Space market fundamentals can differ markedly across property types. Recent data from CoStar highlight some of the supply and demand differences across sectors. In the second quarter of 2022, demand continued to outstrip supply for both industrial and retail, while apartment and office demand fell short of their respective supply counterparts.

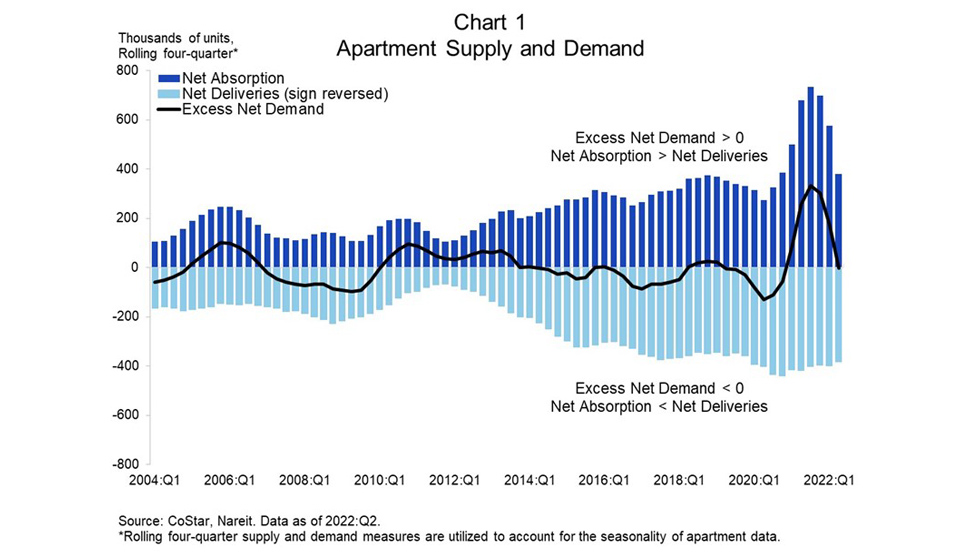

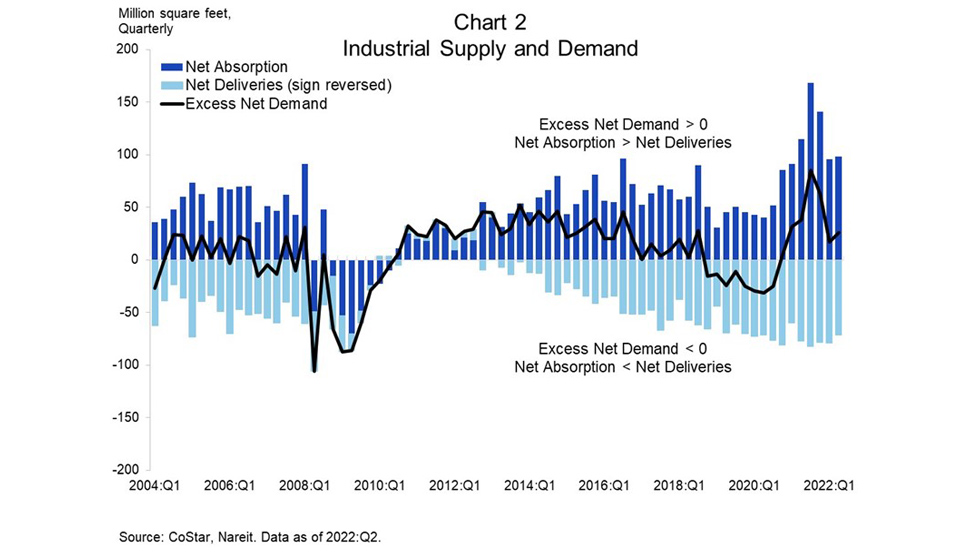

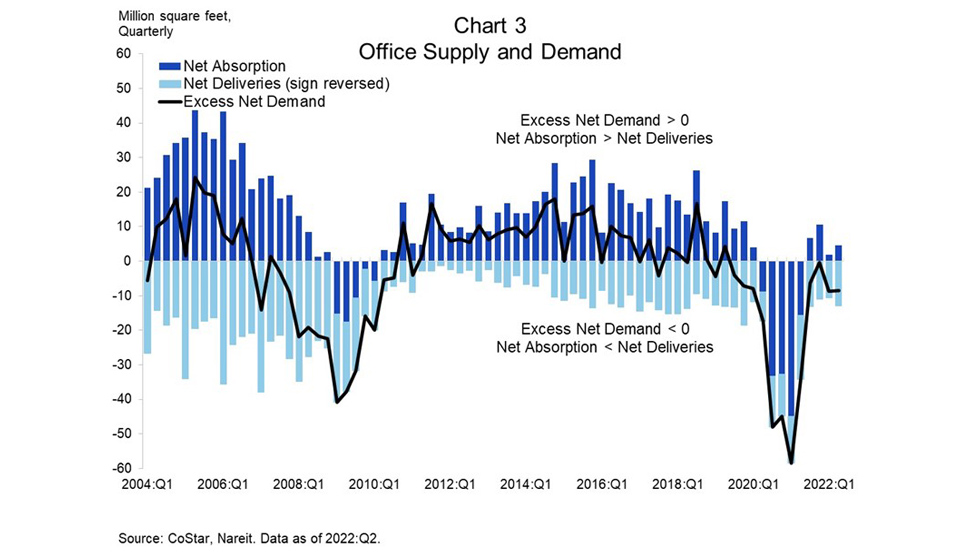

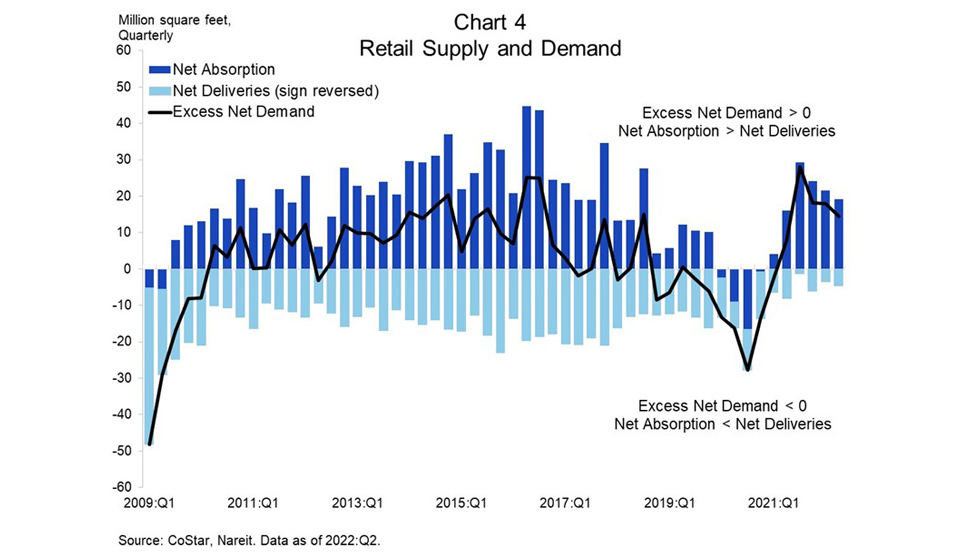

Charts 1 through 4 display net deliveries (supply) and net absorption (demand) for the four major property types: apartments, industrial, office, and retail. The graphs highlight the quarterly “ups” and “downs” of the space markets and illustrate excess net demand (net absorption less net deliveries) for each property type.

As shown in Chart 1, apartment net absorption has fallen from its recent peak. At the same time, rolling four-quarter net deliveries have remained fairly consistent, averaging approximately 400,000 units over the past year. These interactions have caused a precipitous decline in excess net demand. The measure was driven to near zero in the second quarter of 2022.

The drop in excess net demand reflects a sector that is moving toward a balanced supply and demand relationship. With a vacancy rate in proximity of its historic low and near double-digit rental rate growth, significant apartment sector concerns are unwarranted at this time.

As displayed in Chart 2, the industrial sector has enjoyed high levels of demand with analogous supply responses. In the second quarter of 2022, net absorption and net deliveries equaled 98 million and 72 million square feet, respectively. Excess net demand has been positive for seven straight quarters.

