Nareit tracks quarterly investment holdings for the 27 largest actively managed real estate investment funds focusing on REIT investment for insight on expert investor sentiment. As of this writing, three smaller funds had not yet reported third quarter data for this analysis.

In the third quarter of 2023, active managers increased quarterly allocations in the health care and data center property sectors. Both sectors had the largest year-over-year increases, up 3.9 percentage points for data centers and 2.3 percentage points for health care. Both sectors are also overweight in their share of fund assets under management compared to their share of the FTSE Nareit All Equity REITs Index. Active managers have also decreased their allocations to self-storage, and the sector has the largest year-over-year decline at 4.5 percentage points. Compared to the index, self-storage has gone from overweight by 1.8 percentage points in the third quarter of 2022 to underweight by 2 percentage points in the third quarter of 2023.

In terms of returns, active managers increased their share of residential, data centers, and retail in the second quarter of 2023, and all three sectors outperformed the All Equity index in the third quarter. Residential increased 1.1 percentage points and outperformed the index by 2.6 percentage points. Data centers were up nearly a percentage point in the second quarter and outperformed the index by 2.6 percentage points in the third quarter. However, allocation increases in health care have not yet been associated with strong return performance.

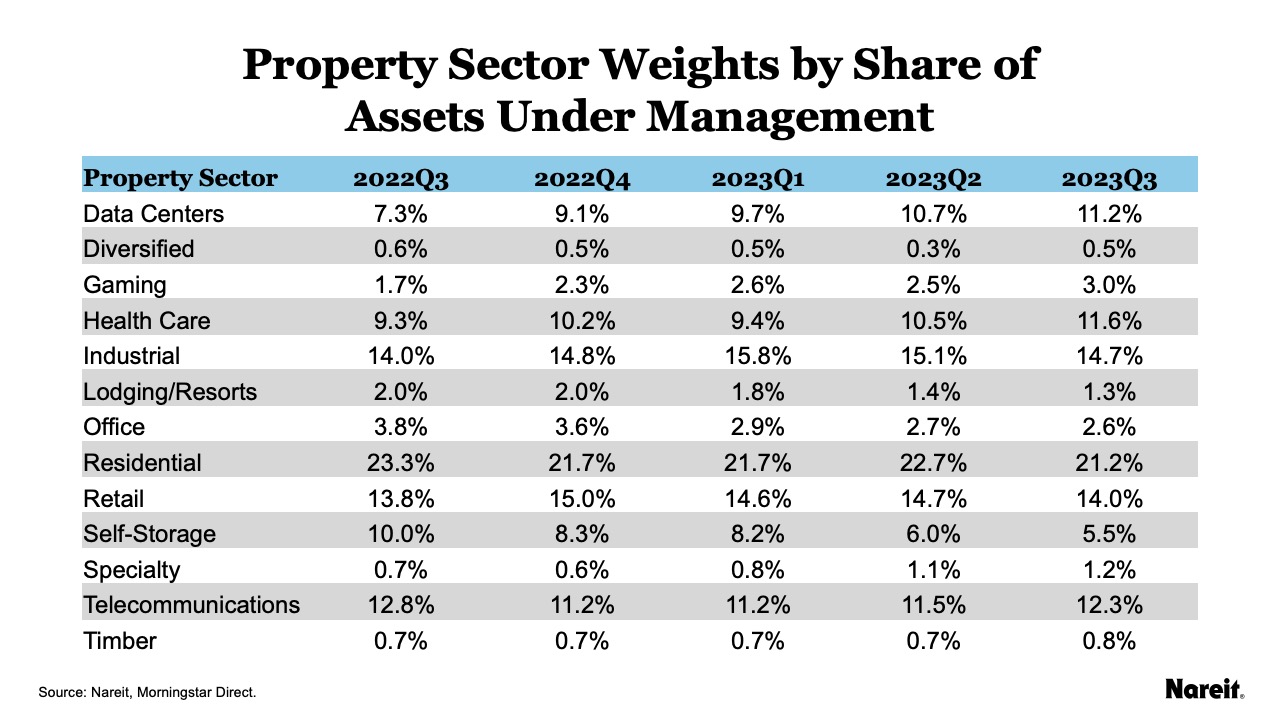

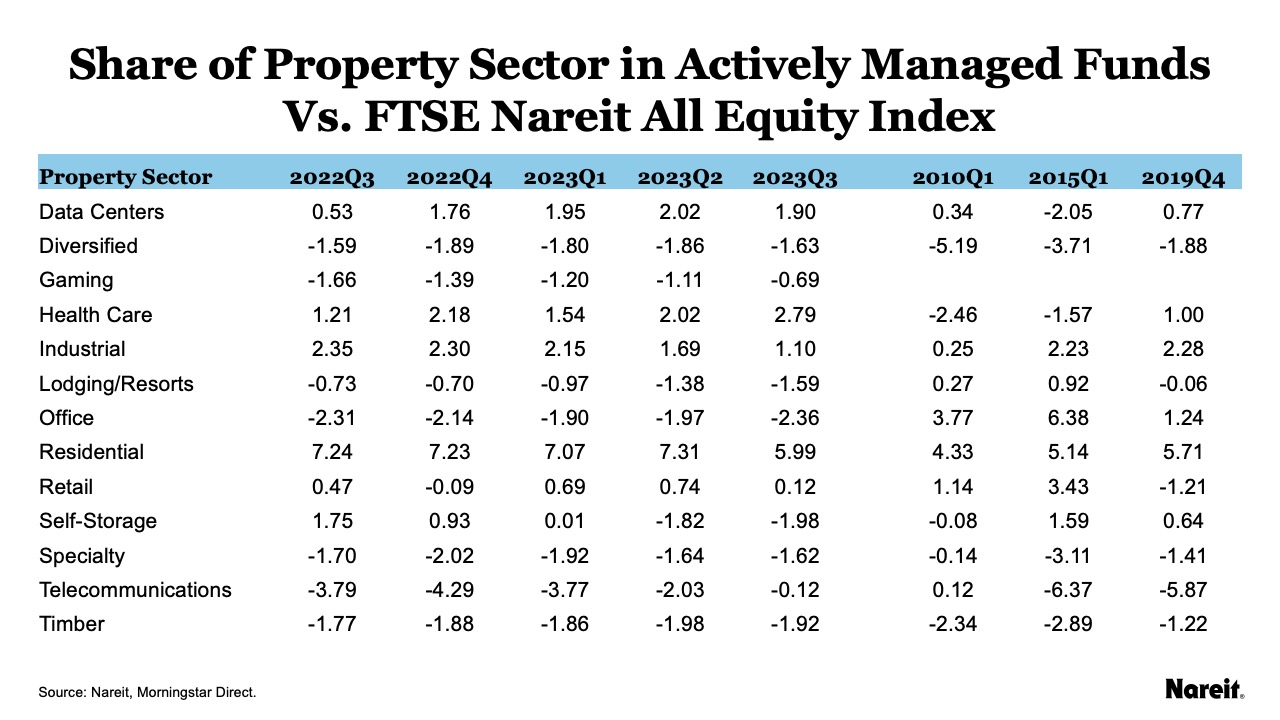

The table shows the share of each equity REIT property sector by assets under management.

- Traditional sectors maintain a meaningful share of assets, with residential the highest share of assets at 21% in 2023Q3, industrial at 15%, and retail at 14%. However, office remains less than 3%.

- Telecommunications, data centers, and health care each have more than a 10% share of assets.

- Diversified and timber have less than a 1% share, and specialty and lodging/resorts have less than a 2% share.

