In the 21st century, real estate has been shaped by technological advancements that have changed the economy and introduced new property sectors for investment. Real estate houses the modern economy, from cell towers facilitating wireless communications, to data centers storing the data being communicated, to logistics facilities that serve as the backbone of e-commerce fulfillment.

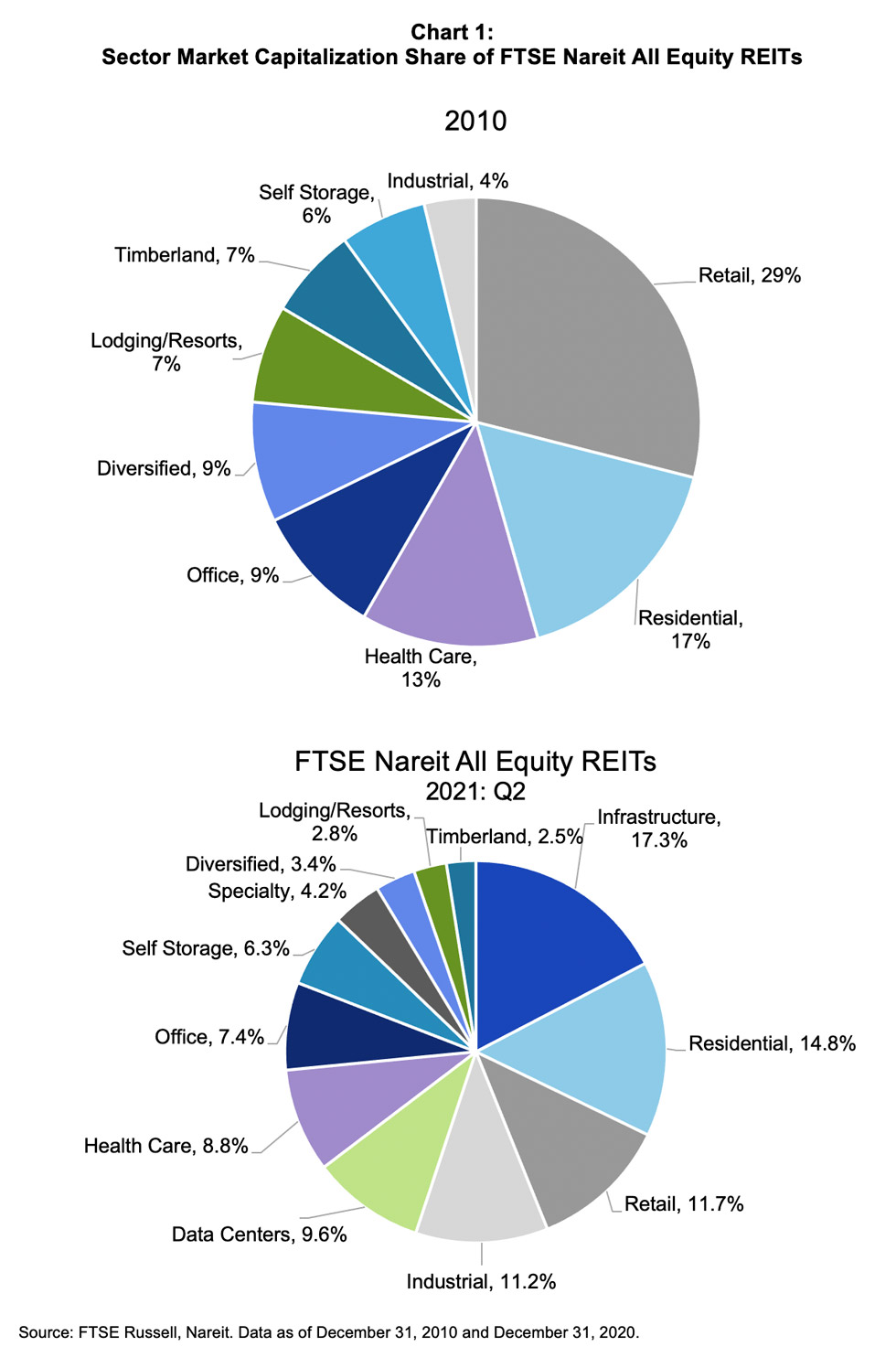

Over the past 10 years, we have seen dramatic changes in the composition of REIT equity market capitalization. As Chart 1 shows, in 2010 industrial accounted for just 4% ($12 billion) of equity REIT market cap, while cell towers had not been introduced into the index series, and data centers were not broken out into a stand-alone sector. At the end of 2020, these sectors accounted for 39% ($460 billion) of equity REIT market cap. While much of the expansion of the real estate sector has been driven by technological advancement, the introduction of new property sectors unconnected to technology have played an important role as well.

