For decades, defined benefit (DB) pension plans have been using real estate successfully within their investment portfolios. This is because most pension plans consider real estate a fundamental asset class with unique investment attributes and return drivers and believe it should be included in all investment portfolios alongside stocks, bonds, and cash.

The defined contribution (DC) world is rapidly catching up with the DB world in terms of investing in real estate, particularly through the use REITs—and for good reason. Past studies conducted by the Center for Retirement Research at Boston College, CEM Benchmarking, a benchmarking firm in Toronto, and others found that DC plans have underperformed DB plans and determined that a key driver was the fact that certain asset classes used in DB plans, such as real estate, are not always made available in DC plans.

During the past 20 years, there has been a dramatic increase in the use of REITs within asset allocation products, and the growing use of these products, particularly target-date funds (TDFs), remains the dominant investment-related trend in the U.S. DC market today. This trend should have a positive and increasingly substantive impact on DC participants gaining exposure to real estate.

Why Real Estate?

The fact that investment experts consider real estate a fundamental asset class is based on the specific, well-documented attributes of real estate investment, including:

- A distinct economic cycle relative to the cycle for most other equities and bonds due to supply constraints, which reduces the correlation of investment returns from real estate with the returns from other assets;

- Competitive, long-term investment returns that potentially provide high and growing income from rents, plus moderate capital appreciation over time; and

- Potential inflation hedging attributes due in part to the fact that many leases are tied to inflation and that real asset values tend to increase in response to rising replacement costs.

Incorporating Real Estate in DC Plans

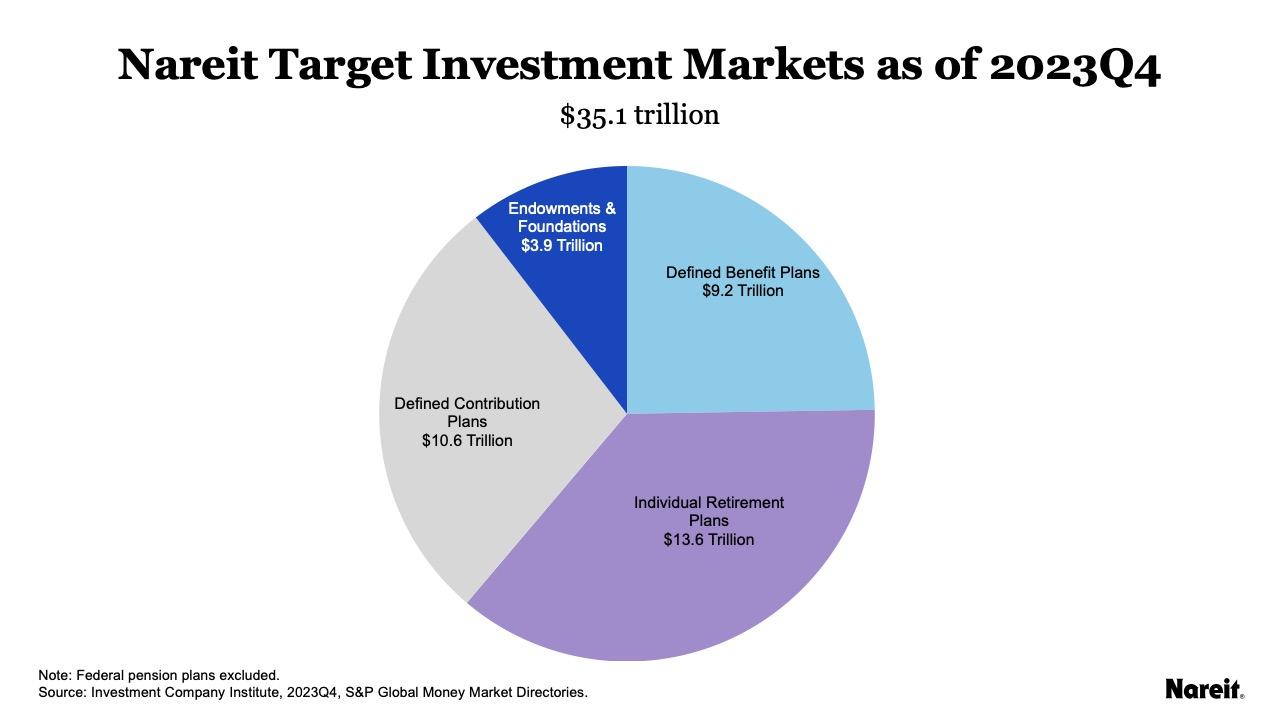

In considering the use of real estate in DC plans, it may be helpful to first consider how real estate is being used in the other two-thirds of the U.S. retirement market. As illustrated by exhibit one above, the U.S. retirement market is roughly divided into thirds across traditional DB plans, DC plans, and Individual Retirement Accounts (IRAs).

