GDP growth decelerated in the fourth quarter to a 4.0% annualized rate, from the record 33.4% pace in the third quarter. Some slowing was inevitable after the quick gains from reopening stores and businesses that had been shuttered during the initial wave of the pandemic. The recovery still has a long way to go, however, as economic activity remained 2.5% below year-ago levels.

This recession is in several important ways the complete opposite from what happened in past downturns. Most obviously, the downturn resulted from an external shock—a global pandemic that made it unsafe to interact in public, as opposed to the internal weaknesses or financial imbalances that triggered past recessions. Although the current recession has caused severe financial damage to households and businesses, many fundamentals for the U.S. economy remain sound, including low inflation and the financial strength of the banking system, which may bolster the recovery once the pandemic is brought under control.

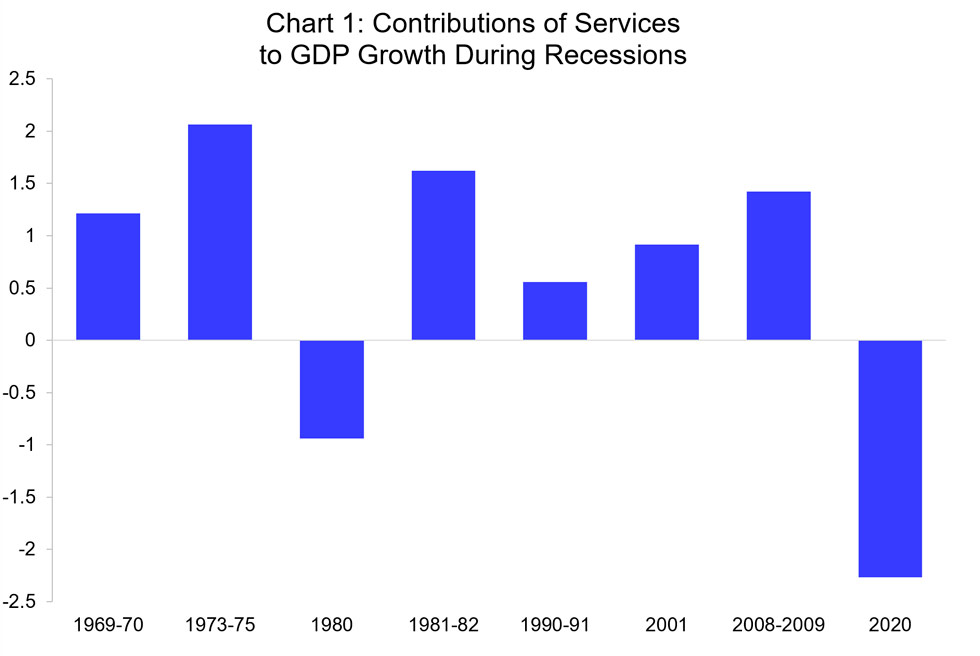

Trends in the composition of major components of the U.S. economy are also the complete reverse of past recessions. To demonstrate, let’s examine three broad groupings of economic activity: goods, services, and construction of structures. We start with services, which include spending on health care, transportation, entertainment, travel, and restaurant dining. Spending on these categories generally continues to rise even during a recession, with the downturn of 1980 being the only exception in modern economic history.

The recession caused by the pandemic, however, has had its worst impact on areas of the economy that rely heavily on face-to-face interactions between customers and workers—that is, the service sector, which contracted sharply in 2020.

