REIT Stock Performance and the Interest Rate Environment

REIT share prices, like the broader stock market, often react to changes in the outlook for interest rates, including both the short-term rates set by the Federal Reserve and the long-term rates that are governed more by market forces.

Over longer periods, there has generally been a positive association between periods of rising rates and REIT returns. This is because rising rates generally reflect improvement in the underlying fundamentals. Market interest rates typically increase during periods when macroeconomic conditions are strengthening, the same strengthening that often drives positive REIT investment performance. Strengthening macroeconomic conditions typically lead to higher occupancy rates, stronger rent growth, increased funds from operations (FFO) and net operating income (NOI), rising property values and higher dividend payments to investors.

The figure below illustrates the relationship between the four-quarter change in the 10-year Treasury yield and the four-quarter total return on the FTSE Nareit All Equity REIT Index. REITs posted positive total returns in 82% of months with rising Treasury yields over the period Q1 1992 to Q4 2022.

REITs have also outperformed broad equity indexes during many of these periods of rising interest rates. The figure below illustrates the relationship between the four-quarter change in the 10-year Treasury yield and the difference between four-quarter total return on the FTSE Nareit All Equity REIT Index and the S&P 500. This illustration reveals that REITs outperformed the S&P 500 in over half of the episodes of rising Treasury yields over the period Q1 1992 to Q4 2023.

REITs are Prepared to Perform in a Rising Rate Environment

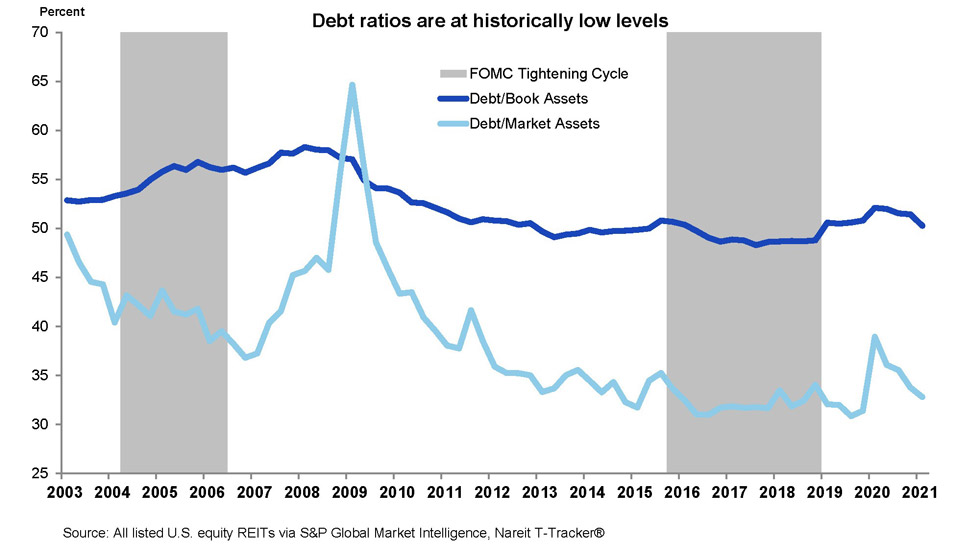

REITs have fortified their balance sheets to position themselves to continue delivering earnings growth in the event of rising interest rates. The REIT industry has continued to maintain lower leverage rates since the recovery from the Great Financial Crisis. Debt-to-book assets was at 50.3% at the end of the first quarter in 2021, holding steady through the pandemic and recovery. The pandemic lowered market values leading to small increases in debt-to-market assets as denominators shrunk. As the economic recovery lifts market values back up, leverage ratios are returning to pre-pandemic levels and debt-to-market assets was at 32.8% by first quarter end.

