Four Corners Property Trust, Inc. (NYSE: FCPT), which spun off from Darden Restaurants Inc. in November 2015, sees significant external growth potential in the fragmented restaurant real estate sector, according to CEO Bill Lenehan.

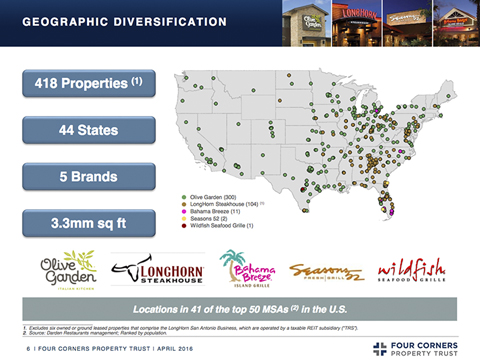

At the time of the spinoff, the triple-net lease REIT’s portfolio included 300 Olive Garden restaurants, 104 LongHorn Steakhouse restaurants, 11 Bahama Breeze restaurants, two Seasons 52 restaurants and one Wildfish Seafood Grille restaurant.

FCPT assembled its acquisitions team this summer and began adding to its portfolio, including the recent acquisitions of six Pizza Hut restaurants, four Kentucky Fried Chicken restaurants, two Arby’s restaurants, three Buffalo Wild Wings restaurants and one Wendy’s restaurant.

Before moving to FCPT, Lenehan served as a member of Darden’s board of directors. He was chair of its real estate and finance committee and a member of its corporate governance committee. Lenehan spoke to REIT.com about the potential to grow beyond its core brands, as well as the unique nature of the spinoff from Darden.

REIT.com: What differentiated FCPT from other spinoff transactions?

Bill Lenehan: In most cases where there’s a spinoff transaction, the goal is to make the spinoff as large as possible. We didn’t have that goal. Because we were going to have a single tenant, we recognized that the larger we were, the more difficult it would be to diversify. Our focus was on quality, not quantity.

Additionally, most spins result in greater combined debt for the pro forma companies than before the transaction. Darden’s debt went from $1.5 billion to under $500 million, and our company was capitalized with $400 million of debt. Our spin was unique because it was de-leveraging.

Lastly, we also positioned FCPT to have very significant acquisition capacity under our revolving credit facility. Many spinoffs are capitalized in a way that’s efficient for the spinoff transaction, but leaves the company with very little flexibility and room to grow.

REIT.com: Darden had more than 1,500 restaurant properties. Why did you decide to spin out with only 418?

Lenehan: We certainly could have created a much larger company had we wanted to, but we felt the size at [the time of the spinoff], the number of assets and the level of rent established a very durable competitive advantage.

REIT.com: What does your investor base look like today?

Lenehan: Ten months after the spin, our investor base looks very similar to large, established REITs. That speaks to the fact that we have an attractive and focused portfolio with modest rents and low leverage. Getting those factors right as part of the spin allows us to have the long-term dedicated REIT investor as our primary shareholder.

REIT.com: How would you characterize FCPT’s strategy?

Lenehan: Our strategy is to focus on the restaurant industry and to acquire well-located restaurants operated by large and growing franchisees or corporate brands with leases that are backed by entities with strong credit.

There are 200,000 branded restaurants in this country. You can look at where the large franchisees are growing, and it’s a very strong growth path. The top 200 restaurant franchisees in the last six years have gone from under 17,000 units to over 25,000 units.

REIT.com: What types of restaurants are you focusing on?

Lenehan: Today, our portfolio is predominantly casual-dining Italian with Olive Garden and casual-dining steak with LongHorn. As we diversify within casual-dining restaurants, our preference would be to move outside of Italian and steak and into varied-menu restaurants, such as Applebee’s.

What you’ve seen in our initial acquisitions—and what we intend to continue—is a focus on quick-service restaurants (QSR). At spin, we had no QSR representation, a significant subsector of the restaurant industry. Additionally, Taco Bell, Pizza Hut, Burger King, et cetera are 75 to 80 percent franchisee operated, which presents a major opportunity for FCPT. Over a long period of time, we want to be more representative of the overall restaurant landscape in this country, not just casual dining.

REIT.com: And how is the competition for assets?

Lenehan: We compete with other REITs, but because we aren’t as big, we can be pretty nimble at the small end of the market. We also compete quite often against individual buyers accessing the 1031 tax exchange market. The average QSR is $1.5 million, so there’s a lot of competition in the one-off market. We certainly do one-off deals, but quite often we’re buying small portfolios between 2 and 10 properties.

REIT.com: How much attention do you pay to prevailing consumer trends?

Lenehan: When we sign a lease, it’s typically 15 to 20 years. So, while we focus significant resources on knowing what’s going on in the restaurant space, you won’t see us overreact to current trends.

The most important trend for us overall is the professionalization of the franchise business and that there’s consolidation to make these companies bigger and more valuable, with better credit. We would favor a Burger King over a small brand that might have a lot of white space to grow.

Many of the sophisticated restaurant companies realize that separating the restaurant business from the franchise business is sensible. Because real estate is very capital intensive, it’s better to have your real estate owned by a REIT that has tremendous access to capital and then take the valuable resources you have as a restaurant company and focus them solely on the operations.