Despite optimism that the Federal Reserve may cut rates this year, liquidity remains the topic du jour across the real estate market. Many listed REITs, though, are finding that they have a leg up on their private real estate peers thanks to strong balance sheets, lower leverage, and improving access to both debt and equity markets.

The big picture for REIT liquidity remains largely positive. REITs have built strong balance sheets that have seen little deterioration over the past year. “Overall, the leverage profile for the REIT market really hasn’t changed,” says Todd Kellenberger, REIT client portfolio manager at Principal Global Investors. “For the next 12 months, the vast majority of the REIT market is positioned quite well.”

REITs also are benefiting from market shifts that are providing a nice tailwind. One of the big improvements in capital markets is that long-term rates have started to come down ahead of anticipated Fed rate cuts. After hitting a high of 4.98% in October, the 10-year Treasury has dropped nearly 100 basis points to hover at around 4% as of mid-January. The ability for REITs to tap equity markets, either via follow-on offerings or ATMs, has improved as well, given that stock prices have improved.

For investment grade REITs, liquidity can be described as “ample and robust,” says Chris Wimmer, senior director, commercial real estate at Fitch Ratings. REITs spent the better part of the last decade building large and flexible balance sheets. “The beauty of what the investment grade REITs did is they took advantage of this era of easy money to unencumber their balance sheets, term out maturities, and basically put themselves in an opportunistic position when the time came that easy money was no longer available. And it seems like we're very much sitting at that point,” Wimmer says.

The beauty of what the investment grade REITs did is they took advantage of this era of easy money to unencumber their balance sheets, term out maturities, and basically put themselves in an opportunistic position when the time came that easy money was no longer available. And it seems like we're very much sitting at that point

Digging into REIT balance sheets continues to show a number of positives for overall credit profiles. According to J.P. Morgan, REITs are currently sitting with 5.6 times net debt/EBITDA, about 33% leverage to total market cap, and interest coverage of approximately 4.5 times. Near-term debt maturities appear manageable, with a weighted average maturity of REIT debt of close to six years. In addition, the majority of REIT debt, close to 90%, is fixed, meaning REITs have less exposure to higher-cost, more volatile floating rate debt.

New Debt Issuance

Capital markets are already baking in anticipated Fed rate cuts in 2024, with rates that have come in meaningfully on various financing vehicles. “You can see this on the REIT unsecured bond markets, where REIT unsecured bond spreads have come in a bit over the past few months, which is a vote of confidence in the credit profile of REITs broadly,” says Danny Ismail, a managing director at Green Street.

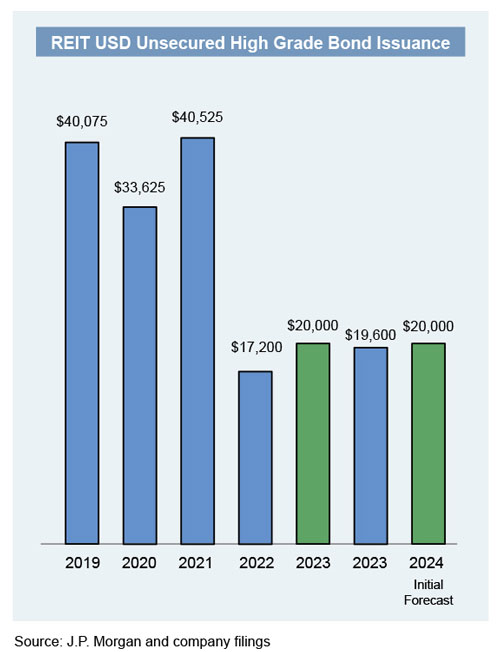

Overall, REITs are in a good liquidity position, although perhaps not quite as strong as 18 months ago because there has been less new issuance, notes Mark Streeter, managing director at J.P. Morgan. REITs did a good job of raising debt in 2020 and 2021 when interest rates and all-in coupons were low. They issued a huge amount of debt in those years in order to proactively take out their near-term maturities, he explains.

However, issuance has picked up significantly in 2024, with several REITs coming forward with new deals. J.P. Morgan has done deals recently with Sun Communities, Inc. (NYSE: SUI), Camden Property Trust (NYSE: CPT), Regency Centers Corp. (Nasdaq: REG), MAA (NYSE: MAA), Kilroy Realty Corp. (NYSE: KRC), Brixmor Property Group Inc. (NYSE: BRX), Kite Realty Group Trust (NYSE: KRG) and Prologis, Inc. (NYSE: PLD).

“We're anticipating a very busy first quarter because the 10-year Treasury rate has gone from 5% to just above 4% and credit spreads have come in from the peak by over 50 basis points,” Streeter says. The cost of financing has come in from north of 7% at its peak to 5.7% on average for the REIT sector. “So, we're going to see more debt being issued, which will pop up liquidity from where we are right now,” he says.

