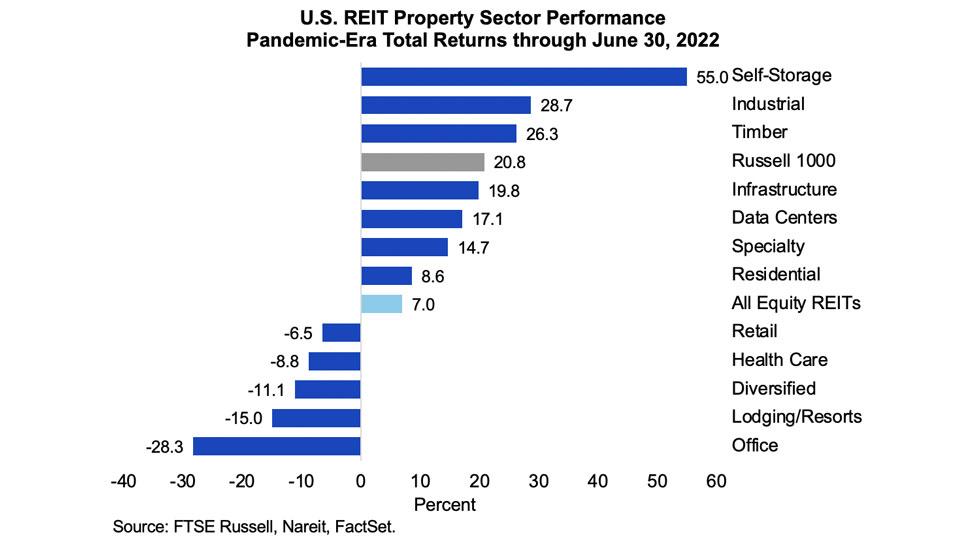

Heading into a period of slower growth, high inflation, and significantly higher interest rates, we see REITs as well positioned for strong relative performance and stability.

Stock performance has reflected the deteriorating economic outlook. Through June, the Russell 1000 was down nearly 21% and REITs were leading the broader stock market by about 175 bps. In the face of this increasingly pessimistic outlook, REITs have continued to post impressive operational results with record high earnings in the first quarter and extremely resilient balance sheets.

REITs Support Completion Portfolios with Increased Returns and Lower Volatility

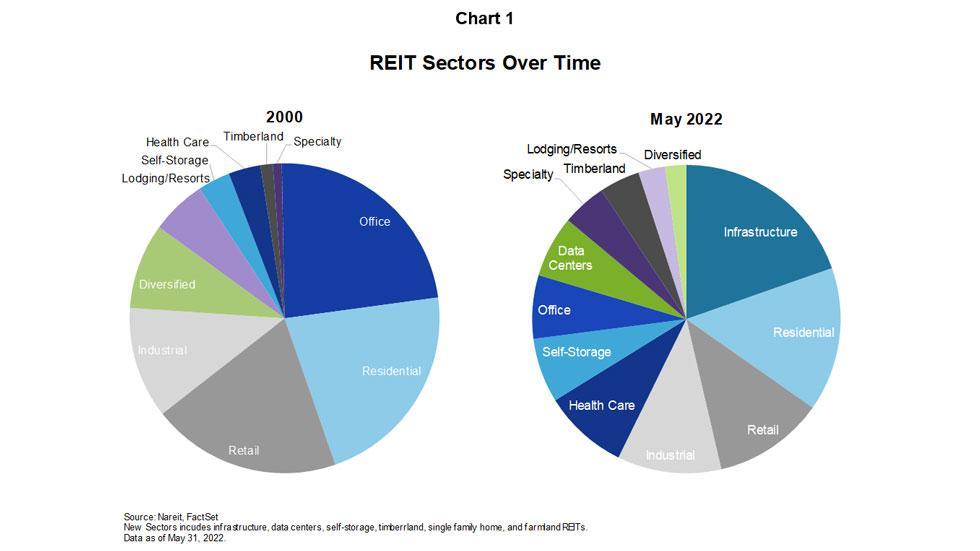

Access to new and emerging property sectors has given rise to an important new dimension of portfolio diversification, one in which REITs are well positioned.

In this mid-year report, Nareit’s research team also discusses an important new dimension of portfolio diversification and the increasingly important role REITs are playing in completion portfolios as institutional investors are using REITs to gain access to new and emerging property sectors.

REIT ESG Performance and Disclosure Improvements

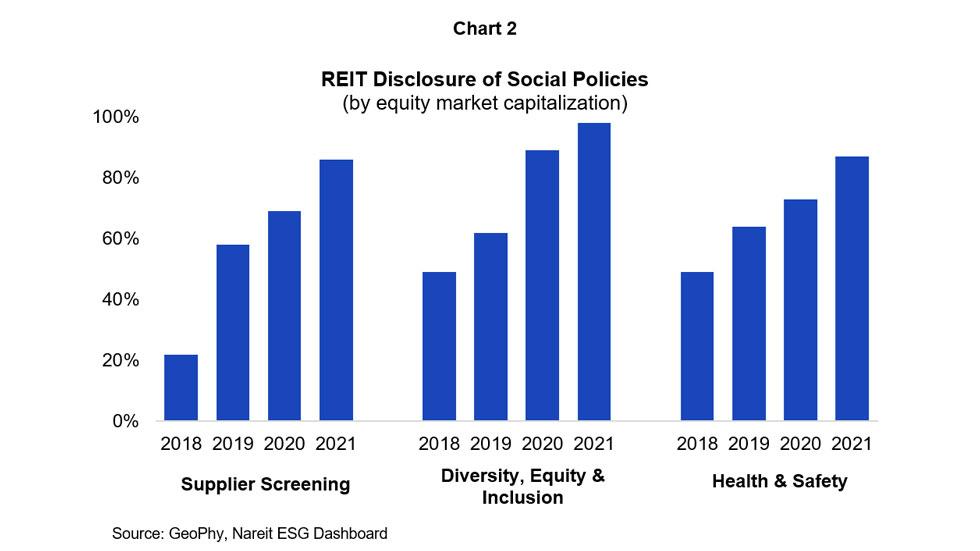

REITs are making great strides in ESG by working to enhance ESG data and disclosure.

ESG continues to be a key emerging theme in institutional investor decisions. Over time, ESG may come to be understood as a REIT comparative advantage. In this review, we provide some insights on the evolution of REIT ESG activities and how REITs have improved their ESG performance over the past several years.