While the macroeconomic outlook for the real estate sector will remain uncertain in 2023, especially in the first half, REIT returns could start to see a rebound during the year, particularly if the economy manages a soft landing instead of a recession, investment bankers say.

Strong REIT balance sheets put the sector in a strong position to deploy capital in 2023, bankers told REIT.com. Meanwhile, REIT debt and equity issuance is expected to improve, and IPO activity, along with an uptick in mergers and acquisitions (M&A), is also a possibility later in the year, they say.

REIT.com spoke with:

Ernest Kwarteng , Managing Director, Barclays

David Lazarus , Managing Director, Eastdil Secured

Noel Purcell , Managing Director, Head of Real Estate Banking at Mizuho Americas.

Stephan Richford , US Group Head, Real Estate Investment Banking, BMO Capital Markets

Seth Weintrob , Managing Director, Global Head of Real Estate, Morgan Stanley

What is your general outlook for REITs and commercial real estate in 2023?

Ernest Kwarteng : After an incredibly challenging 2022, I expect 2023 to be a year of two halves. The first half of the year will continue to be heavily influenced by the pace and magnitude of the Federal Reserve rate hikes. Thus, activities in the first half will be choppy. Once there is a pause in the upward Fed rate hikes or even a moderation in the rate of hikes, I expect capital markets to strongly rebound in the second half and drive up corporate activities.

David Lazarus : The economy and capital markets are sending slightly different signals as we open the year. The economy continues to be strong, but rates are cyclically high. While property values and REIT prices have been declining, 2023 should see the beginning of a rebound, especially in the public markets, which tend to be a forward indicator. We continue to focus on the actions of the Fed as this has been an important predictor in past cycles. Importantly, when the Fed begins easing again, the market usually responds.

Noel Purcell : The pressing question at hand is whether there will be a hard recession or not? Will the number of employed Americans significantly reduce or will we see the continuation of current “full employment”? These and associated macro questions will drive the real estate market in 2023.

In general, assuming a relative soft economic landing, we believe we will see more of the same as we saw in late 2022, with overall liquidity continuing to be relatively restrained. However, we are already seeing green shoots of promise early in the year with properly managed balance sheets. We expect liquidity, at the right price, will also be there for the more leveraged counterparts as well.

Stephan Richford : All asset classes are going through a recalibration process given the moves by Federal Reserve banks to curb inflation. That said, listed REITs and commercial real estate, in general, are much better capitalized than during the beginning of the great financial crisis. This does not mean real estate equity values have not been impacted, but overall, the real estate sector should weather the storm and be in a position to be able to capitalize on opportunities as the debt markets stabilize.

Seth Weintrob: Private real estate is in the midst of being repriced to account for a new environment in which we will have higher interest rates and a near term growth outlook that is less robust than the last couple of years, which was in part driven by the emergence from the COVID shutdown and a world awash in liquidity.

I would expect assets to reprice by approximately 20% (some more, some less). While the REIT market has effectively priced that in, I expect 2023 to continue to be volatile, with a potential further leg down near term (in large part driven by the general equity market), followed by a strong rebound in the back part of the year.

After a rapid rise in interest rates last year, what are you anticipating for this year, and what impact could that have for REITs?

Weintrob: It is impossible to predict interest rates. However, the one near-certainty is that rates will rise from the near-zero levels of the recent past, and the outlook will no longer include the tailwind of declining rates that we have seen for the last four decades.

Kwarteng: The Fed raised rates seven times in 2022, including four consecutive 75 basis point hikes between June and November. That was challenging for REITs. We’re now starting to see some moderation in inflation, but I also think it’s an uphill battle for the Fed to get to its target 2% inflation rate, which could result in more aggressive hikes for a longer period, which will clearly not be conducive for real estate broadly.

Richford : Markets and decision-makers favor stability, so as the Fed approaches a terminal rate where they feel inflation has been tamed, the market will begin to price in a shift in policy. The market appears to be foreshadowing this already, but we would expect this to crystallize in the back half of this year. REITs are well positioned to take advantage of any dip in rates through hedging strategies and opportunistic refinancings.

The impact of elevated rates on transaction volumes has been evident over the last 12 months, though given public REIT balance sheets are strong, and REITs are typically less reliant on leverage than their private counterparts, we expect REITs to have an advantage in deploying capital in 2023.

Lazarus : Inflation in 2022, as well as the Fed response, were both factors that we had not seen for almost 50 years. It does appear based on recent data that the Fed’s rate increases are starting to bring inflation under control. This is again a positive sign for REITs. REITs have already traded down significantly in response to the rise in rates, so they are poised for a rebound.

