The FTSE EPRA Nareit Developed Extended Index (PDF) faced headwinds in September as investors grappled with rising bond yields in the United States and other developed markets. Though inflationary pressures have continued to ease in the U.S. and other markets, hawkish commentary from central banks including the Federal Reserve and European Central Bank have led markets to expect interest rates to remain higher for longer than anticipated earlier in the year.

Global Real Estate Performance

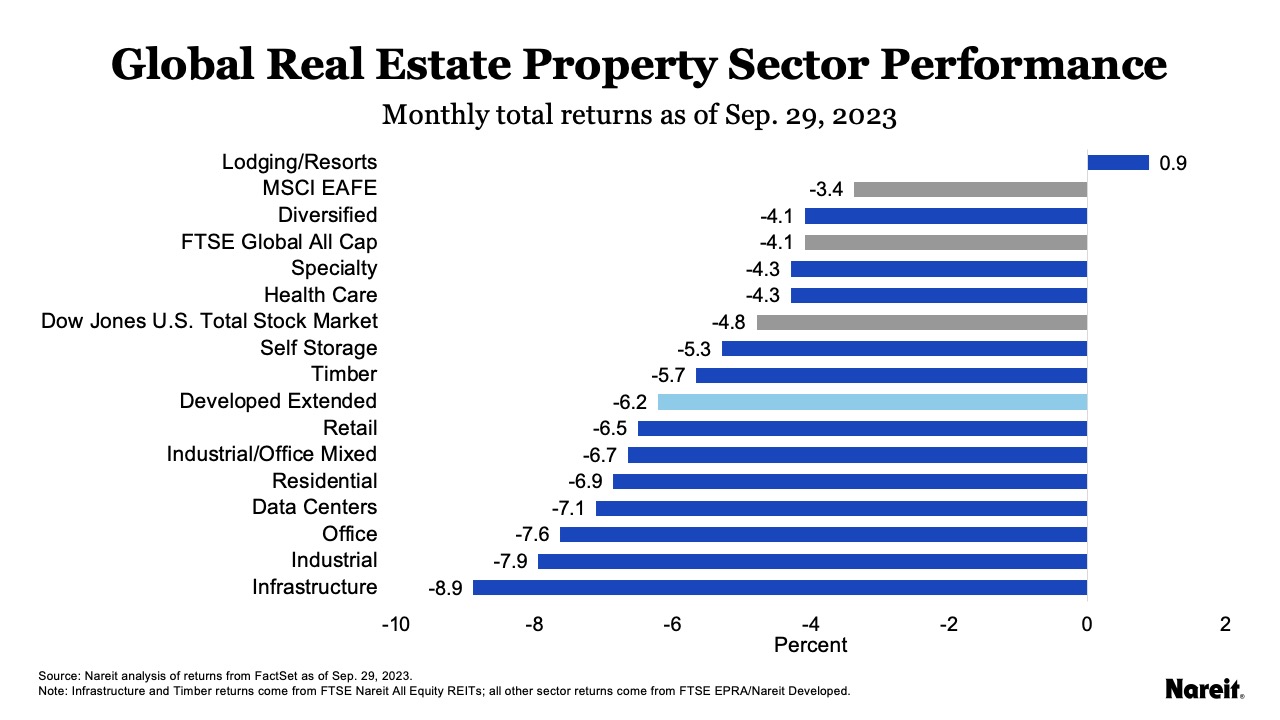

The FTSE EPRA/Nareit Global Real Estate Index Series (PDF) underperformed broader markets in September. The Developed Extended Index posted a total return of -6.2% for the month and -6.0% year-to-date; while the Global Extended Index, which includes both developed and emerging markets, returned -5.9% for the month and -6.1% year-to-date. The FTSE EPRA Nareit Developed Index, which does not include cell towers or timberlands, posted a -6.0% total return in September and -4.1% year-to-date.

Broader Market Performance

Broader equity markets struggled in September in the face of rising bond yields as well, with total returns on the MSCI EAFE, FTSE Global All Cap, and Dow Jones U.S. Total Stock Market of -3.4%, -4.1%, and -4.8%, respectively. On a year-to-date basis, the Dow Jones U.S. Total Stock Market is up 12.4%, the FTSE Global All Cap is 9.9%, and the MSCI EAFE is up 7.6%.

