The Nareit Foundation launched the Nareit Hawaii Community Giving Initiative in 2018 to support affordable housing and family focused programs. In more than four years, the Nareit Foundation initiative has given nearly $2 million statewide.

The Nareit Foundation recently undertook a significant expansion of its mission with the launch of the Dividends Through Diversity Giving Campaign and Grant Program that raises funds from Nareit members in support of organizations, initiatives, and programs that will help create a more diverse REIT and publicly traded real estate industry.

Dividends Through Diversity Giving Campaign and Grant Program

The Nareit Foundation’s Dividends Through Diversity (DTD) Giving Campaign demonstrates the collective commitment to advance diversity within the REIT and publicly traded real estate industry while complementing and compounding the impact of individual companies' efforts in similar areas.

Funds raised through this campaign support non-profit organizations whose national programs focus on educating and creating opportunities for diverse individuals and businesses in the areas of employment, entrepreneurship, and investment education.

Nareit Hawaii Community Giving Initiative

The Nareit Hawaii Community Giving Initiative of the Nareit Foundation, supported by REITs that invest in Hawaii, is dedicated to forward thinking programs that are creating affordable housing solutions and improving the quality of life for families statewide.

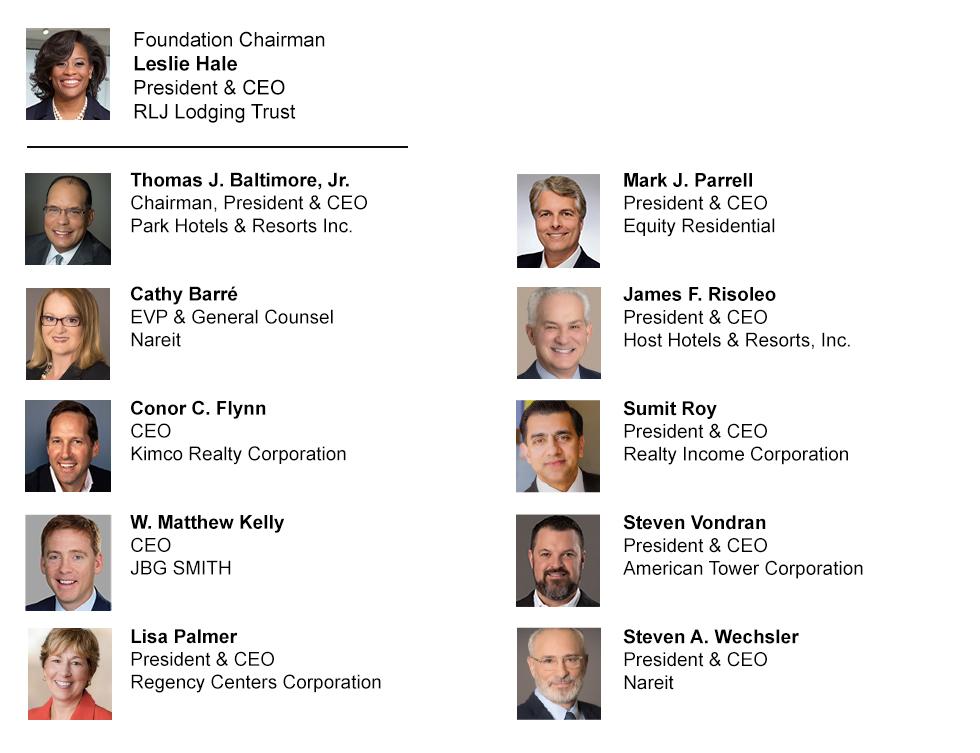

Nareit Foundation Leadership

The Nareit Foundation is recognized by the U.S. Internal Revenue Service as a 501(c)(3) tax-exempt charitable organization; donations are accepted from both U.S. and non-U.S. donors; contributions to the Nareit Foundation from U.S. donors may qualify for charitable deductibility under U.S. federal income tax laws.

The Nareit Foundation is recognized by the U.S. Internal Revenue Service as a 501(c)(3) tax-exempt charitable organization; donations are accepted from both U.S. and non-U.S. donors; contributions to the Nareit Foundation from U.S. donors may qualify for charitable deductibility under U.S. federal income.