Nareit tracks quarterly investment holdings for the 27 largest actively managed real estate investment funds focusing on REIT investment for insight on expert investor sentiment. Four funds had not reported first quarter data for this analysis.

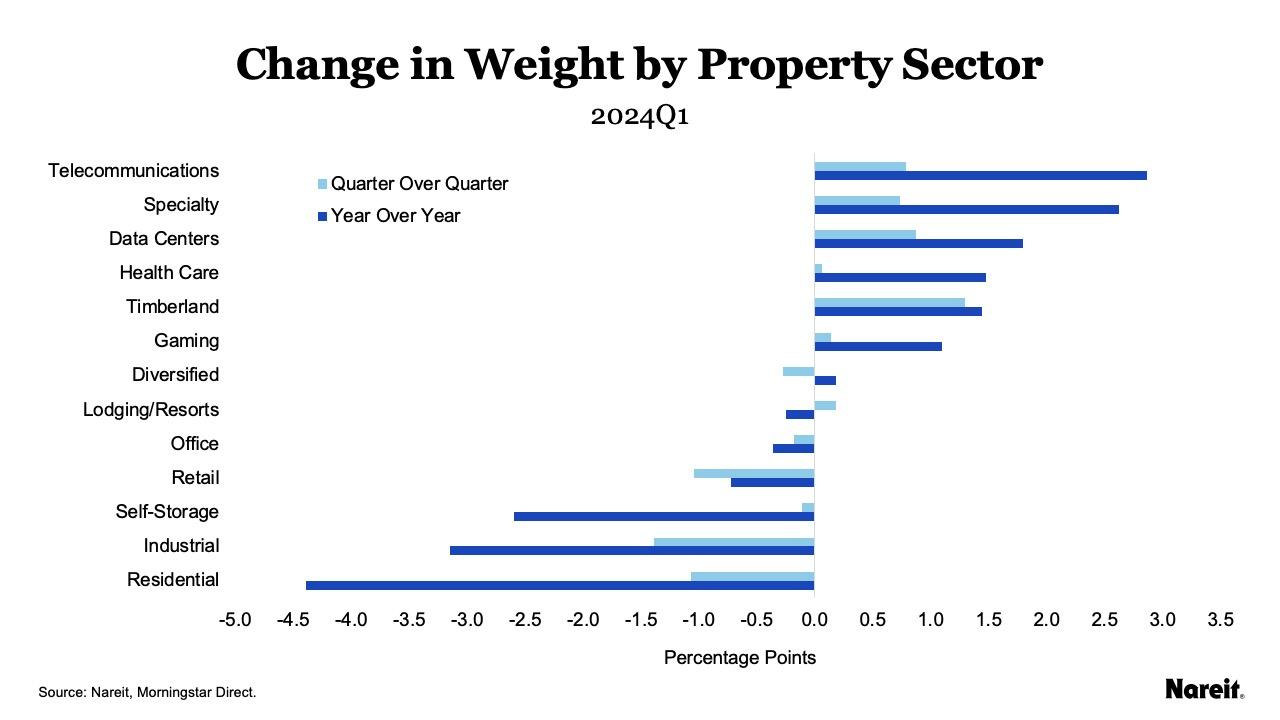

In the first quarter of 2024, active managers increased allocations in telecommunications, overweighting the sector and giving it the second highest share in the funds. Year-over-year, telecommunications is up 3 percentage points and has a 14% share in the funds as of the first quarter of 2024. Telecommunications’ gain came partly at the expense of traditional sectors retail and industrial. Both retail and industrial had lower weights in the first quarter of 2024, dropping their rank by weight to third and fourth respectively, following residential with the highest share and telecommunications at the second highest.

In terms of returns, active managers’ increase in specialty in the fourth quarter of 2023 by nearly 1.5 percentage points matched the sector outperforming the index by 12.8 percentage points in the first quarter of 2024. Easing off on industrial in the fourth quarter matched underperformance in that sector. Funds reduced their share in industrial by 0.7 percentage points in the fourth quarter of 2023, and the sector underperformed the index by 1.2 percentage points the next quarter.

