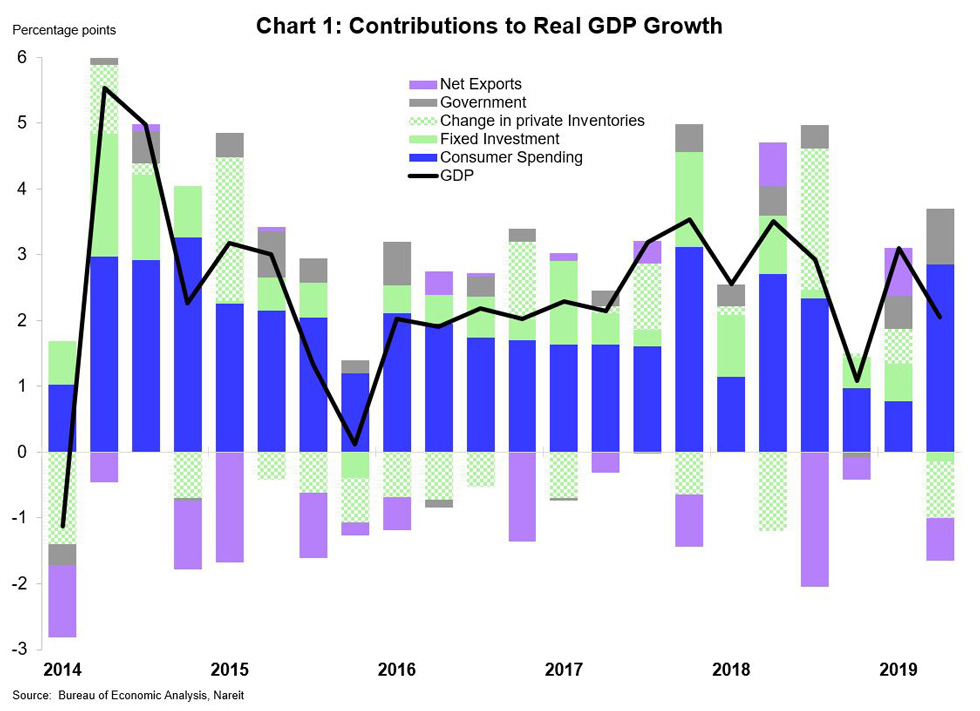

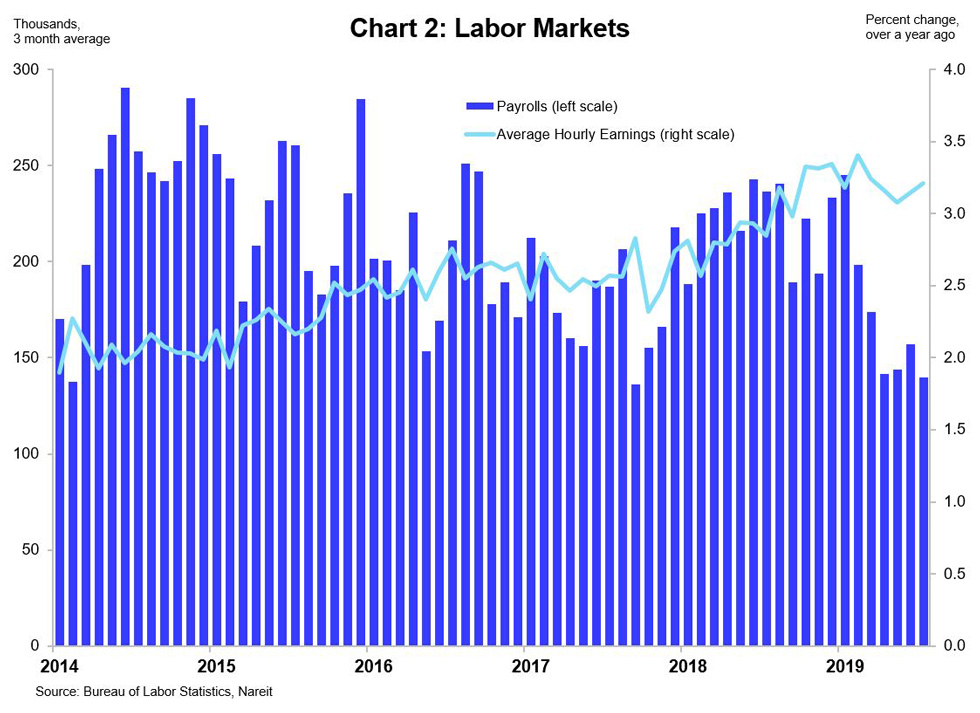

The economy is returning to its trend growth after getting a boost from the 2017 tax cuts. Strong consumer spending boosted gross domestic product (GDP) in Q2 while net exports, a possible result of the trade war, dragged overall growth. The job market followed a similar trend with employment growth less than the accelerated pace of 2018. Low jobless claims and a strong consumer, however, bodes well for future growth and will help fuel demand for commercial real estate.

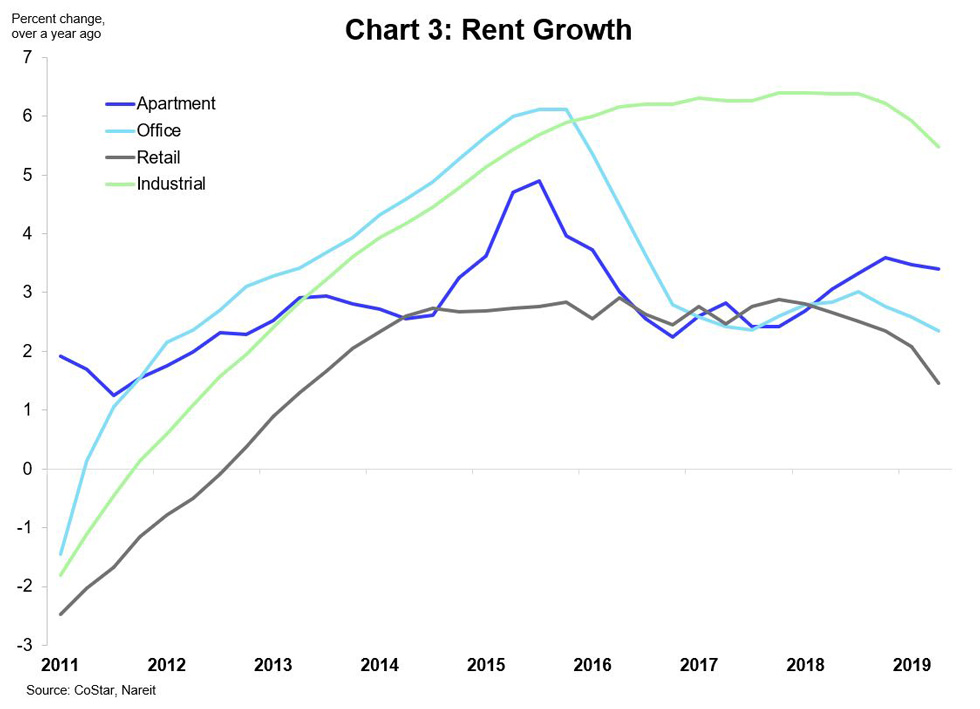

Apartment and office sectors shined in the second quarter while retail and industrial softened. Retail continues to see minimal activity while industrial saw demand soften the past two quarters. We expect this to be short lived, however, as demand for goods being shipped continues to grow.

GDP rose at a 2.1% annual rate in Q2, softening from its 2018 pace. Consumer spending rebounded from a weak Q1 (blue bars, total GDP in solid line) with the largest increase since 2017, while exports and business investment declined.

Labor markets softened in July , in line with the rest of the economy, as the boost from the 2017 tax cuts fades. The economy added 164 thousand jobs, down from the 223 thousand average during 2018. Job growth may slow further from the accelerated pace of 2018, but low jobless claims and confidence in manufacturing indicate that labor markets remain on solid ground.

Rent growth slowed moderately or somewhat more sharply in Q2 , depending on the property sector. Apartment and office growth were similar to recent trends, due to strong demand. Retail and industrial rent growth softened further because of low absorption of new space. Industrial rent growth, however, remains quite high compared to other sectors.

See the Nareit Commercial Property Update for more detailed discussion on CRE markets and economic fundamentals in Q2.