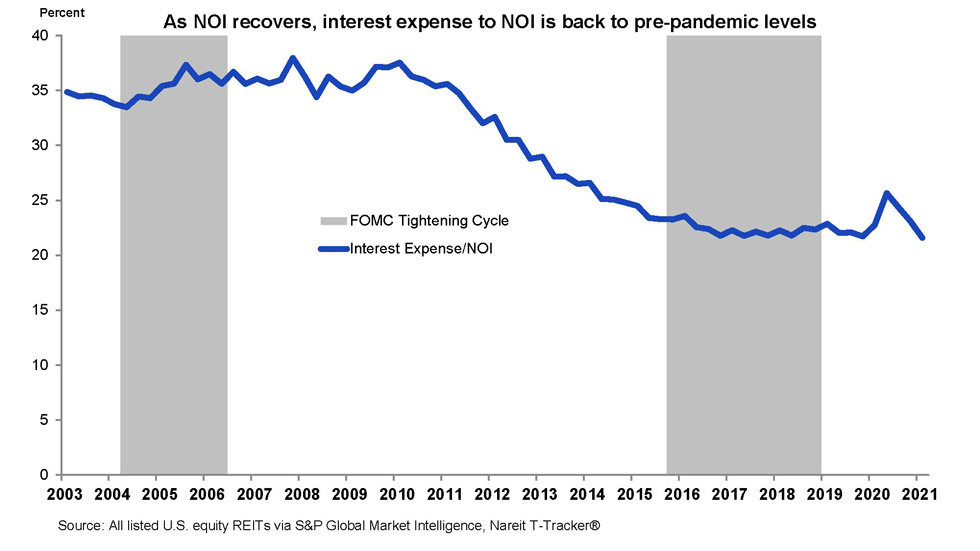

The decline in leverage means interest expense takes a smaller bite out of REITs’ earnings. Interest expense was 21.6% of net operating income in the first quarter of 2021, down from 25.7 at the peak of the pandemic.

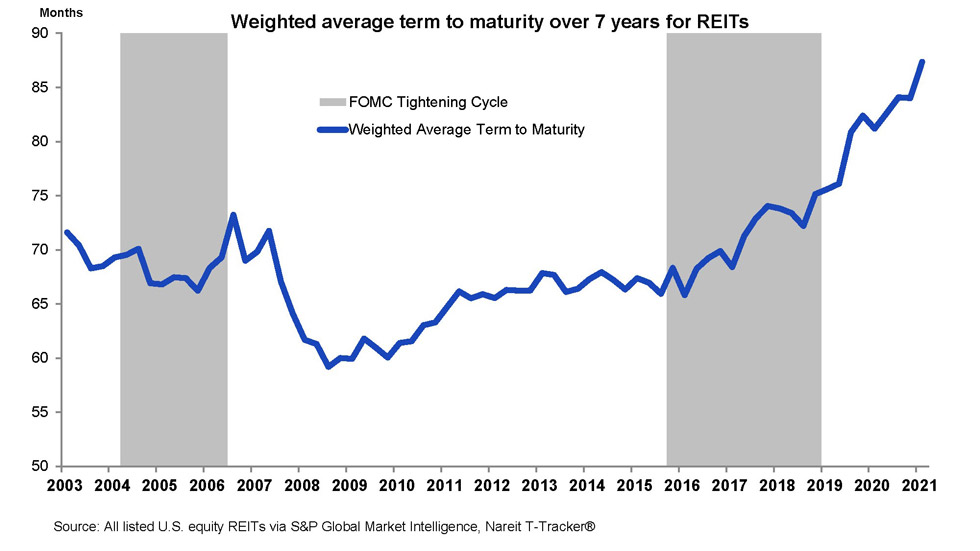

Interest expenses also are not likely to rise much as rates move higher, because most of the borrowings of REITs are fixed-rate debt. And, REITs have extended the average maturity of their debt to over 87 months, locking in these low interest rates for years to come.

Learn more about REITs and interest rates:

- In 2023, REITs Are Likely to Remain Resilient to Higher Interest Rates

- Historical REIT Outperformance Across Inflation, Interest Rate, and Economic Growth Regimes

- How Rising Interest Rates Have Affected REIT Performance

- Interest Rates, Inflation, the Stock Market and REITs: What are the Risks?

- S&P Dow Jones Indices: The Impact of Rising Interest Rates on REITs (PDF)