Property Sector Highlights

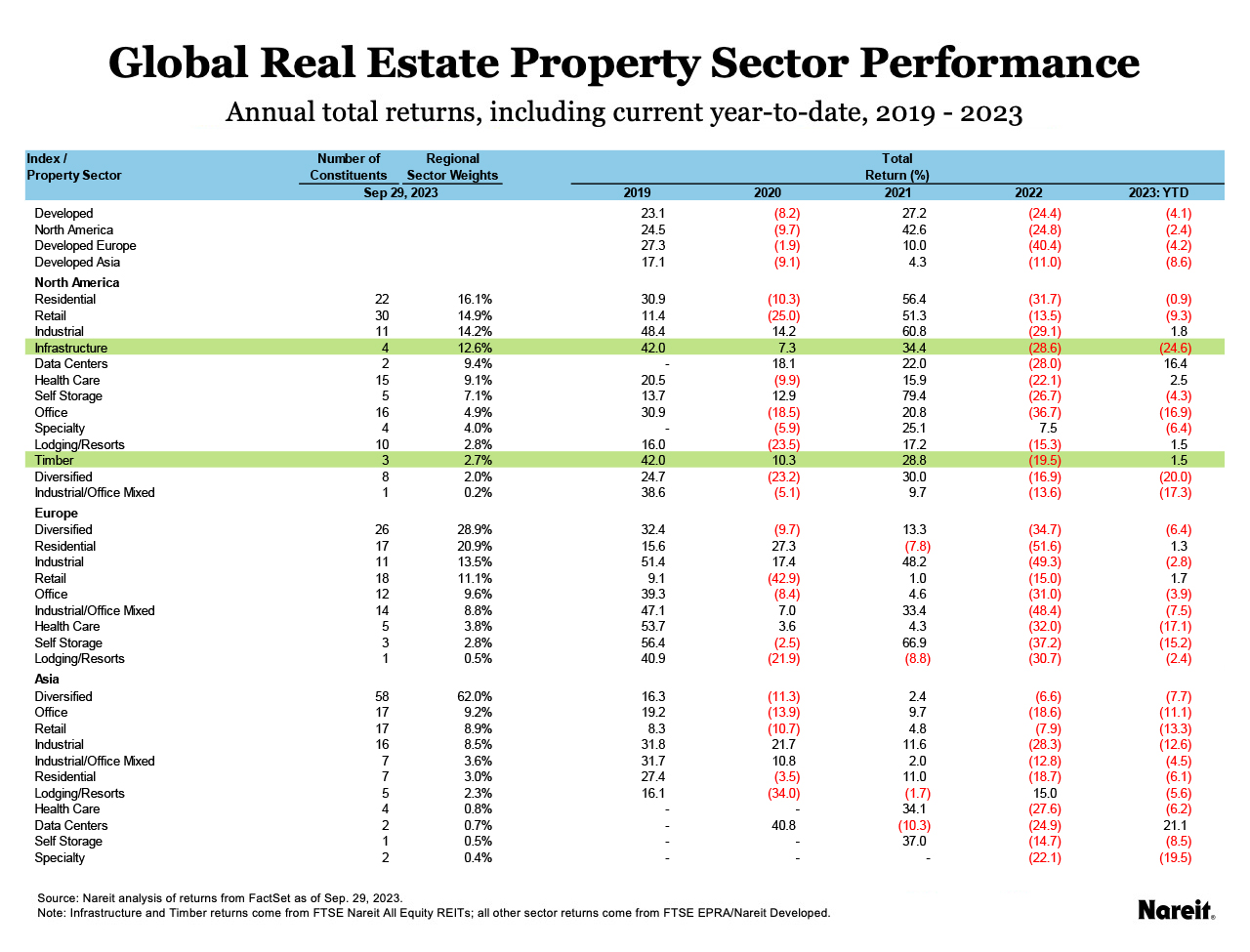

As shown in the above chart, the lodging/resorts sector led with a total return of 0.9% in September, followed by diversified at -4.1% and specialty at -4.3%. On a year-to-date basis, the data centers sector is up 16.5%, followed by timber at 1.5% and health care at 0.9%.

Regional Performance

Regionally within the EPRA Nareit Developed series, Asia outperformed in September, with a total return of -3.7%, followed by EMEA at -5.8% and North America at -6.7%. Year-to-date, the regions posted returns of -8.6%, -4.4%, and -2.4%, respectively.

The FTSE EPRA Nareit Emerging Markets Index (PDF) was down 2.1% for the month and declined 7.6% year-to-date. Within the emerging series, Europe rose 3.3% in September, followed by the Middle East & Africa, which closed the month flat, Emerging Americas at -2.6%, and Asia Pacific down 2.7%. On a year-to-date basis, Americas leads with a total return of 33.9%, followed by Europe at 2.8%, Middle East & Africa at 1.0%, and Asia Pacific at -16.5%.