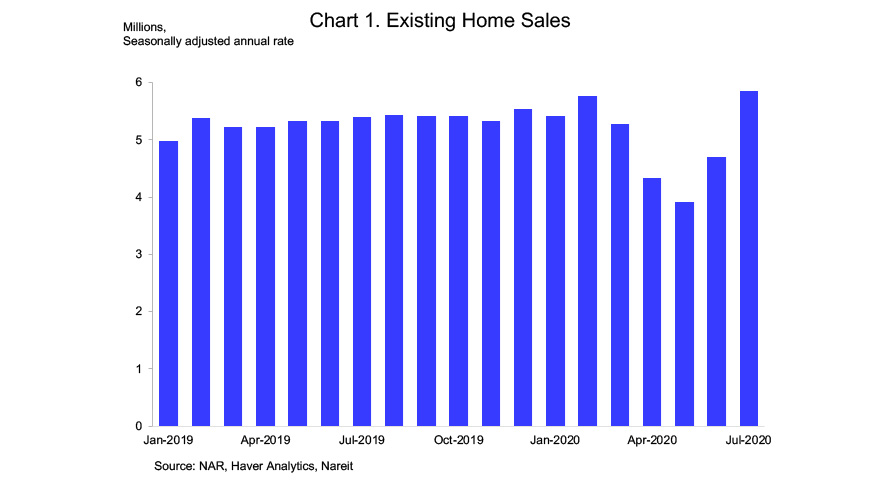

Housing markets are leading the economic recovery from the shutdowns that began in March to battle the pandemic. Nearly every recent housing market indicator has shown significant increases for July, and were above consensus expectations. Existing home sales jumped nearly 25% in July to a 5.86 million annualized rate.

This is the highest sales level since December 2006, as record-low mortgage rates spurred buyers who may have shied away from open houses during the spring.

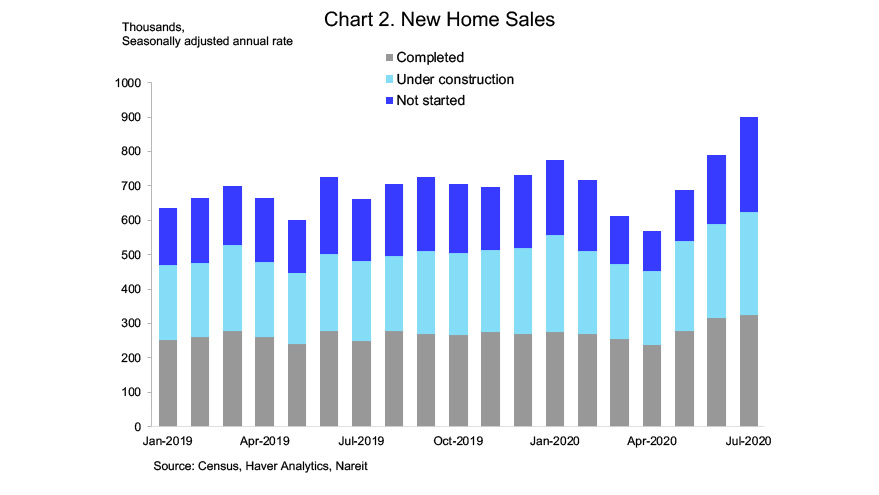

Sales of new homes confirmed the robust demand for housing, rising 13.6% to a 901 thousand annualized rate. This is also the highest sales pace since December 2006. The rising demand for homes reflects buyers’ confidence as well as, perhaps, a need for more space to work from home or take online classes.

The sales figures for new homes not only demonstrate robust demand. The composition of sales by stage of construction also signal greater building activity in the months ahead. In particular, nearly three-quarters of the increase of new home sales in July were homes for which construction has not yet started, while sales of completed homes or those currently under construction rose slightly. This is likely to result in increased housing construction in the months ahead.

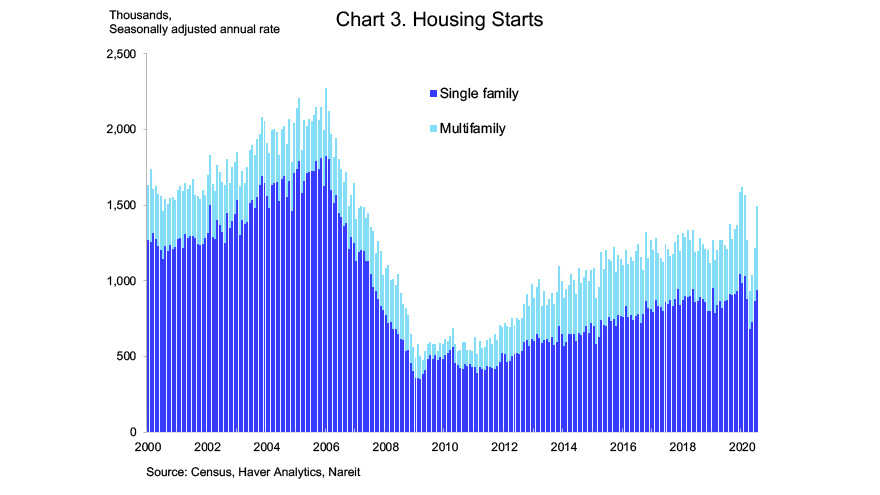

This firming in demand occurs at a time when construction activity has already been rising. Housing starts increased 22.6% in July to an annualized 1.496 million pace. Groundbreaking for new multifamily units drove the rise, increasing 55.8% from June. Multifamily construction is more volatile than single-family starts, but the average over the past three months is well above the prior decade. Indeed, the low levels of construction over this earlier period has contributed to tight housing markets.

Residential REITs, and especially Single Family Rental (SFR) REITs are benefitting from the vigorous demand for housing. SFR REITs is one of the few property sectors or subsectors with positive stock market returns in 2020, with total returns YTD as of August 24 of 1.2% (the other sectors with gains include Data Centers, 29.6%; Infrastructure, 12.4%; Industrial, 11.7%; and Self Storage, 0.2%). Single family rentals arose after the 2008-2009 housing crisis to provide professionally-managed rental homes for households that desired the extra living space and location of a single family structure, including proximity to schools and parks for children, but who were unable to afford a home purchase or unwilling to take on the financial commitments of home ownership. The current economic environment may increase the attractiveness of single family rentals even further.