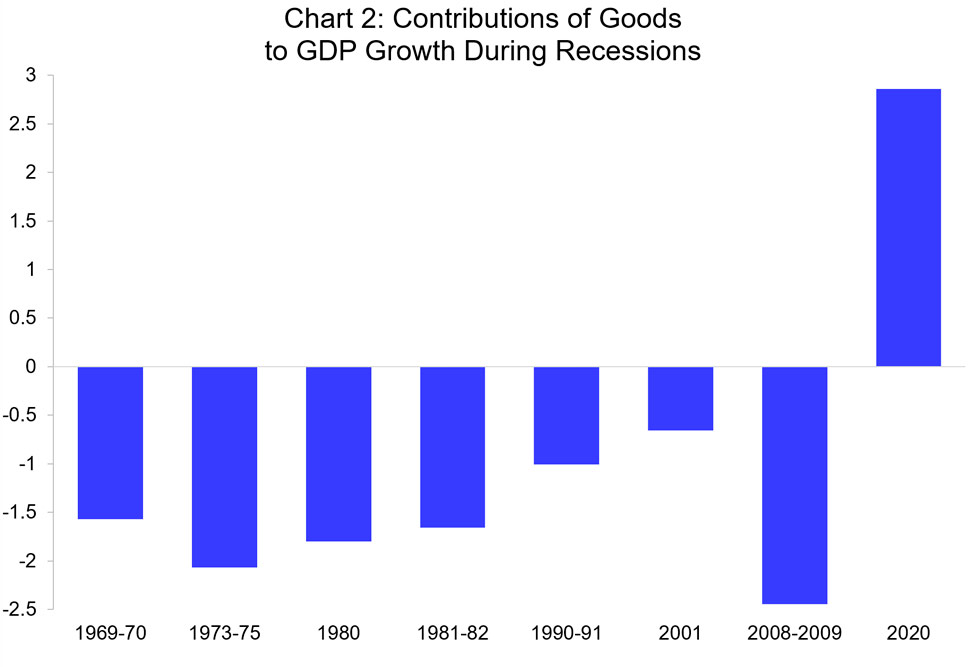

Spending on goods is also upside-down in this recession. Purchases of goods, especially durable goods like autos, furniture, and household appliances, typically fall sharply during a recession and are among the most cyclical components of the economy. Consumers can shift the timing of these purchases according to their financial condition, and generally buy more when times are good and cut back when times are bad.

Goods purchases have surged during the pandemic, however. Stay-at-home orders have spurred buying to fix up our homes, including electronics for home entertainment, home offices, sports and exercise equipment, and space heaters for outdoor social distancing. In addition, the money not spent on travel, entertainment and meals outside the home—all parts of the service economy—gives room in the budget for more purchases of goods.

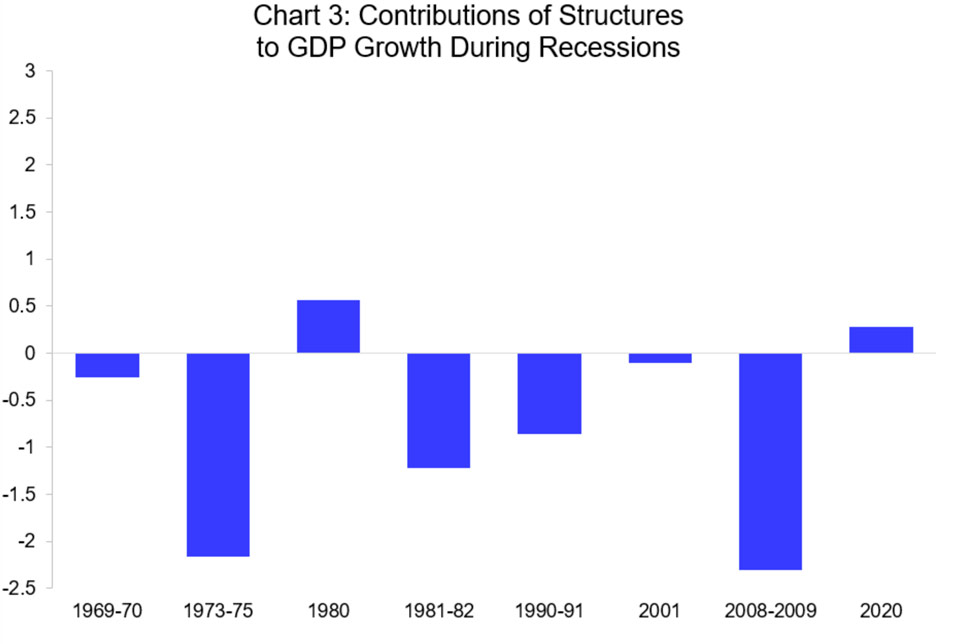

The impact of structures during the pandemic also differs from past recessions. Construction has made a (slight) positive contribution to GDP growth, in contrast to past declines. Growth in construction has been due entirely to a booming housing market, as strong demand and rising home prices have spurred housing starts. Commercial construction, in contrast, has slowed.

These unusual trends have implications for the path ahead. The boost to GDP from purchases of goods may fade, as many households have already bought the goods they need to be more comfortable during their days at home, and these items may no longer be in demand as the vaccines allow people to interact in public more freely. A potential slowdown in the goods sector poses a risk of the economic recovery losing some momentum.

The service sector, in contrast, is poised for a rebound once the pandemic is brought under control. One of the most common complaints during the pandemic has been how much we all miss dinners out, travel, and the ability to enjoy in-person entertainment. There is a pent-up demand for these services that may surge later this year.

Finally, the slowing of commercial construction will reduce the supply of new commercial buildings over the next few years. Such a moderation in supply has helped commercial real estate markets recover from most downturns, and is likely to help lower vacancy rates, boost rent growth, and support commercial property prices as the economy recovers in the months and years ahead.