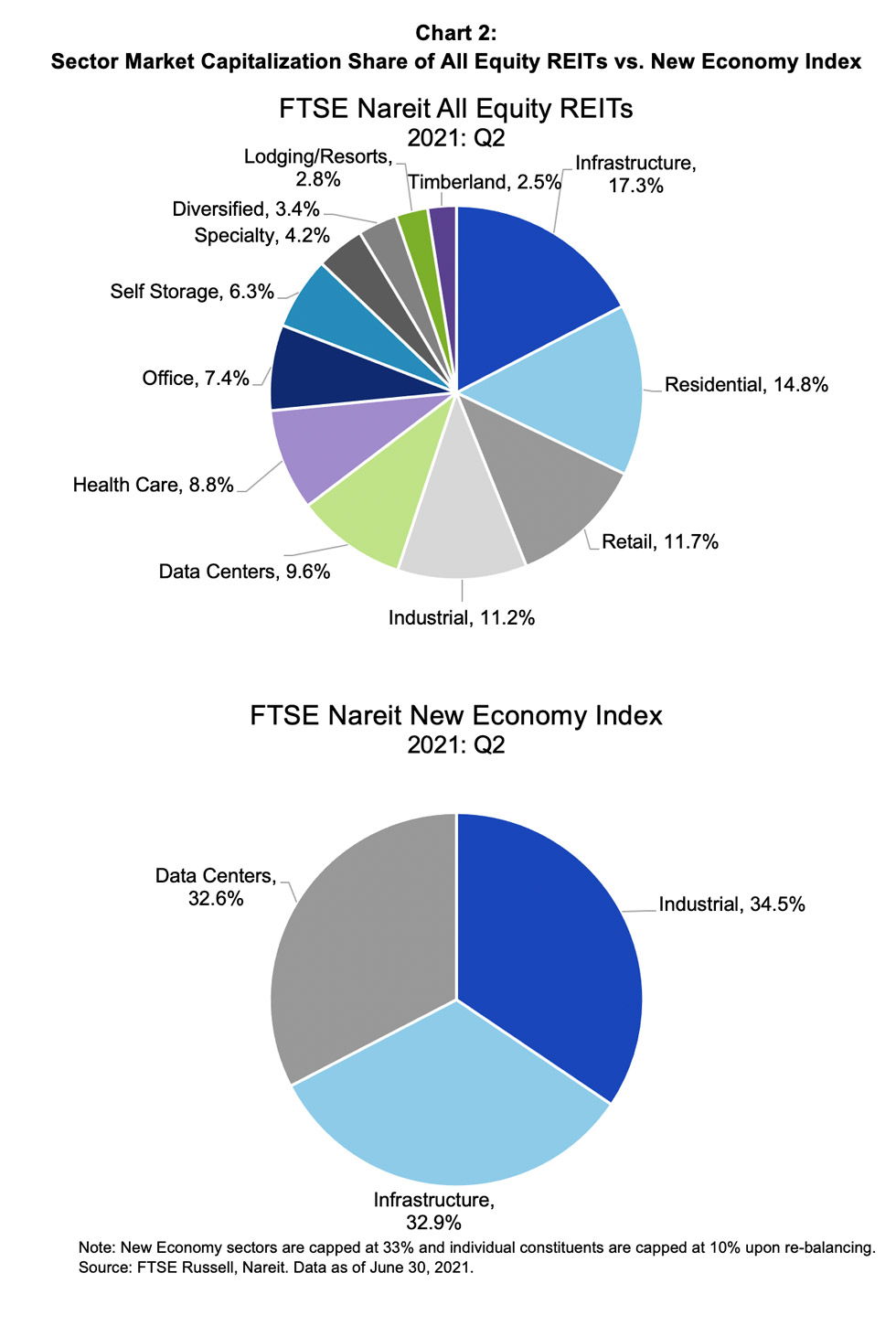

The growing importance of these new property sectors has fueled investor demand for products that accommodate these new investment propositions. Over the past 18 months, Nareit, along with its index partners FTSE Russell and EPRA, have updated and expanded the FTSE Nareit and FTSE EPRA/Nareit indexes to better reflect the evolving real estate landscape. The changes include introducing a new U.S. tech focused index (the FTSE Nareit New Economy Index). Chart 2 compares the sector weights of the New Economy index with the All Equity REITs index as of the second quarter of 2021.

