Total retail sales fell 1.1% in July, a larger-than-expected decline that signals some important shifts in the underlying landscape for retail sales. Part of the decline was due to slower auto sales, which fell 4.3% last month. This decrease was due to global supply chain issues, as shortages of semiconductors have hurt auto production and as auto dealers struggle for inventory. Auto production rose 11.2% in July, however, according to the Federal Reserve, suggesting that auto inventories and sales will pick up again in the near future.

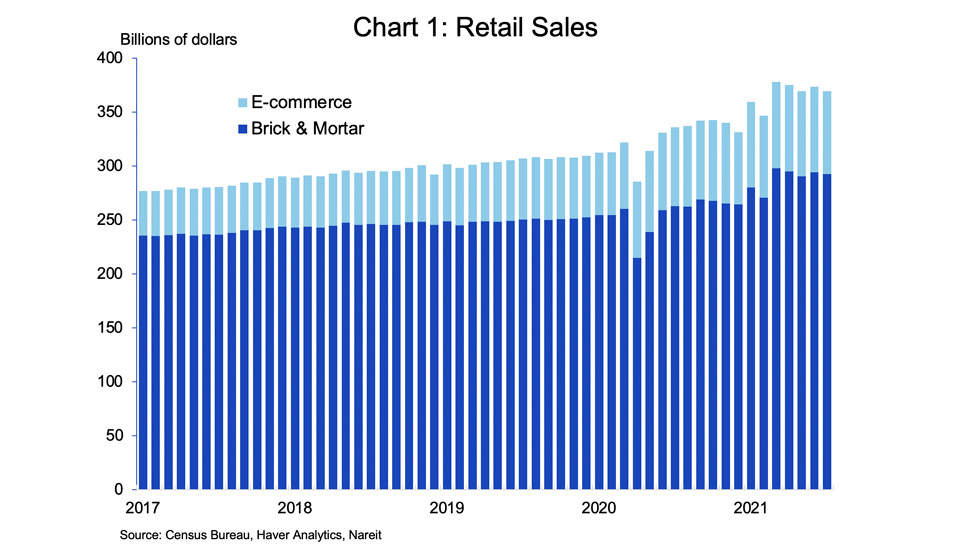

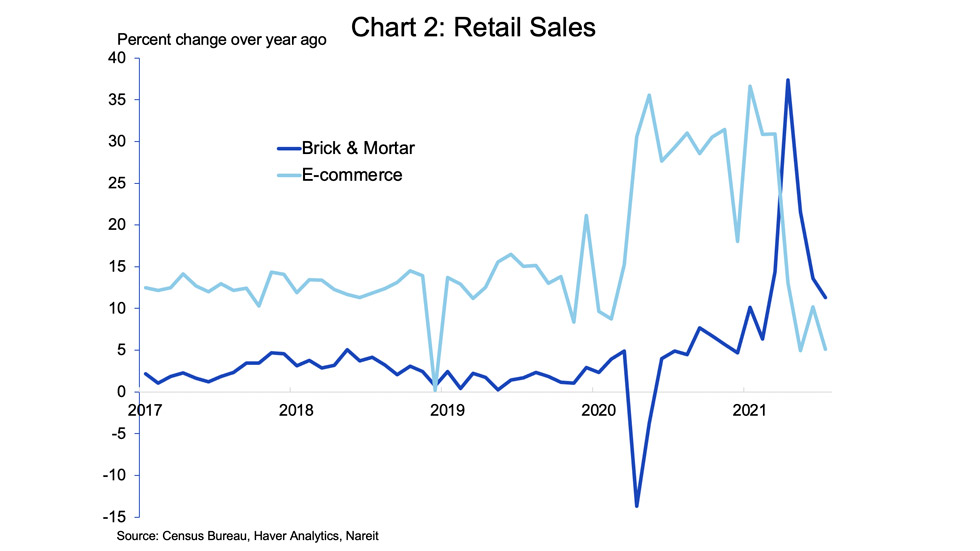

More important for the medium-term outlook was the significant decrease in e-commerce sales, which fell 3.1%. E-commerce sales have declined in eight of the past 14 months, after having surged 30% as shoppers went online during the first three months of the pandemic. Brick-and-mortar sales, in contrast, have been robust during 2021, and edged down just 0.6% last month. In fact, the growth of brick-and-mortar sales compared to one year ago has exceeded the growth of e-commerce sales since April 2021. The last time that brick-and-mortar sales rose more rapidly than e-commerce sales was in 2013, before the online shopping boom began.

These recent trends in brick-and-mortar sales versus e-commerce bode well for the retail property sector and retail REITs, as shoppers demonstrate their continued preference for in-person shopping for many types of items. Sales of products where consumers want to check size, fit, and style continue to thrive at in-store locations even as more standardized items like books and electronics have migrated online.

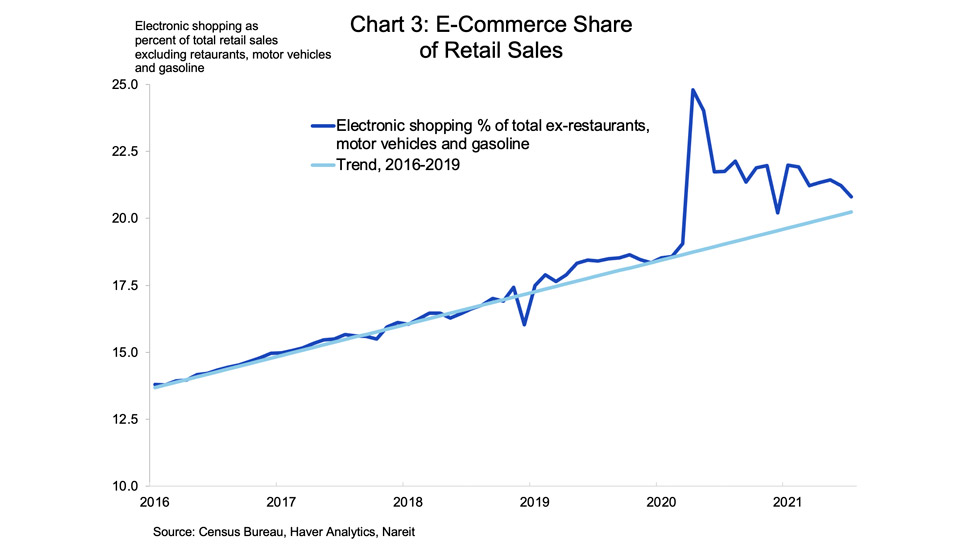

The slower growth and even outright declines in e-commerce sales as brick-and-mortar sales continue moving higher have brought the e-commerce share of total retail sales nearly back to its pre-pandemic trend line. Several retail REITs have reported that they are facing strong demand for new leases to fill space vacated during the pandemic. Retail real estate is getting some fresh wind in its sails as the economy reopens.