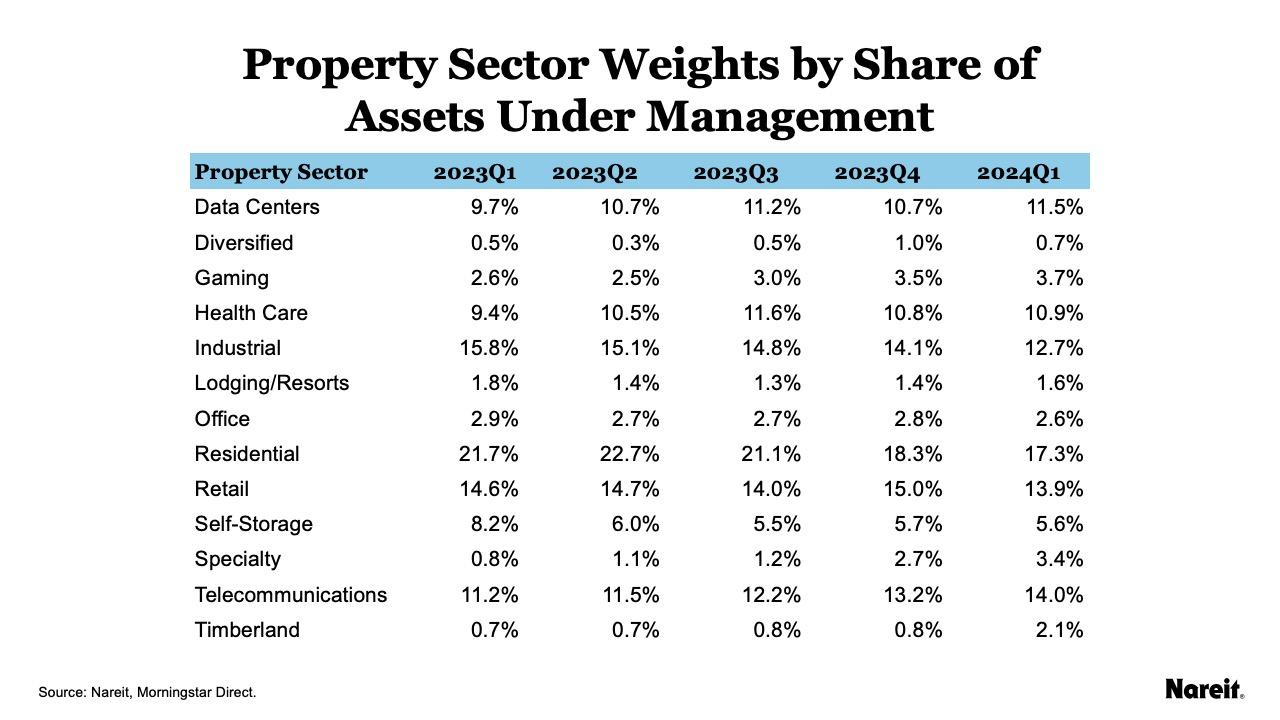

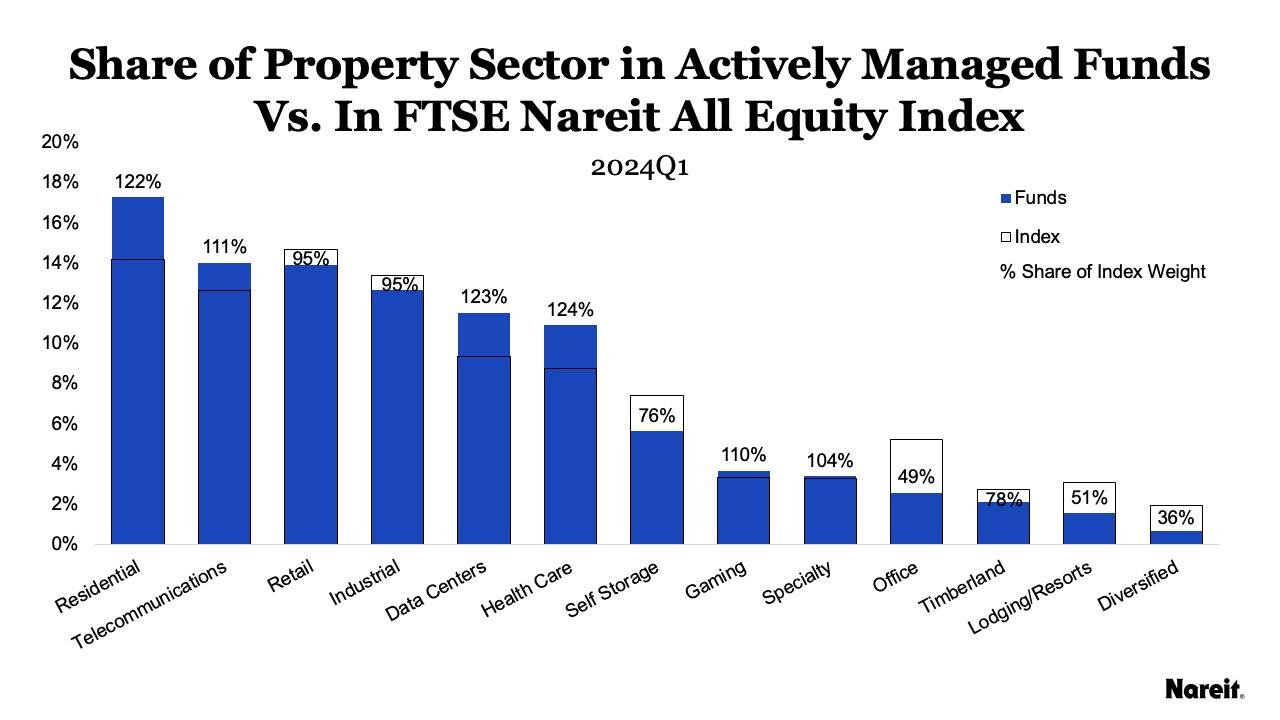

The table above shows the share of each equity REIT property sector by assets under management.

- Residential remains the property sector with the highest investment at 17.3%, but telecommunications is the second highest at 14.0%, for the first time edging out retail (13.9%) and industrial (12.7%).

- Data centers and health care each have more than a 10% share of assets.

- Lodging/resorts and diversified have less than a 2% share.