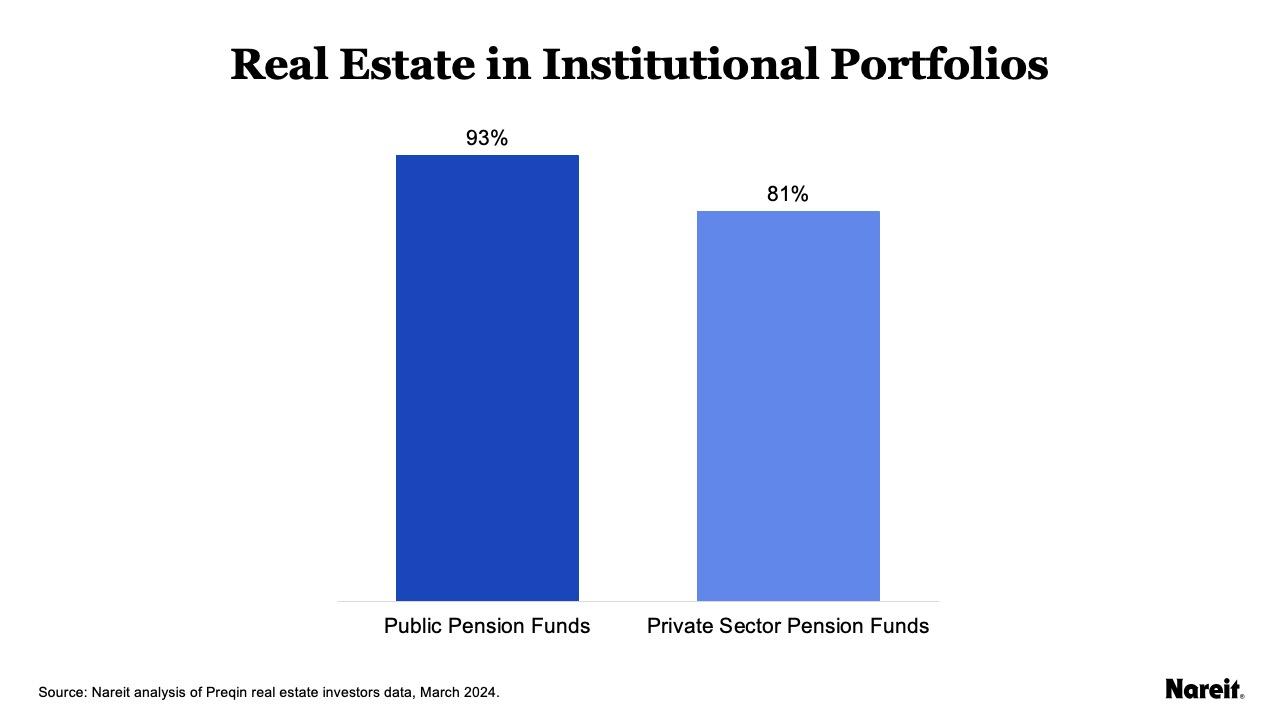

As referenced earlier, most DB plans consider real estate to be a fundamental or core asset class and thus include real estate within their portfolio allocations. In fact, based on Preqin data of DB plans that incorporate assets other than stocks, bonds, and cash, more than 90% of the largest pension plans in the U.S.—public DB plans—invest in real estate.

In considering the IRA market, it is important to examine the behavior of financial advisors as they have significant influence over the asset allocation decisions associated with these accounts. As evidence of this, based on data from the Investment Company Institute’s Annual Survey of IRA owners, 75% of traditional IRAs are managed using investment professionals. With respect to the use of real estate by financial advisors, according to a 2021 Chatham Partners survey, 83% of advisors invest their clients in real estate through the use of REITs. The most frequently referenced REIT attribute they cite is portfolio diversification.