The impact of elevated rates on transaction volumes has been evident over the last 12 months, though given public REIT balance sheets are strong, and REITs are typically less reliant on leverage than their private counterparts, we expect REITs to have an advantage in deploying capital in 2023.

Purcell: Our firm position is that rates will remain higher for a longer period of time than the markets seem to have priced in. We do not believe inflation can return to the Fed’s target with the labor market as tight as a 3.4% to 3.7% jobless rate suggests.

In addition, we believe it’s entirely possible that after the Fed pauses, the next policy move could well be a further tightening, not the rate cut that the market has already discounted. With this in mind, we believe the market could react to the negative in the second half of 2023, thus we are advising clients to look to access the market in appropriate windows early in the year.

Do you expect REIT debt and equity issuance to pick up this year?

Weintrob : Absolutely. I would expect debt market issuance to improve in the first half of the year, while equity issuance will likely be back-end loaded. But when the markets open up, I would expect strong volume, driven by pent-up demand.

Richford: REIT teams did a tremendous job taking advantage of the low-rate environment over the last few years. So, between limited 2023 investment grade unsecured note maturities (approximately $7 billion) and muted acquisition activity, we would expect the year to fall short of the $21 billion in investment grade unsecured notes priced in 2022. Also, the bank market is choppier than it has been in the last decade, which will make it more difficult to leverage the bank market to fill funding gaps.

We would expect equity issuance to slowly increase as we move across 2023 as interest rates stabilize. Given volatility, ATM issuance will likely be the preferred execution mode as issuers focus on being opportunistic and managing all-in costs. However, higher interest rates will continue to incentivize management teams to fund growth with equity as they look to maintain low leverage, but this is against a backdrop of lower property transaction volume.

Purcell: Once we see the backdrop for M&A become more constructive, we would expect an acceleration in debt and equity issuance. On the equity side in particular, for companies/sectors that are trading at or above premiums to net asset value (NAV) and are generally more acquisitive (i.e. net lease, gaming, industrial, single family rental, health care, etc.), we believe we will see activity throughout the year both via ATM programs and more traditional follow-ons/ bought deals. For sectors such as shopping centers, malls, and multifamily, issuance will likely be driven by accretive M&A opportunities.

Additionally, we believe private markets should correct in line with public markets, making the case for listed REITs to pursue accretive growth opportunities. Bank debt capacity could be limited, resulting in the need for bond and equity issuance to fund refinancing and/or acquisitions.

Kwarteng : I expect fairly fragmented capital markets, meaning there are going to be pockets of opportunities for issuers in certain markets. It’s clear and as is customary, the investment grade market remains open and constructive. The asset-backed securities market has been relatively resilient. On the other hand equity, CMBS, and the non-investment grade debt market are just beginning to show some positive signs of recovery. I believe those markets will pick up meaningful steam in the second half of the year.

