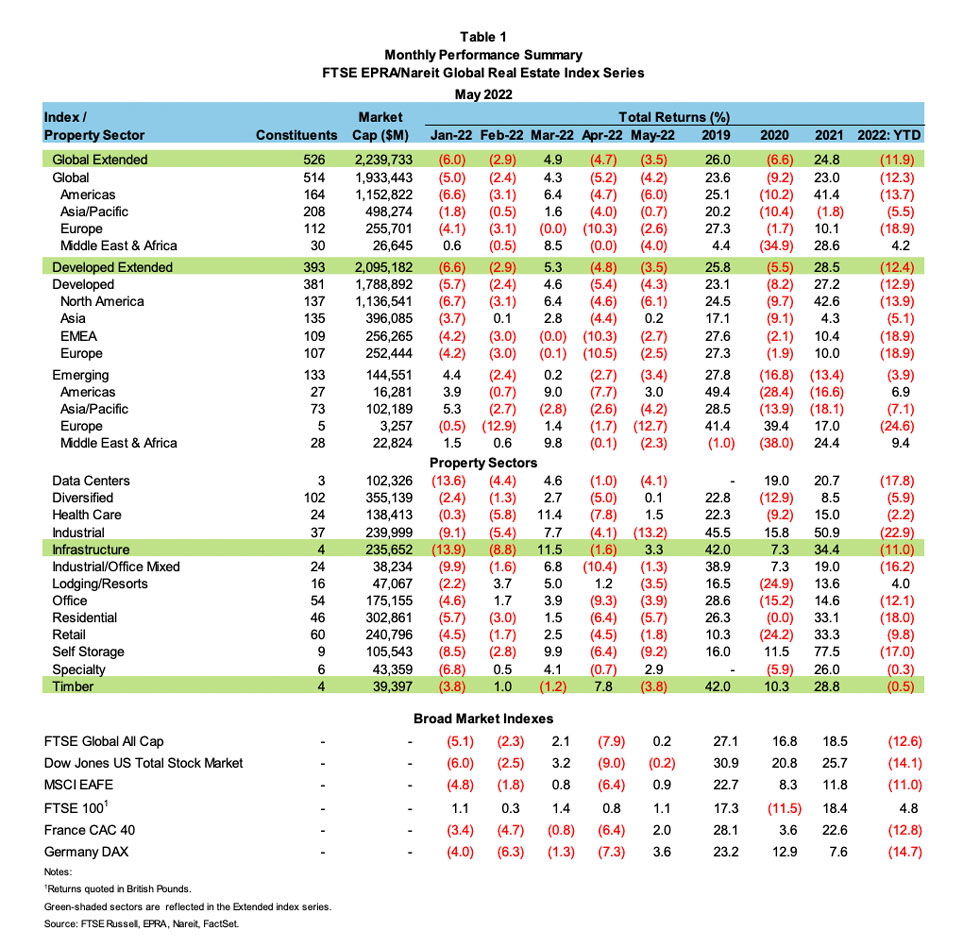

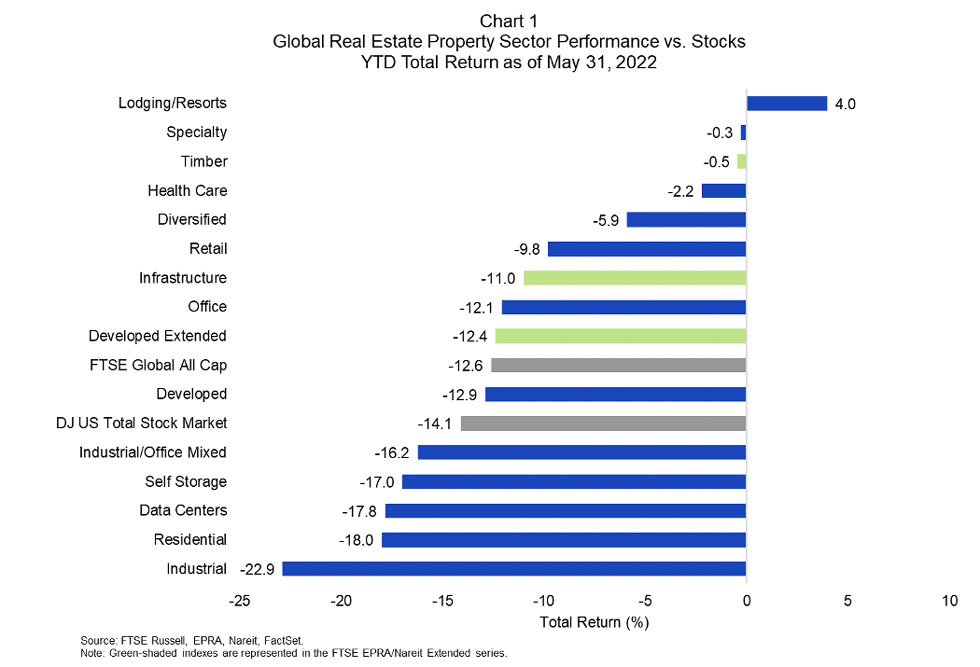

The FTSE EPRA/Nareit Global Real Estate Index Series underperformed broader markets in May as turbulent trading conditions persisted. The FTSE EPRA/Nareit Developed index posted a total return of -4.3% for the month and -12.9% year-to-date, while the Global index, which includes both Developed and Emerging Markets, returned -4.2% and -12.3% over these respective periods. The FTSE EPRA/Nareit Extended Index Series, which broadens the investable global real estate market to include cell towers and timberland, returned -3.5% in May and -12.4% year-to-date.

As tightening monetary policy and inflationary pressures continue to buffet financial markets, both factors have lowered expectations for economic growth and correspondingly corporate earnings. The disappointing results released by Amazon at the end of April persisted as a headwind in May as investors grappled with the prospect of additional warehouse space coming into the market as Amazon looks to sublease at least 10 million square feet of excess warehouse space. While this miscalculation highlights the difficulty of planning for the future in the current environment, it also serves to remind us of the specialized knowledge REITs and real estate companies rely on in building out the capacity of their property portfolios. The industrial sector, which makes up approximately 13% of the Developed index, lagged all other sectors with a total return of -13.2% in May.

Regionally within the Developed series, Asia continued its relative outperformance in, with a total return of -0.2%, followed by EMEA at -2.7, and North America at -6.1%. Year-to-date, these regions posted returns of -5.1%, -18.9%, and -13.9%, respectively.

In the Developed Extended index series, infrastructure led to the upside in May, with returns of 3.3%, followed by specialty at 2.9% and health care at 1.5%. As previously noted, industrial lagged with a return of -13.2%, followed by self-storage at -9.2%, and residential at -5.7%. Lodging/resorts remains the lone sector in positive territory on a year-to-date basis, with a total return of 4.0%.

Broader markets posted lackluster returns in May, but outperformed real estate, with total returns on the FTSE Global All Cap, Dow Jones U.S. Total Stock Market, and MSCI EAFE of -0.2%, -0.2%, and -0.9%, respectively. Year-to-date, the FTSE Global All Cap is down 12.6%, the Dow Jones U.S. Total Stock Market is down 14.1%, and the MSCI EAFE is down 11.0%. Since Russia invaded Ukraine on Feb. 23, the FTSE Global All Cap is down 4.0%, the U.S. Total Stock Market is down 2.6%, and the MSCI EAFE is down 5.7%. Over this period, the Developed index is down 4.0% while the Developed Extended index is down 1.7%.