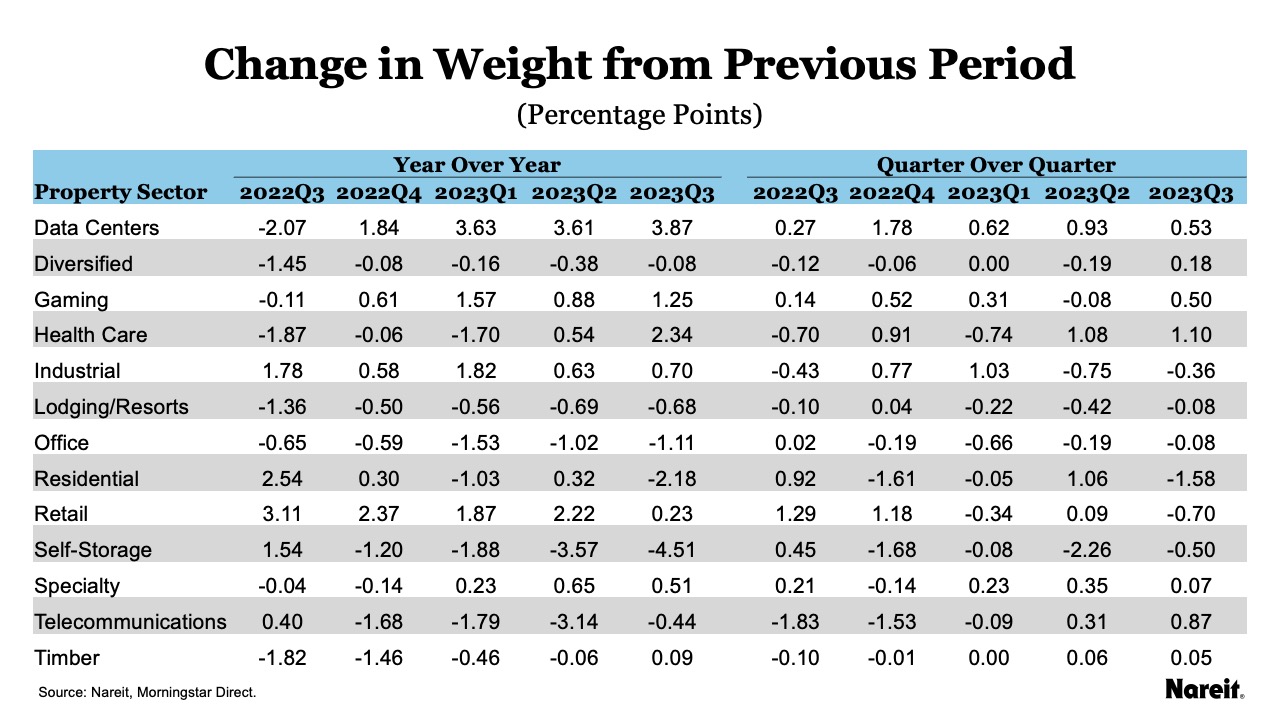

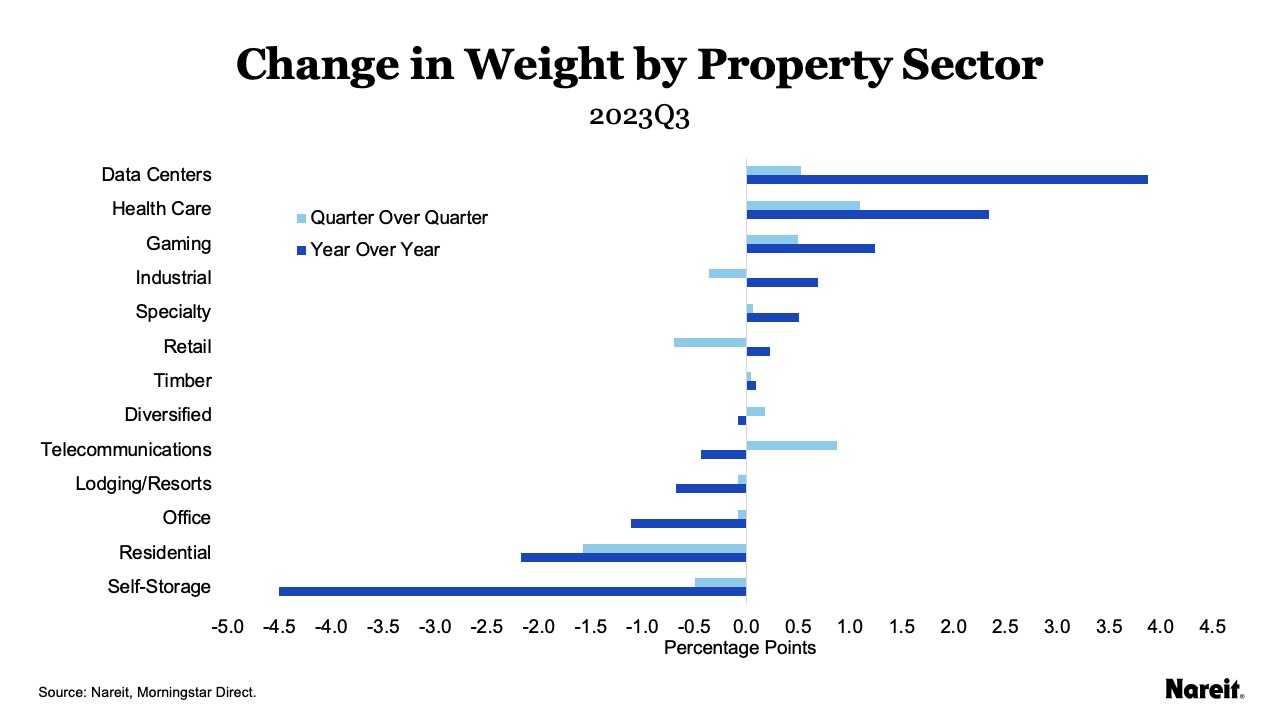

The table and chart show the change in property sector asset share by quarter and from the previous year.

- Data centers has the biggest increase year-over-year at 3.9 percentage points, and up 0.5 percentage points from last quarter.

