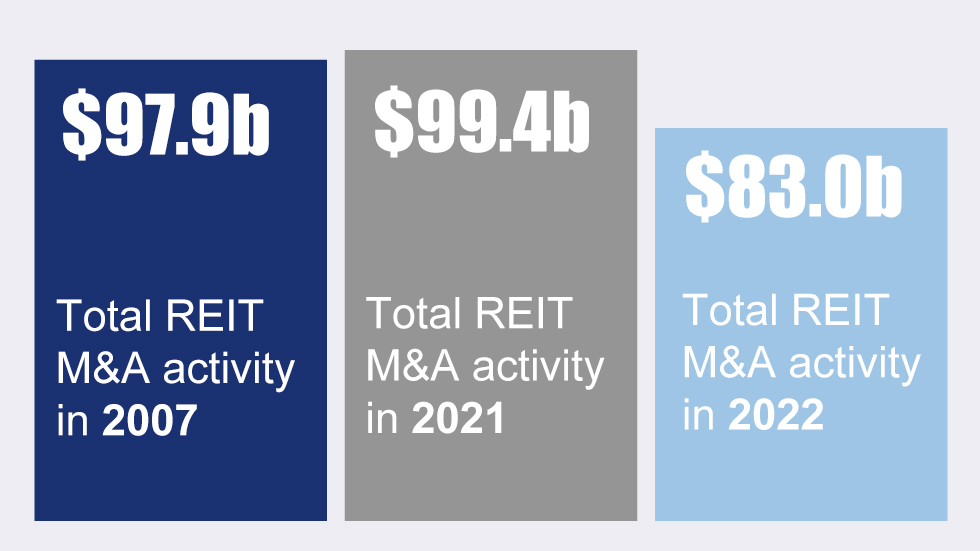

Total REIT merger and acquisition (M&A) activity came to $83.0 billion in 2022, the second highest annual figure since 2007, with transactions taking place across a range of property sectors. In 2021, total REIT M&A activity stood at $99.4 billion. The highest level prior to that was $97.9 billion in 2007.

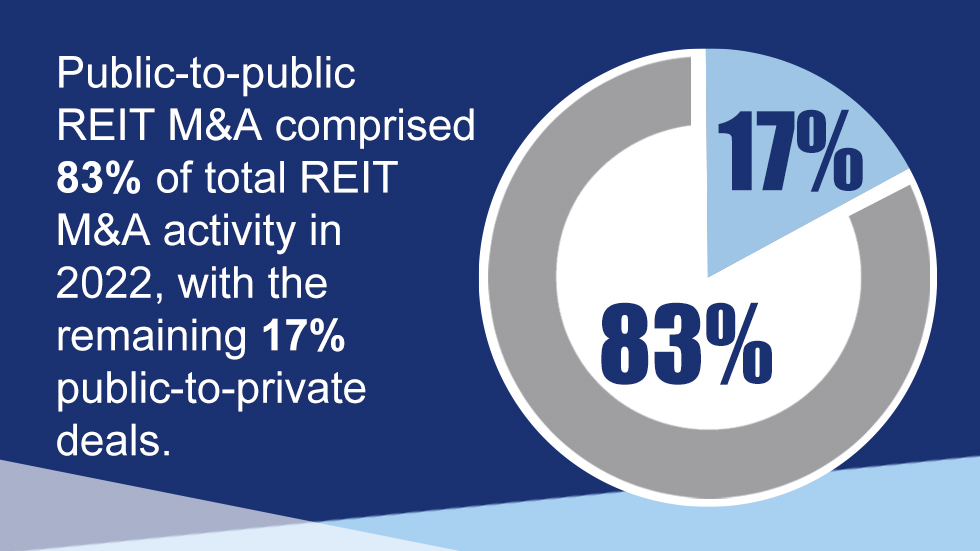

Total public-to-public REIT M&A in 2022 was $69.2 billion, comprising 83% of total REIT M&A activity, with the remaining 17% representing public-to-private deals.

Prologis, Inc.’s (NYSE: PLD) acquisition of Duke Realty Corp. stood out as the largest transaction of 2022, with a value of $25.4 billion. Meanwhile, Blackstone was a key player in 2022, with deals that included the purchase of American Campus Communities and PS Business Parks.

Christopher Johnston, partner and Americas REIT Leader at EY, noted that 2022 saw some large transactions, “but those deals take some time to work through so you’re right on the heels of a good recovery in the economy in 2021, leading into 2022 with some good tailwinds. They were able to pull the trigger and get those deals closed in the front half of 2022, and even into the third quarter.”

Adam Emmerich, partner at Wachtell Lipton, noted that deals slowed down in the second half of 2022, with the momentum to consolidate or go private “countered by large gaps between seller and buyer valuations and a challenging macro environment, particularly rising interest rates and difficult debt markets, volatility in REIT stock prices, and general economic and geopolitical uncertainty.”

Vinson & Elkins Partner Daniel LeBey noted that “usually when the capital markets slow down, M&A activity picks up. I think that is exactly what we saw, at least in the first part of 2022.”

LeBey agreed that higher rates and increasing debt costs created a disconnect between how buyers were valuing portfolios, while sellers still had “stars in their eyes” from an evaluation standpoint—a holdover from 2021 when valuations were high. “That disconnect caused some headwinds… particularly in the latter two quarters of 2022,” he added.

As for IPOs, 2022 was a particularly uneventful year with only one IPO recorded. LeBey noted that conditions made it “virtually impossible” to execute a successful IPO in 2022. “Those conditions were reflective of the broader conditions in the capital markets generally,” he said.

In addition to higher interest rates and higher debt costs, LeBey said that inflation and fears of recession combined to create “volatile and generally poor market conditions in the public equity capital markets generally. That's a very challenging type of market environment in which to launch an IPO.”