Nareit commissioned EY to estimate the current economic contribution of all U.S. REITs (including public listed, public non-listed, and private REITs) in the United States.

Download the complete study.

Download the one page overview.

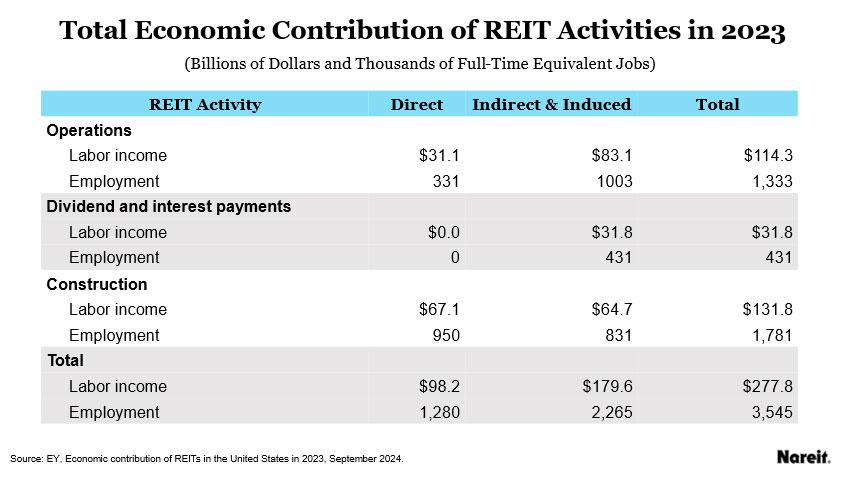

- The total economic contribution of U.S. REITs in 2023, the most recent year of complete information, was an estimated 3.5 million full-time equivalent (FTE) jobs and $278 billion of labor income. The total economic contribution, or “footprint,” of REITs consists of the direct operations of REITs and related businesses in the U.S., as well as the impacts from dividend and interest payments by REITs and REIT property improvement and construction investments. The U.S. economic contribution of REITs extends beyond the direct operations of REITs and includes the indirect contributions of their suppliers and the induced contributions of businesses supported by the spending of REIT employees, bondholders, and shareholders.

The table above summarizes the direct, indirect, and induced REIT contributions to U.S. employment activity.

- REIT operations supported 1.3 million FTE jobs and $114.3 billion in labor income.

- Capital expenditures and new construction supported 1.8 million FTE jobs and $131.8 billion in labor income.

- Dividends distributed and interest payments to investors supported 431,000 jobs and $31.8 billion in labor income.

Some key results related to REIT economic contributions in 2023 include:

- REITs directly employed an estimated 331,000 FTE employees who earned $31.1 billion of labor income in the U.S. REIT supplier purchases and spending by REIT employees supported an additional 1 million FTE jobs and $83.1 billion of earnings in the U.S. In total, the economic footprint of U.S. REIT operations comprised 1.3 million FTE jobs and $114.3 billion in labor income.

- REIT activities also resulted in the payment of an estimated $88.1 billion of interest income and the distribution of $110.8 billion of dividend income by REITs. This interest and dividend income supported 431,000 FTE jobs earning $31.8 billion of labor income through the induced contribution of re-spending by REIT bondholders and shareholders.

- REITs invested an estimated $120.9 billion in new construction and routine capital expenditures to maintain existing property. The related construction activity supported 950,000 FTE construction jobs that earned $67.1 billion in labor income. Purchases of goods from suppliers and consumer spending by construction and supplier employees contributed an estimated 831,000 FTE jobs and $64.7 billion in labor income.

Download the complete study.

Additional Resources

- Learn how this data applies to REITs in states across the country, visit REITs Across America.

- Read Nareit’s market commentary, REITs Supported 3.5 Million Jobs in 2023.