- Health care has the biggest increase from the last quarter, up slightly more than one percentage point and up 2.3 percentage points over third quarter last year.

- Gaming REITs also made significant gains in the third quarter and for the year, up 0.5 percentage points for the quarter and 1.25 percentage points for the year.

- Funds have been selling off self-storage since the fourth quarter of 2022. The sector has the largest decline year-over-year, down 4.5 percentage points.

- Lodging/resorts, office, and residential are all down for the quarter and down for the year.

- Residential is still the most heavily weighted sector, but funds lowered their weights by 1.6 percentage points in the third quarter, which put the sector down more than 2 percentage points for the year.

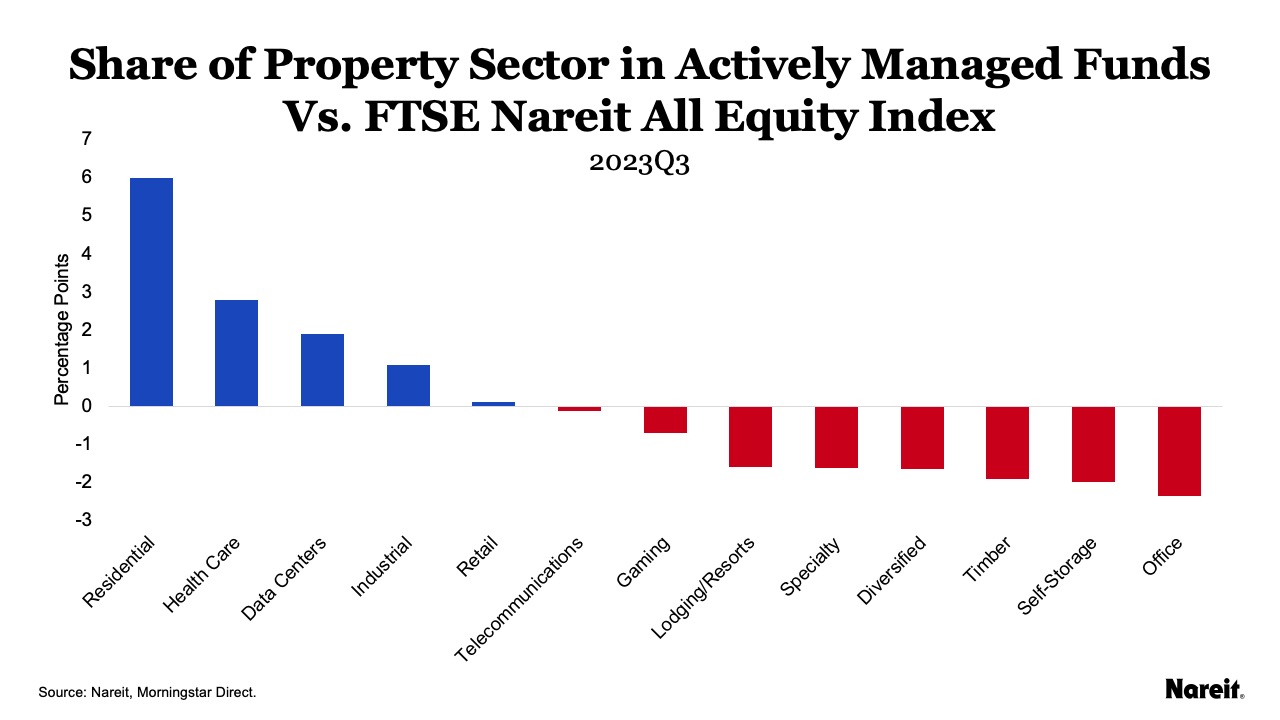

The chart compares the weight of the sectors in actively managed funds to the weight of the sectors in the All Equity Index.

- Residential remains strongly overweighted in the funds compared to the index, even with the drop in the third quarter. Residential is weighted 6 percentage points higher than its share in the index.

- Health care and data centers are also overweighted in the funds at 2.8 percentage points and 1.9 percentage points respectively.

- Traditional sectors of retail and industrial have historically been consistently overweighted in the funds, but lower allocations in the third quarter for retail have put the sector nearly at parity.

- Office has gone from strongly overweighted in the funds to underweighted post-pandemic, even as it has continued to shrink its weight in the index. Office is 2.4 percentage points underweight in the third quarter.

- The shrinking asset weight by funds in self-storage has moved the sector from overweight by 1.8 percentage points in the third quarter of 2022 to underweight by 2 percentage points in the third quarter of 2023.

For more information on the active manager project, see Reading the Real Estate Market: Tracking Active Managers’ Allocations Over Time.