REITs in India have a relatively short history, but they have fundamentally altered the trajectory of real estate investment in the country, says Ritwik Bhattacharjee, chief investment officer at Embassy Office Parks REIT (NSE: EMBASSY, BSE: 542602).

“We’re only five years old as an asset class in an emerging country. In that time, despite a pandemic and market interest rate volatility, we’ve produced four REITs which continue to perform impressively and are managed extremely well,” Bhattacharjee says.

Embassy REIT, India’s first publicly listed REIT, is a founding member of the Indian REIT Association (IRA), along with Brookfield India Real Estate Trust (NSE: BIRET, BSE: 543261), Mindspace Business Parks REIT (NSE: MINDSPACE, BSE: 543217), and Nexus Select Trust (NSE: NXST / BSE: 543913).

Bhattacharjee, whose career includes more than 12 years as an investment banker during which time he worked on numerous REIT and real estate capital markets and advisory transactions in the United States and Asia, spoke with REIT.com about the current and future state of REITs and real estate investing in India.

What’s the history of REITs as an asset class in India and what does the future hold?

The origins of floating REIT shares in the markets in India traces back to the mid-2000s, following the emergence of REITs in Singapore. However, it was only in 2014 that the Securities and Exchange Board of India (SEBI) introduced the regulatory framework for REITs.

Embassy REIT was the first REIT to list in 2019. The listing of a then 33 million square foot marquee office portfolio in one of India’s gateway office markets created a significant milestone that provided Indian investors with a unique opportunity to invest in income-generating commercial real estate assets for as little as one share.