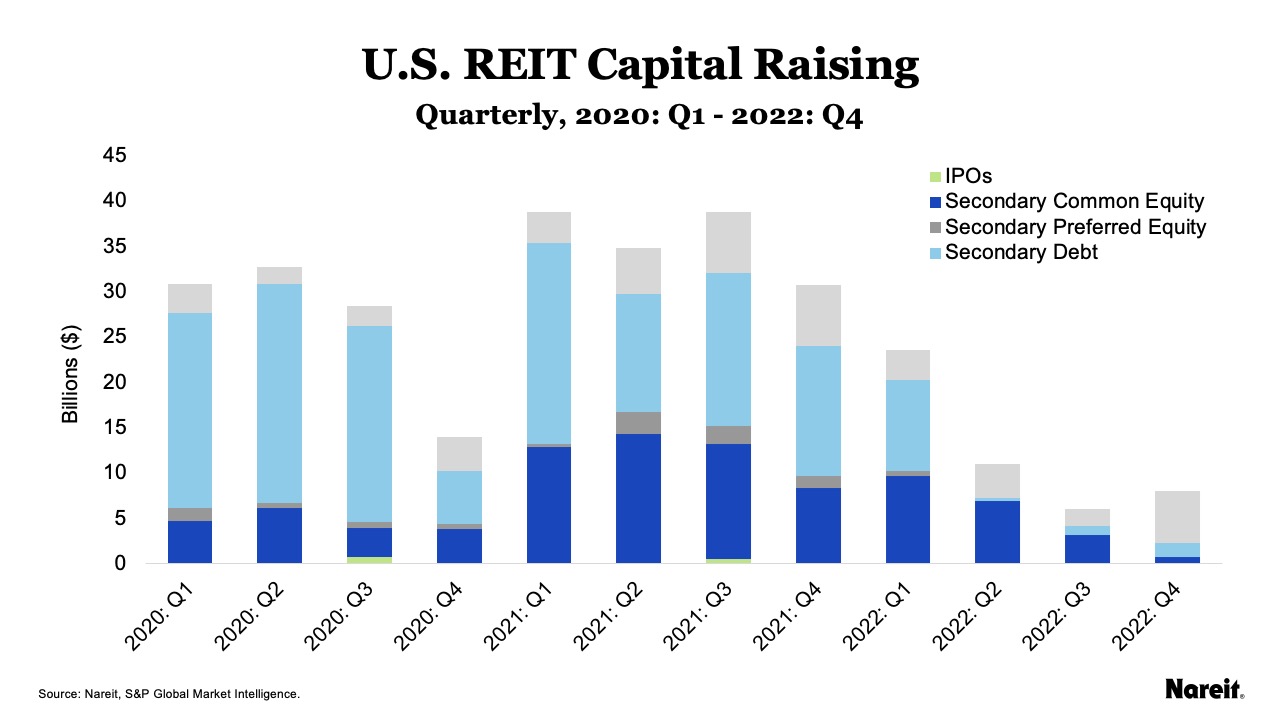

Lazarus : Even in a slow year like 2022, REITs raised over $30 billion of equity according to Nareit, although much of this came from ATM programs. However, in 2022, public, non-listed REITs also raised about $30 billion, which was a record both in this cycle and overall. This year, I expect listed REITs to return to the equity market to raise capital as prices have adjusted, and private market pricing will provide some opportunities for acquisition and growth.

REIT M&As were prevalent in the first half of 2022, but that pace slowed later in the year. Do you anticipate more M&A activity in the months ahead?

Purcell : In 2023, we expect to start seeing more movement in private market prices. With higher debt costs likely to persist through the year, as well as a very different pricing environment for CMBS refinancing, cap rates will need to rise to reflect the financing backdrop.

Since these pricing movements will take some time, we don’t expect an immediate rush of M&A (corporate level or portfolio level), but as we move toward the back half of the year, we expect activity to pick up.

With some degree of distress, this year will provide M&A opportunities for the better positioned companies. M&A volume will likely be driven by strategic REIT mergers where cost of capital deviate between acquirer and target. There can also be room for sovereigns to privatize smaller REITs that have limited access to growth capital and inferior yield due to outsized general and administrative expenses.

I believe the sectors that have exhibited most resiliency in fundamentals are poised to see meaningful M&A activity in 2023; this will include industrial, self-storage, net lease, and multifamily.

Kwarteng: Conditions in 2021 and the first half of 2022 were incredibly conducive for M&A. You had supportive capital markets, fundamentals in many sectors were very sound, valuations for sellers were attractive, and the system was flush with capital. I believe the sectors that have exhibited most resiliency in fundamentals are poised to see meaningful M&A activity in 2023; this will include industrial, self-storage, net lease, and multifamily.

Lazarus : M&A deals are difficult and especially difficult to get right in markets defined by volatility and uncertainty. M&A is about making long-term strategic decisions that require a clear view about what the future environment looks like. Most importantly, in order to fund transactions, REITs will need to use debt which is currently difficult to obtain and very expensive. As volatility subsides, companies will be more confident engaging in M&A, and I would expect the number of M&A deals to increase in 2023.

Weintrob : I do expect M&A volumes to improve meaningfully toward the end of the year. I would expect continued activity in the residential, industrial, and even office sectors over the next 12 to 18 months.

Richford : We expect deal activity to be slow in the first half of the year until there is more asset price discovery and interest rate certainty. For REITs, relative valuations and cost of capital differentials within sectors should encourage consolidation, so there is potential for REIT mergers. Given the massive dry powder in the private market, deal momentum has the potential to pick up significantly in take-privates and large transactions. The return of non-listed REIT capital raising volume would further accelerate deal volume.

Is there any chance for the REIT IPO pipeline to reopen this year?

Lazarus: In a word, yes. Due to declining property prices, 2023 could be the first year since 2009/2010 when a significant number of companies could trade above NAV. We expect this to occur across many sectors where public prices have adjusted and private prices are coming down. Historically, as private prices come down, public prices begin to recover, which provides a window in which value is better in the public markets than in the private markets .

Purcell: There is pent up demand from the buy side for new issuance, and if the right names come to market, investors will show up. Currently, the names coming to market are certainly of higher quality, but there is nonetheless a desire to put more capital to work. As IPOs perform well in the aftermarket, more companies will be enticed to follow suit. Additionally, if private markets seize up and REITs trade at a premium to declining NAVs, we could see an increase in activity.

Richford : I agree, but the IPO window will be very tight. As with any IPO market, this will be available to companies with strong leadership, an institutional mindset, appropriately scaled and capitalized platforms, and attractive growth prospects.