With an all-time low vacancy rate and an accelerating double-digit rent growth rate, industrial remains a darling sector for real estate investors. While its strength has been predicated on vibrant demand for logistics and warehouse space, Amazon’s announcement to scale back its warehouse operations and developments may be a harbinger for the broader industrial market.

As illustrated in Chart 3, office has struggled with demand and its ability to limit supply. Recent positive, albeit modest, gains in net absorption have fallen short of net deliveries which have continued at roughly the same pace since late 2014. Negative excess net demand has persisted since the first quarter of 2019.

The office sector faces a battle on two fronts: increasing demand and curtailing supply. With work-from-home and flexible workplace arrangements likely to persist, it is unclear if office demand will materially strengthen. Given the demand-side uncertainties, a reduction in net deliveries would help benefit office space market fundamentals, but its longer development cycle may prove to be an obstacle in the near term.

As presented in Chart 4, the retail sector has had a recent surge in net absorption, while continuing to experience a dearth of net deliveries. In the second quarter of 2022, retail saw its fifth consecutive quarter of robust demand and sixth straight quarter of modest supply which has resulted in positive excess net demand.

After more than two years of lackluster performance, retail has enjoyed a reversal of its space market fundamentals which has pushed the vacancy rate lower and rental growth rate higher. Nonetheless, the sector continues to work through structural issues that include an evolving tenant mix and the relationship between e-commerce and physical stores.