Americold Realty Trust, Inc. (NYSE: COLD) says two recently established partnerships are key to creating a more integrated and efficient global food supply chain and will generate extensive opportunities for the REIT to pursue external growth in the years ahead.

Americold’s collaboration with Canadian Pacific Kansas City (CPKC) to co-locate Americold warehouse facilities on the CPKC rail network, alongside its development of a global cold chain logistics platform starting in Dubai in conjunction with DP World, are expected to generate between $500 million and $1 billion in development opportunities for the REIT in coming years.

The CPKC and DP World partnerships represent a new growth avenue for Americold, adding a more holistic supply chain solution-driven growth strategy to their existing customer-centric growth strategy. “This is about building up global infrastructure through ports and rail lines and then developing services on that infrastructure that customers want, and then marketing those services,” says George Chappelle, CEO of Americold.

“One of the big things that we're trying to help solve is how you maintain cold chain integrity globally across every node in the supply chain,” adds Robert Chambers, president, Americas, at Americold.

Both partnerships had been in the works for several years and came together at relatively the same time by chance, Chappelle says. He notes that Americold is a strong partner for both DP World and CPKC because it designs, builds, owns, and operates its facilities, differentiating it from other players in the sector. “It's our suite of services, our balance sheet, our global perspective, and our desire to continue to grow externally that sets us apart.”

Port Partnership

Chambers notes that DP World is the world’s third largest port terminal operator, managing more than 80 ports globally. Under the December 2023 agreement, Americold and DP World will work together to identify opportunities where cold chain infrastructure does not exist in ports that DP World operates today. Americold will have the right of first refusal to develop that port infrastructure.

“The value proposition for DP World is that the more volume they can handle through the port, the more terminal operating fees they get. For Americold, we get a facility and our traditional storage, handling and value-added service fees associated with the volumes that come through that facility,” Chambers says. The customer, meanwhile, gets a much more efficient and reliable supply chain solution, given that almost all imported fresh or frozen food into Dubai today is air freighted in at great expense, he points out.

Through its joint venture with RSA Cold Chain, Americold will build a state-of-the-art cold storage facility with 40,000 pallet positions in the Jebel Ali Free Zone (Jafza) in the Port of Jebel Ali in Dubai.

Chambers says that Americold will be able to go to all the large food manufacturers that want to potentially enter a new geography that's either logistically or financially inaccessible today and provide them with a new solution. “Because our customer base tends to be the big blue chip food manufacturing customers, it's very compelling to them. It’s a win-win, which is pretty rare in business,” he adds.

As for how fast the partnership between Americold and DP World could grow, Chambers says the REIT would be “thrilled” if it had a facility at 10 DP World ports five years from now.

Chappelle notes that another strength of the relationship is that it doesn’t change Americold’s underwriting process in any way. If the business case doesn't pencil, Americold won’t build the property. “We've lost none of the flexibility in terms of underwriting and deciding what projects we take on or not, but we've gained all of the capability of having a knowledgeable partner everywhere we go who's in the same mode as us in terms of objectives,” he says.

Benefits of Rail

A similar underwriting agreement is in place for the Americold/CPKC partnership, formed in June 2023.

One of the key triggers of the CPKC partnership, Chambers explains, was the merger of CP and KC Southern in April 2023 that created the only contiguous rail line to connect all of North America. “It was a very fortuitous merger,” he says.

Once the merger was completed, Americold began to accelerate conversations around a potential partnership “because we recognize that rail is a great way to transport frozen and chilled product,” Chambers says.