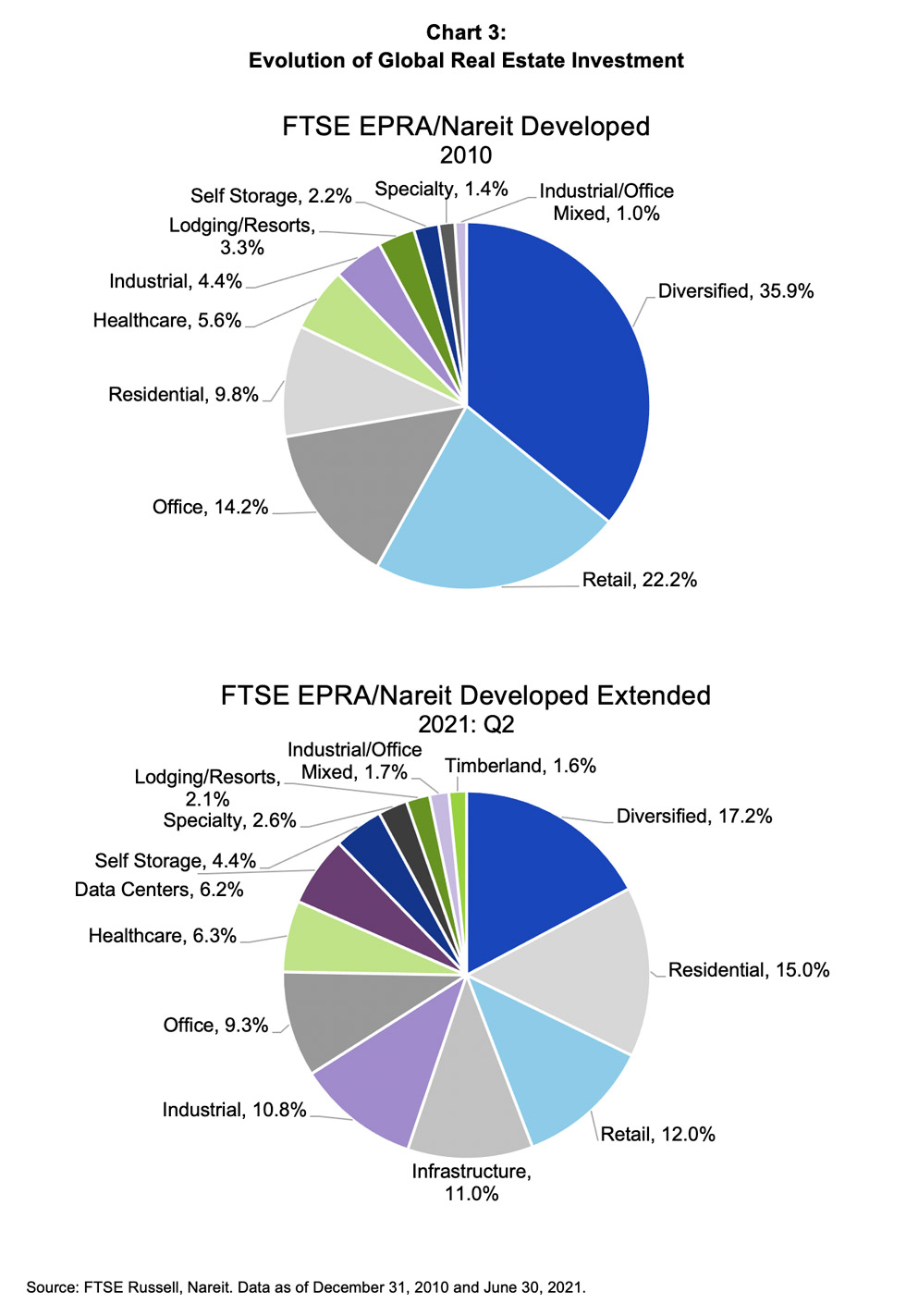

Globally, we have introduced a new index with a broadened scope that includes cell phone towers and timberlands (the FTSE EPRA/Nareit Global Extended Index series (PDF)), and updated the ground rules for the existing global index so all data centers are eligible. Chart 3 illustrates the evolution in the global opportunity set for real estate investing from the FTSE EPRA/Nareit Developed index in 2010 to the FTSE EPRA/Nareit Developed Extended index in the second quarter of 2021.