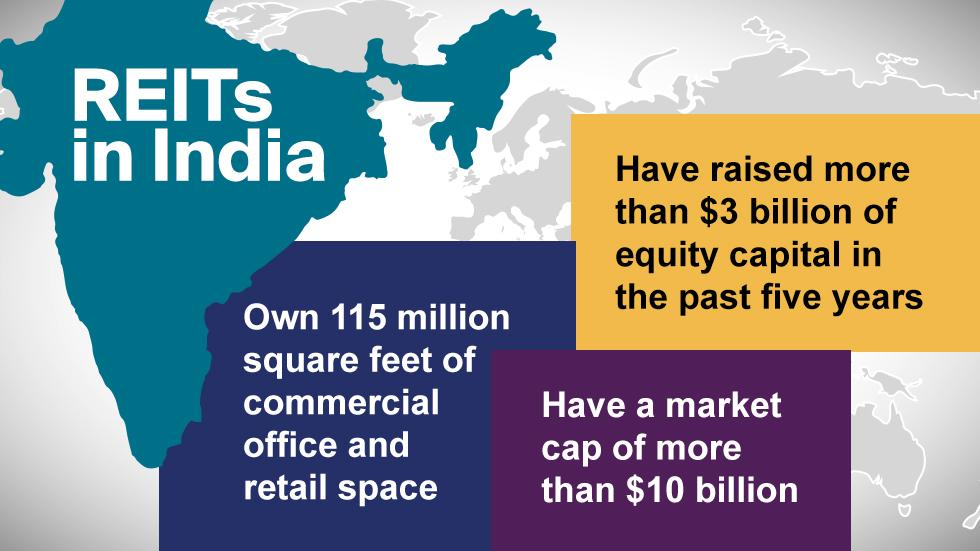

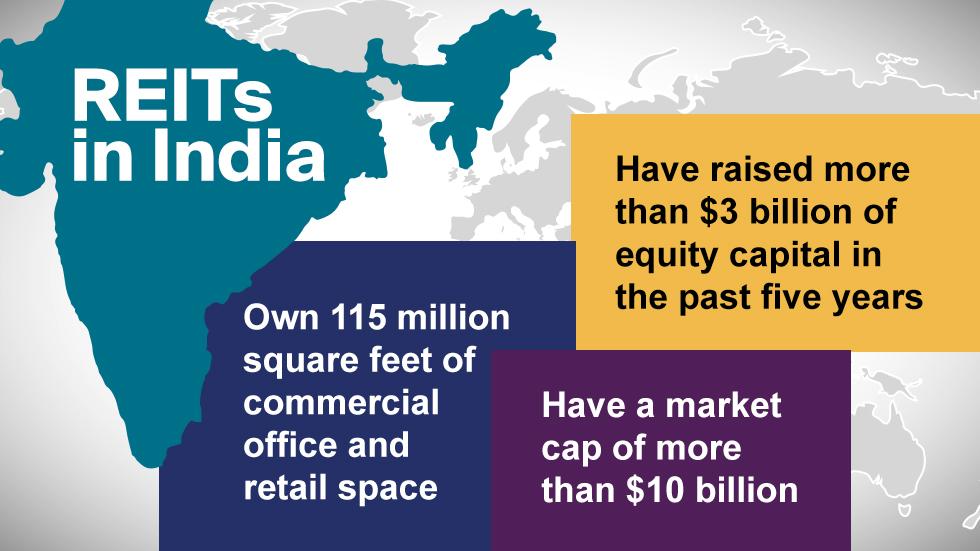

The successful listing and subsequent outperformance of Embassy REIT paved the way for more REIT launches in India. We've got three other listed REITs as of 2024. Together, REITs in India own 115 million square feet of commercial office and retail space and comprise a market cap of over $10 billion. In just five years, the four REITs have distributed nearly $2 billion, and have raised over $3 billion of equity capital through primary issuances, including initial listings and follow-on offerings.

In a short time, we’ve seen a lot of growth in the sector. India is obviously a very attractive investment destination, and the ability to generate rents from sectors such as office and retail and pass them onto shareholders in the form of distributions bodes well for Indian REITs.

In addition, regulatory authorities like SEBI are continuously refining and enhancing the regulatory framework for REITs to foster more transparency, investor protection, and market efficiency. The regulations mirror global REIT standards, and we are mandated to be very cautious on leverage. For example, Indian REITs are only allowed to lever up to 49% of the company’s portfolio value.

How are the sectors in which the four Indian REITs operate performing?

Presently there are three office REITs and one retail REIT. Office spaces and retail have been the primary focus of Indian REITs, with most of our portfolios comprising income-generating commercial properties leased out to tenants. Overall, there are800 million square feet of office space in India, and while not all of it qualifies as Grade-A, we do think there is ample opportunity for REITs to add to their portfolios over time.

Office in India is booming, based on unprecedented demand as India continues to attract global capability centers from major companies worldwide. We’re seeing pre-pandemic levels of office absorption, with major office markets like Bengaluru, Delhi, Mumbai, and Hyderabad continuing to attract bellwether global companies.

The same goes for retail malls. Nexus REIT is a prime example of a stable portfolio with embedded growth potential. It’s an ideal introduction to how the retail sector can monetize India’s rising consumer spend into a secure, cash-generating instrument for the very same people who frequent malls and have multiple outlets to spend their rising disposable income.

What are some of the challenges of managing a REIT in India?

REITs are permanent capital vehicles that rely heavily on the financial markets to finance growth. In developed markets, like the U.S., REITs can readily raise equity and debt at will.

Indian REITs have been able to access equity markets and have the best creditworthiness in the real estate sector, but the capital markets for Indian REITs are still evolving. For equity, we need to issue a prospectus and run a process much like an IPO. It’s a slower equity capital formation process in India, so REITs have to be extremely judicious about raising equity to fund growth.

Additionally, debt costs are also higher than established REIT markets like the U.S., Singapore, Japan, and Australia. India has always been a nominally higher interest rate environment. We currently fund at around 8% to 8.5%, whereas other REITs in mature markets, even in an elevated interest environment, fund at around 5% to 6%.

It speaks to the pedigree of Indian REITs that despite macro volatility and the evolution of the markets, our access to capital continues to be strong, and that the creditworthiness of REITs has enabled us to raise debt capital at perhaps the tightest spreads in the industry.

A second major challenge is obviously investor awareness. There’s a general sense that REITs are quasi-debt instruments more akin to bonds or fixed deposits and completely uncorrelated with equity. In reality, they are merely high dividend paying stocks with exposure to the economic cycle, and armed with ample growth levers like rent escalations, accretive development, and the ability to inject growth via acquisitions. That’s how we run our businesses, and that’s what we’re constantly telling our investors and other stakeholders, like our lenders and regulators.