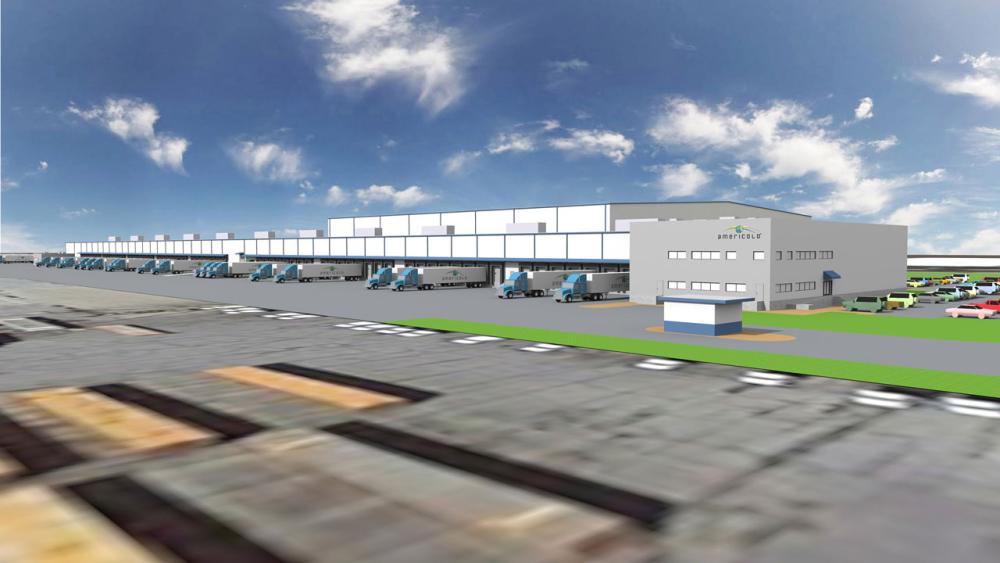

This April, Americold officially broke ground on a $127 million cold storage facility in Kansas City, which is expected to be completed in about a year. Longer term, the partnership envisions Americold building five or six temperature-controlled facilities across CPKC’s network of 30 intermodal rail yards.

“It will allow our joint customers to bring product directly to the rail line, store it in an Americold facility right there, and then put those containers directly onto CPKC's rail and transport them south into Mexico and then north from Mexico back up into the U.S., and ultimately up into Canada,” Chambers says.

At the same time, Americold is developing capabilities through partnerships with governmental agencies to pre-clear product within its facilities and avoid extra stoppage time at the border. Chambers notes that there can be as much as a three-day delay for trucks waiting to cross the border into Mexico, in part because they have to go through the customs clearance process. “Now you'll actually have a faster solution, and one that’s cheaper and more environmentally friendly,” he says.

Chappelle adds that once the partnership is up and running, “I think we'll be expanding this service almost as quickly as we implement it because it solves the problems that have been around for a long, long time.” He points out that clearing customs in Kansas City is going to be a “huge benefit to manufacturers in the U.S., Mexico, and Canada. And then having the ability to have multiple nodes in the supply chain in all three countries to store product and forward it on will, I think, literally transform not just the documentation environment but the flow of goods, which has always been disjointed and had zero visibility.”

Automation Advantage

Underlying all of Americold’s partnerships today is technology, an area where the REIT says it is breaking new ground.

Chappelle says automation has become a big push for its largest customers in the last few years, spurred by pandemic-related labor shortages, with the result that Americold has developed five fully automated facilities just in the last year.

“We're a leader in automation. We're the only company that has automated facilities on every node of the supply chain, whether it's a distribution center or a plant attached facility, or major market mixing center. And we're the only ones to have implemented retail automation in our peer set,” Chappelle says.

Chambers points out that retrofitting existing facilities to become automated is possible to a limited extent. That process involves looking at ways to add automated guided vehicles instead of manned forklifts into facilities or putting conveyor systems into a conventional facility, or automating portions of the work content such as individual case picking or layer picking.

From a new build perspective, Americold has to assess whether automation makes sense given the particular location and use of the facility. If the land is expensive, it is logical to build higher, making automation a good fit. In the case where a facility is used for a commodity that’s harvested once a year, with only a small staff, then automation isn’t the answer.

“It’s key analytics to make sure you provide the customer with the right overall solution from an automation standpoint. It'll be a big part of our growth strategy, but it doesn't suit every single building,” Chambers says.

As for internal technology, Americold has recently invested in new Enterprise Resource Planning (ERP) infrastructure, Chappelle notes. It covers billing, human resources, maintenance management, general accounting forecasting, and financial planning, and was recently implemented across the Americas and Asia-Pacific. It will be introduced in Europe early next year.

“As we changed the processes, we became much more efficient months before the system became live. We’re really bullish on the fact that we were able to save a significant amount of money before the system was even turned on,” Chappelle says.

Enduring Customer Relationships

As he reflects on Americold’s latest partnerships, Chappelle is also keen to highlight the strength of the existing customer-centric partnerships that have formed the backbone of the REIT’s enduring success. Many of Americold’s relationships with its top customers, who are often in multiple facilities, go back 30 years or more.

“These partnerships are minute by minute, hour by hour, with product flowing out of their facilities through our facilities to their customers. Partnership isn't strong enough of a word at that point. We're literally an extension of their business. Those partnerships are so deep because we both need each other very, very badly to be successful,” Chappelle says.

Looking ahead, Chappelle underscores the benefits the new partnerships will bring to the long-standing challenges of burdensome documentation, lack of visibility during the transportation process, and the absence of true end-to-end infrastructure. At the same time, there is the distinct advantage of lowering risk through collaboration.

“We're entering a market with a knowledgeable partner who's been operating there for years. They have customer experience and first-hand knowledge of the geopolitical environment in that area,” he says.

Chappelle is also keen to stress that these are not static partnerships. “We want to grow with them. I really think that it's going to provide a very nice runway for us over the next three to five years.”