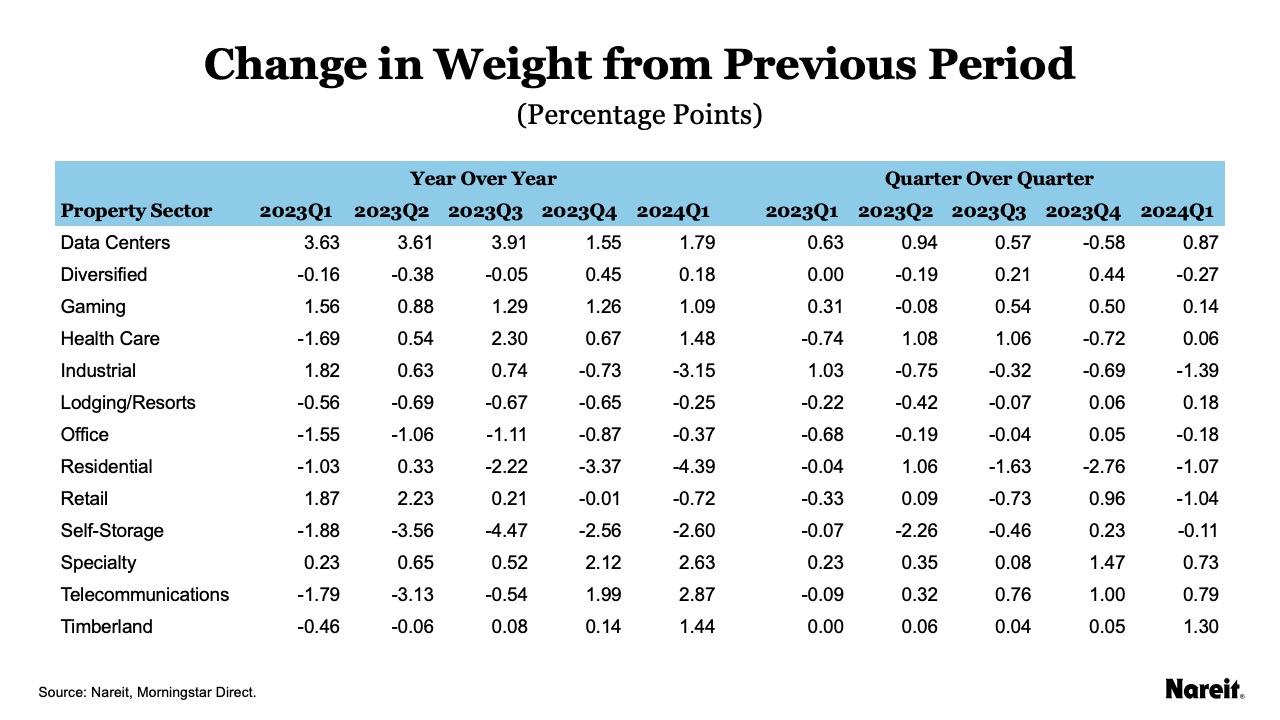

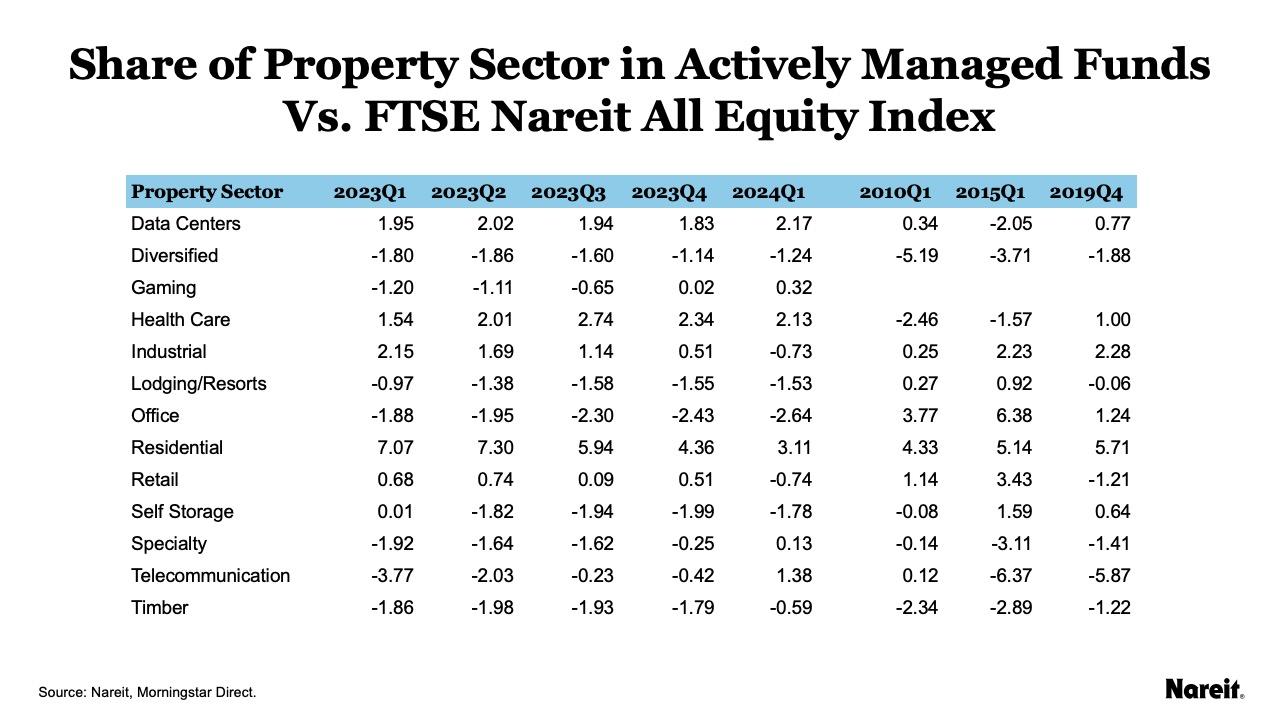

The table and chart above show the change in property sector asset share by quarter and from the previous year.

- Telecommunications had the highest year-over-year gain in weight, up 2.87 percentage points. The quarterly gain of 0.79 percentage points was also among the highest.

- Specialty also saw another quarter of relatively large gains, up 2.63 percentage points for the year and 0.79 percentage points for the quarter, bringing its overall weight up from less than 1% in the first quarter of 2023 to more than 3% at the beginning of 2024.

- Timberland and data centers had the largest quarter-over-quarter increases (1.3 and 0.87 respectively), and both were up for the year. Like specialty, continued increases in timberland has brought the sector up from less than 1% in the first quarter of 2023 to more than 2% in 2024.

- Industrial and residential both showed losses in share for the quarter and the year. Residential had the largest decrease for the year, down 4.39 percentage points. Industrial had the largest decrease for the quarter, down 1.39 percentage points.