The newly formed IRA will play a critical role in working with regulators and both debt and equity investors to deepen the capital markets, as well as educate stakeholders on REITs. Both are top priorities for the IRA.

What are the catalysts driving India’s REITs?

We’re confident the market will continue to open for Indian REITs, the cost of capital will decrease, and distributions will grow.

We’re entering a new investment climate for India. The growth vectors we’re witnessing in sectors like office and retail, coupled with the steady flows of funds into financial asset classes by Indians, are already finding their way into REITs.

The benefits of the REIT structure for a country like India, with its growth tailwinds, are enormous and far outweigh the near term costs. For asset owners, as we’ve seen, they have created tremendous value, permanent capital vehicles that can and do access the markets, and they have grown over time.

For investors, REITs provide organization and transparency to a previously fragmented and chronically illiquid commercial real estate sector. Investments in office assets tended to be driven by fractional ownership, which tended to be opaque, short on disclosure, and very hard to exit.

Tellingly, Indians also love dividends or distributions. The idea that commercial real estate can pay out a 7% to 8% dividend has propelled the growth of retail investment in the asset class quite sharply.

In India, we’ve gotten a lot of praise from global investors for building a REIT structure that allows investors to invest quite easily. Our investor universe spans global mutual funds, sovereign wealth funds, global pension funds, endowments, hedge funds, among other investors. Domestically, we have domestic mutual funds, insurers, family offices, and 200,000 retail investors in our shareholder registers who are continuously adding exposure.

In some ways, a successful REIT regime is a litmus test for a country’s capital markets and financing regime, and I think India’s regime successfully passes that test.

The discipline with which REIT managers run their businesses, quarter after quarter, despite market dislocations, has been a huge boon for investors. There’s a real sense of satisfaction in institutionalizing the asset class and building a real estate product this country desperately needs.

Do you view the Indian REIT market as an alternative to China?

Structurally, both India and China are very different REIT markets. Indian REITs cater more to office and retail, whereas China has more of an infrastructure-focus in its REITs, with warehousing, toll roads, industrial parks, and public utilities forming the mainstays of the REIT universe, although we do understand there is more of a consumption-oriented mandate such as shopping malls, and supermarkets that have been approved. India’s infrastructure trusts (‘InVITs”) assume the mantle of some of these C-REIT infrastructure mandates.

Indian REITs have performed quite resiliently, and both office and retail are sectors that are doing well. The Chinese property sector is clearly volatile at the moment, and C-REITs haven’t been immune to the sell-off that Chinese developers are experiencing.

What other sectors could become REITs in India?

Currently, only offices and malls can deliver sustainable rents. Over time, we do expect that to change, but currently the near term bet would still be office and retail.

The office sector in the U.S. is evolving due to remote working. Is this trend affecting India’s office REITs too?

India’s young demographic dictates the importance of a physical office space, which has only become more pronounced over the last two years. Offices are extremely important for young professionals as they provide opportunities for culture, career, and collaboration. The average Indian employee in office parks is aged between 25 and 35. Many live with their parents or in shared housing in environments not conducive to working from home.

Also, office rents are much cheaper in India than in developed office markets. Leading Indian office markets such as Bangalore or Mumbai run at $1 to $4 per square foot per month, whereas Singapore, Hong Kong, and New York could fetch double-digit rents.

So, while hybrid still exists, it simply cannot be thought of as a substitute for the office. We’re seeing more and more senior managers ask employees to return to the office. Physical occupancy levels are working their way up to 60% to 70% across cities, and we believe it will continue to grow.

What do you think the role of the IRA should be?

The IRA was formed to mirror what Nareit does for U.S. REITs. We’re much smaller in our membership and scope, but we work ceaselessly to smooth out the regulatory regime and we provide the best platform for investors to better understand REITs and build a well-rounded portfolio of financial assets.

Nareit estimates 170 million Americans have exposure to REITs, on a base of approximately 350 million people. We have a population of more than 1.5 billion, and even if you take the investable class at half that, it’s still over two times the entire U.S. population—with only a fraction of those who are actually investing.

The financialization of India’s savings from bank deposits and physical assets is only going to grow. There is a vast pool of untapped new capital that’s entering the market, and we’re primed to take advantage of that.