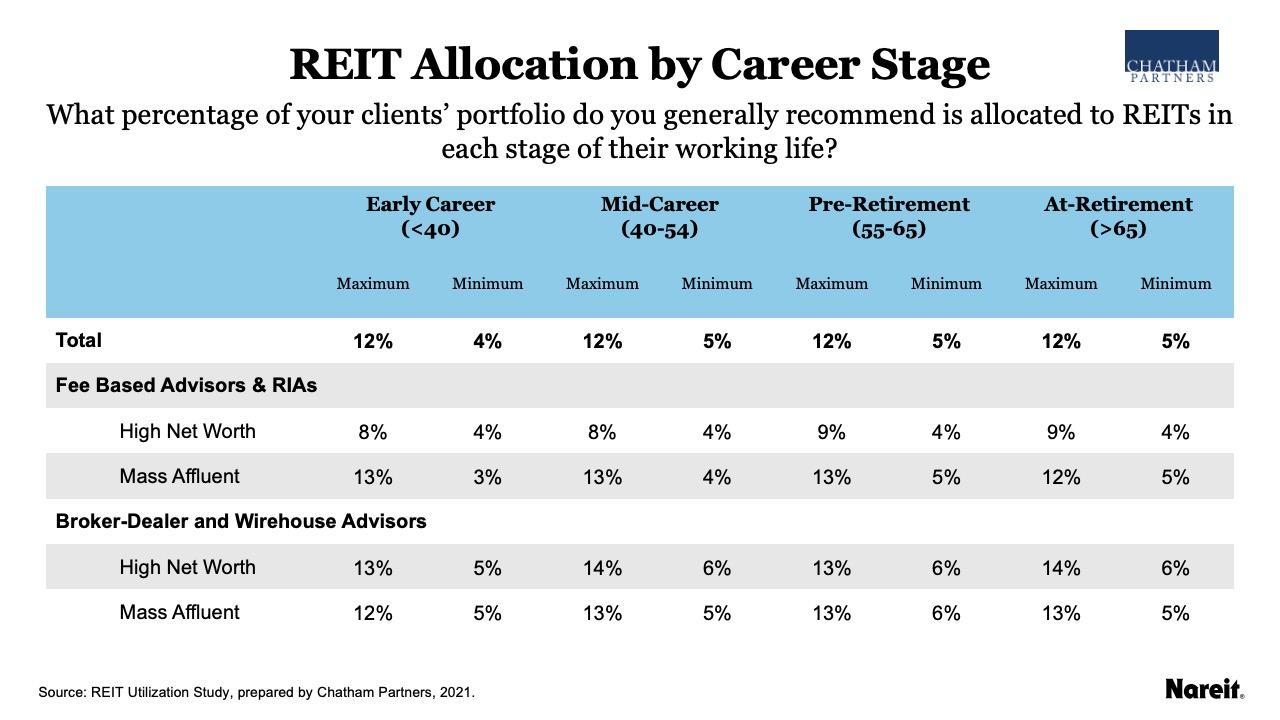

As shown above in exhibit three, advisors recommend allocations to REITs in the range of 4% to 12%, irrespective of the client’s age, from early career through retirement.