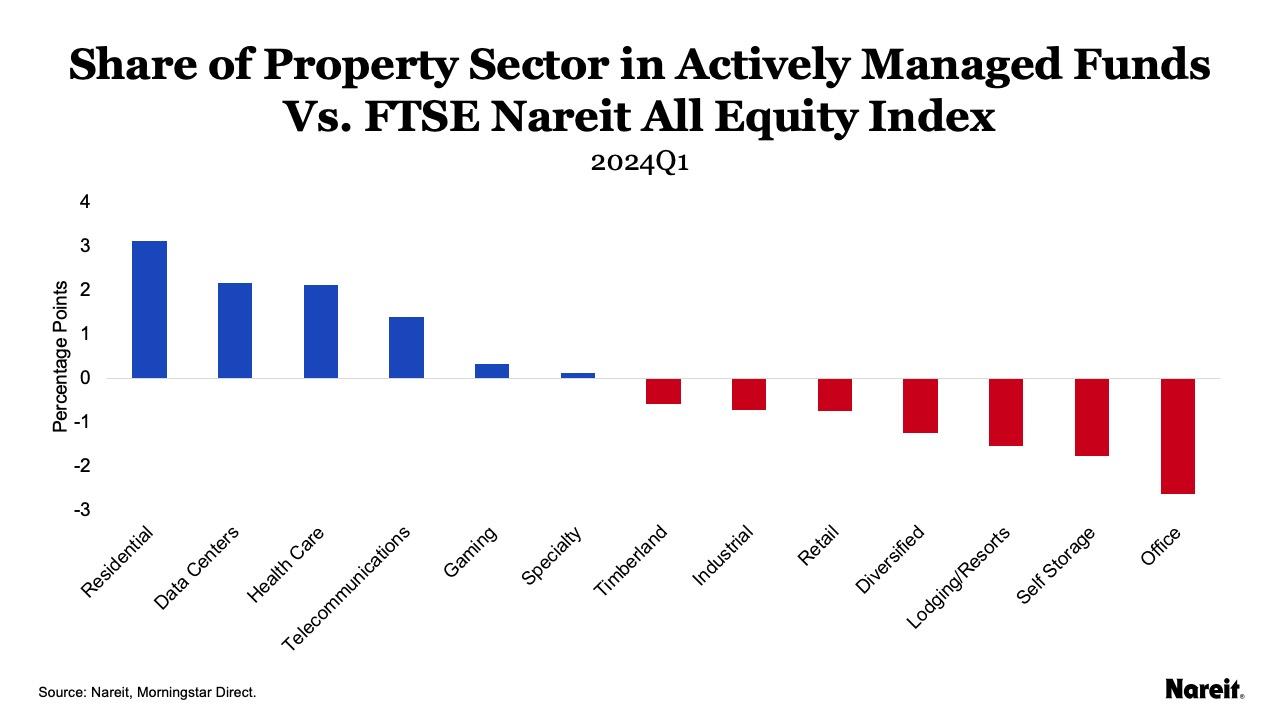

The charts and table above compare the weight of the sectors in actively managed funds to the weight of the sectors in the All Equity index.

- Residential’s large overweight in the funds has been steadily decreasing, going from 7.07 percentage points overweight compared to the index in the first quarter of 2023, down to 3.11 percentage points overweight in the first quarter 2024. Funds are invested at 122% of the index weight in residential.

- Telecommunications, historically underweight in the funds, has flipped to overweight in the funds, invested at 111% of its share of the index weight. Pre-pandemic, telecommunications was nearly 6 percentage points underweight in the fourth quarter of 2019 and nearly 4 percentage points underweight in the first quarter of 2023. The sector is now overweight by 1.4 percentage points.

- Traditional sectors retail and industrial have both fallen below their index weights as of the beginning of 2024. Both sectors are at 95% of their index weights and underweighted by 0.74 and 0.73 percentage points respectively.

- Office, lodging/resorts, and self-storage are the most underweight sectors.

- Office is the most underweight sector with just 49% of its index share, translating to 2.64 percentage points underweight.

- Lodging/resorts is also significantly underweight at 51% of its index share. The sector has been hovering around 1.5 percentage points underweight for the past year.

- Self-storage is the second most underweight sector at 1.78 percentage points below the index weight in the first quarter of 2024. However, funds are at 76% of the index share, which is significantly higher than office or lodging/resorts.

For more information on the active manager project, see: Reading the Real Estate Market: Tracking Active Managers’ Allocations Over Time.