Tapping Equity Markets

One of the capital sources that has become more attractive given the rally in REIT share prices is the potential to tap the equity markets. Several property sectors are trading at a premium to NAV, meaning that they can, theoretically, accretively issue shares and go out and acquire assets. “That makes it a unique time for REITs to potentially be a consolidator in the private markets,” Ismail says.

For example, Welltower Inc. (NYSE: WELL) has been an active issuer of equity over the past two years. In November 2023, the health care REIT raised roughly $1.5 billion in gross proceeds from a public offering of 17.5 million shares of common stock. The company has said that it plans to use those funds to help fund acquisitions, including roughly $3 billion in acquisitions that it had either purchase agreements with or is under contract to purchase.

Broadly speaking, REITs are hovering at parity with NAV or slightly above. However, NAV is very sector specific, with office still trading at deep discounts while data centers, industrial, health care, gaming, and net lease, for example, are seeing high-single digit or even double-digit premiums to their NAV.

“REITs aren’t going to rush to issue equity after two years of underperformance. What we are seeing is more convert issuance, which has an equity component to it,” Streeter says. A convert is basically a bond subsidized by an equity option, which lowers overall borrowing costs. That becomes attractive for REITs worried about the impact of rolling debt at a higher interest rate environment. “Interest rates are not as high as they were, but we still think there’s going to be more convert issuance because of this,” Streeter adds.

Less Exposure to Loan Maturities

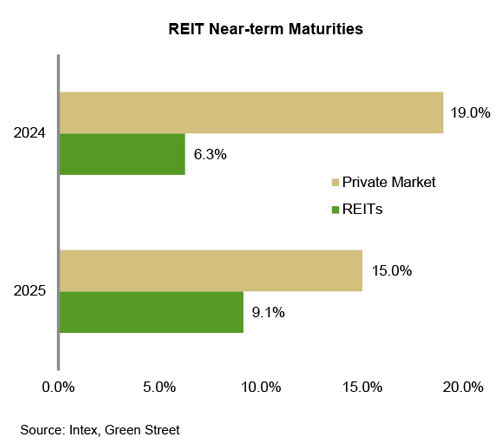

REITs have less exposure to one of the biggest market risks overshadowing the outlook for the real estate market–CRE loan maturities. According to Trepp, there is an estimated $1.08 trillion in real estate loans maturing in 2024 and 2025 across various lender types.

J.P. Morgan says REITs have roughly 17% (about $110 billion) of their total debt (about $663 billion) maturing in the next two years. Putting on new debt at higher costs will create some drag on earnings. J.P. Morgan estimates that higher interest rates will pose a roughly 2% annual earnings headwind over the next few years.

REITs are not only putting in more equity, but they are refinancing at higher rates–roughly 200 basis points higher than existing in-place debt. “That’s going to probably filter through to be a low single-digit earnings headwind for the REIT market over the next couple of years,” Kellenberger says. “However, a lot of this is expected and one might say much of it is baked in already into those consensus forecasts and expectations.”

Overall, analysts generally agree that REITs are in a good position to take advantage of dislocation and distress that might arise as the market comes out of this interest hiking cycle. Private sector firms continue to face high capital costs and tighter liquidity, particularly from bank lenders. The cost of REIT unsecured debt is now roughly 150 basis points cheaper versus conventional secured debt. “I think that's a real advantage that the listed market has, and 2024 could shape up to be a good year in terms of REITs taking [market] share because of that better balance sheet situation,” Ismail says.

Pain Points for Liquidity

Analysts generally have a favorable view on strong balance sheets and a more bullish outlook for REITs. However, it remains a bifurcated market with some REITs better positioned than others. Office is clearly facing the biggest liquidity challenges in the broader real estate market.

Office REITs, however, represent a relatively small part of the public REIT market at roughly 6% of total market cap, and within that group the ability to access capital varies depending on the strength of the company. The big four investment grade REITs– BXP (NYSE: BXP), Highwoods Properties, Inc. (NYSE: HIW), Kilroy Realty Corp . (NYSE: KRC), and COPT Defense Properties(NYSE: CDP)–are able to access capital at more favorable rates. For example, J.P. Morgan just did a 12-year deal for Kilroy at 6.25%.

Although the office sector gets a lot of attention, there also is some concern and tightening liquidity around multifamily in the broader real estate market. “We're not seeing that in the bond market because the multifamily REITs are all very strong credits with low leverage balance sheets, and they have incredible access to the market,” Streeter says. Case in point, J.P. Morgan recently did bond issuance deals for Camden and MAA, both of which are A- rated credits. Camden issued 10-year bonds at 4.9% and MAA issued 10-year bonds at 5%.

One question that remains is how REITs that are well-capitalized will put that money to work in 2024. REITs that went into capital preservation mode during the rate hiking cycle may be shifting attention back to external growth opportunities.

“While strategies will vary, we believe REITs with low leverage and plentiful liquidity will be in a position to select premium properties at discounted prices ,” Wimmer says. “There could be good acquisition opportunities ahead as sources of capital remain expensive, or even scarce, for those poorly capitalized owners and developers who are looking to refi or cash out.”