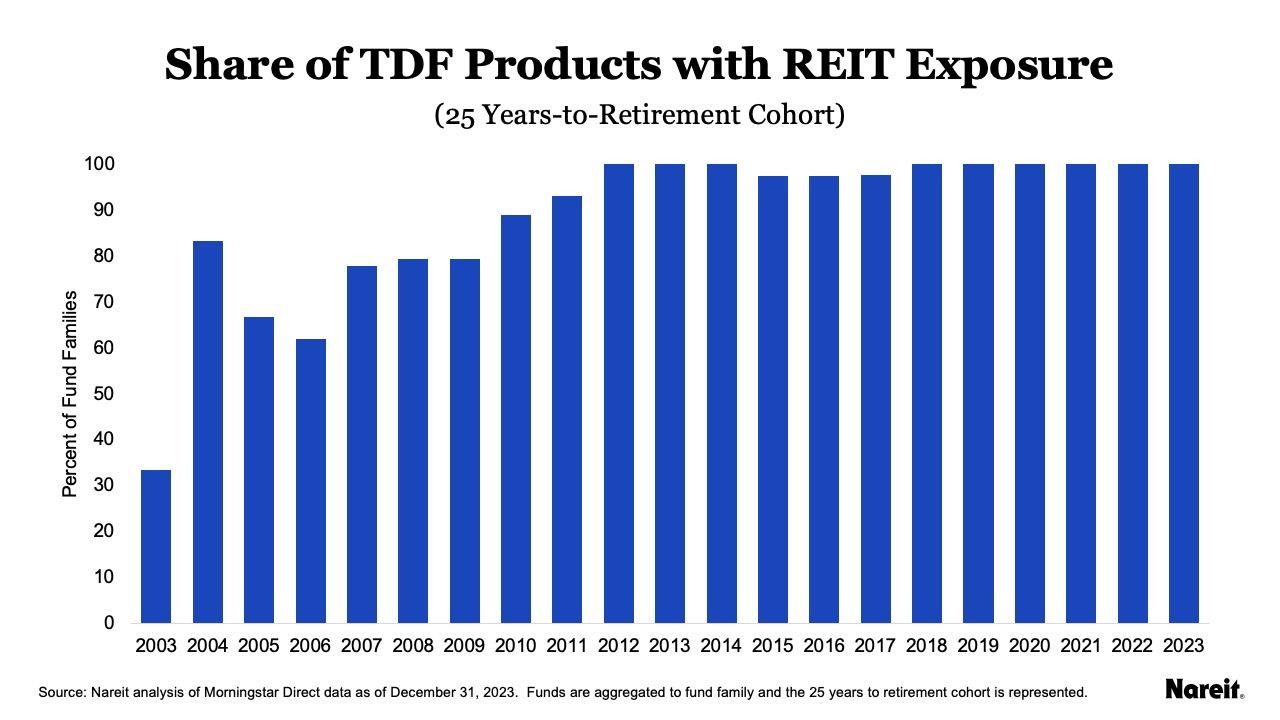

DC plan sponsors considering whether to include real estate in their plans should be aware that while DC plans have been slower than DB plans to include real estate, their adoption of the asset class in recent years has been rapid. A significant portion of DC plans has added real estate investment options on a stand-alone basis. However, many more have incorporated this important asset class within their asset allocation offerings, such as their TDFs. In a vast majority of cases, this real estate exposure is gained through an investment in REITs. In fact, a particularly noteworthy development in the asset allocation arena in the U.S. has been the significant increase in both the number of asset allocation products that now include a REIT allocation and the percentage of total assets allocated to REITs within these products.

As evidence of this, based on an analysis using Morningstar Direct data, the share of TDFs with REIT exposure increased from 50% in 2003 to nearly 100% in 2019 (see exhibit four above). In addition, 61% of TDFs used in the U.S. now have a dedicated REIT sleeve within their asset allocation.

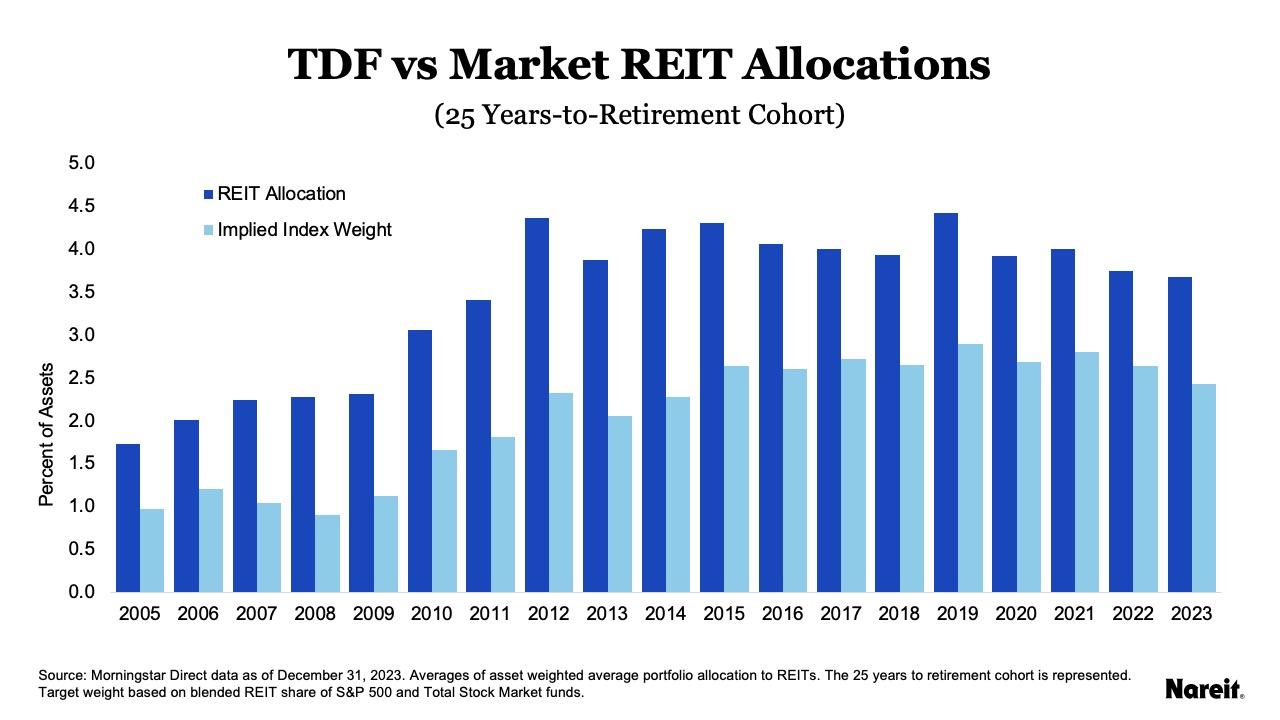

Additional evidence of the increased use of REITs in TDFs may be found above in exhibit five. This bar chart compares the implied REIT index weights against the actual REIT allocations across a broad spectrum of TDF vintages. It demonstrates that the actual REIT allocations across all vintages are well above the implied index weights.