Weintrob : I would expect IPO activity to be back-end loaded. While the public markets lead the private markets down, it is important to remember that they generally also lead the private market up in recoveries, on expectations for improved valuations and fundamentals. I would expect certain issuers to take advantage of a window that opens up to access the markets, and for public market investors to embrace new entrants with attractive and differentiated business models.

Kwarteng : In the last three years, we’ve seen a meaningful decline in REIT IPO activity. Given the expected heightened uncertainty, I expect REIT IPO activity to be low in the first half of 2023. I believe there will be opportunities for well capitalized companies with strong sponsorships to access the IPO market in 2023, especially if there is not a supercharged recovery in the private market.

What trends are you seeing regarding foreign investor interest in U.S. real estate?

Purcell: Foreign investors and likely sovereigns see value in participating in real estate investments given sponsors are on the sidelines and there is limited competition from the REIT universe at this time. They are also generally low levered buyers which positions them well versus the competition.

Weintrob: I do not expect to see any let-up in foreign investor interest in U.S. real estate, in both the public and private markets. The U.S. remains a very attractive investment destination with relatively strong demographics and business environment. That said, the composition could shift, both geographically and by investor type, with increasing flows from individual/retail investors and insurance companies, while we may see less investment than we historically have from China, for instance.

Kwarteng: The U.S. economy is in a much healthier position relative to the global economy, and real estate investment opportunities remain more attractive in the U.S., which suggests that capital will continue to flow into U.S. commercial real estate. We are seeing inflows from not just one region but from multiple countries across the globe. So, while inflows will continue, the reverse is also true—that the recent strengthening of the dollar will make U.S. investors look for opportunities abroad, especially in Europe.

Richford : The U.S. continues to be a favored market in volatile economic times. For transaction volume in the second half of 2022, foreign investors led the charge in many large deals and we expect this to continue in 2023, particularly as institutions outline their capital capacity and allocations to real estate.

Lazarus : The U.S. remains the top destination for capital in the world. U.S. commercial real estate will continue to be a beneficiary of all the great things you get by investing in the U.S. economy through purchases of real estate. In 2022, the rapid and large increase in rates led to a big decline in inbound capital as the dollar became stronger and hedging costs skyrocketed for non-U.S. investors. These costs are moderating as the rate environment is stabilizing.

Traditionally, the large foreign investors have very long term investment horizons, and thus periods of disruption in the U.S. markets provide a better opportunity to buy quality assets at depressed prices in either the public or private markets. We are already seeing increased interest from the Middle East given energy prices and the attractiveness of U.S. assets.

Are there any other notable trends on your radar at the moment?

Weintrob: While transaction activity over the past few years was driven mostly by core investors (funds and institutions/pension funds/sovereign wealth funds), I would expect closed-end value add and opportunistic funds to lead the next wave of transaction activity (which will notably require higher returns and functioning debt markets).

I also expect to see continued interest and attractive fundamentals in some of the hot sectors of the recent past, including industrial, residential, and data centers. The office sector will undergo further fundamental changes that in some respects will mirror what happened to malls over the last decade: there will be demand for fewer assets/less square footage, but a sharper bifurcation (and higher bar) between class A/trophy assets (which will still garner significant demand) and more commodity-like space.

Kwarteng: It’s hard to talk about 2023 and not mention public, non-listed REITs (PNLRs), which for the past several years have been such a dominant factor in real estate. The reported uptick in redemptions in late 2022 grabbed a lot of headlines. It is going be interesting to watch the net fundraising in PNLRs and any resulting impact on asset purchases and sales.

Richford: The real estate market continues to evolve and find new sectors that are attractive consolidation opportunities that can run more efficiently and effectively at scale. There are a few new niche sectors that are very promising and will provide great opportunity for investors.

Lazarus : We continue to monitor the situation with Open-end Diversified Core Equity (ODCE) funds and PNLRs. Many of these vehicles have seen an increase in redemptions at the same time as inflows have slowed. With limited asset liquidity available in today's market, these companies have limited redemptions. This prevents them from having to be a forced seller of assets in a challenging market. Instead, they have found liquidity in other ways, such as the recent $4.5 billion capital investment by the University of California in Blackstone Real Estate Income Trust (BREIT), which looks like a win/win for both parties.

Purcell: We are tracking two major trends: First, REITs and sovereigns are likely to emerge as partners as access to capital will enable acquisitions and investment financing. Second, from an equity standpoint, we are seeing more investment managers creating private pockets of capital to either invest in private funding rounds for companies or even invest directly at the asset or portfolio level. They recognize the opportunity to earn attractive returns before these entities come to the public market, and then are positioned to be holders once they do.