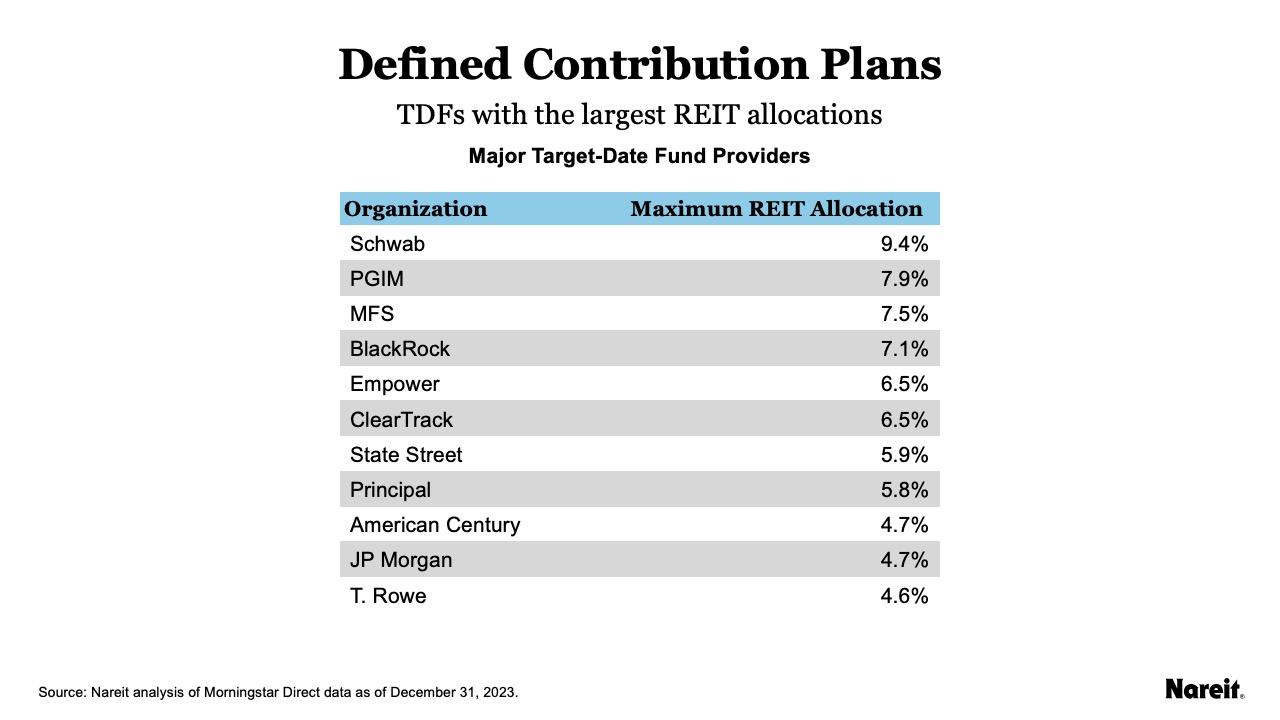

Exhibit six above lists the maximum real estate allocations included in the TDFs of some of the major asset allocation fund providers in the U.S. As of year-end 2023, the funds of a number of TDF providers have allocations in the high single digits.

The Growth and Importance of Asset Allocation Products

The growing use of asset allocation products, particularly TDFs, remains the dominant investment-related trend in the U.S. DC market today. In fact, some industry experts believe that a majority of assets in U.S. DC plans will be invested in target-date products within the next 10 years.

As a result of this trend, DC plans in the U.S. will continue to gain greater exposure to diversifying asset classes because investing will be done less frequently by plan participants and more frequently by investment professionals—individuals who understand the importance and value of diversification. This trend should have a positive and increasingly substantive impact on DC participants gaining exposure to real estate.

Why Listed Real Estate?

Quite simply, listed real estate companies, including REITs, are organizations with a core business of owning stabilized properties, managing them to maximize long-term net total returns, and passing rental income along to investors in the form of corporate dividends. The same set of underlying factors that determine the returns of non-REIT real estate investments—the pace of new construction, occupancy rates, rent growth, investor discount rates, and more—also determine REIT returns.

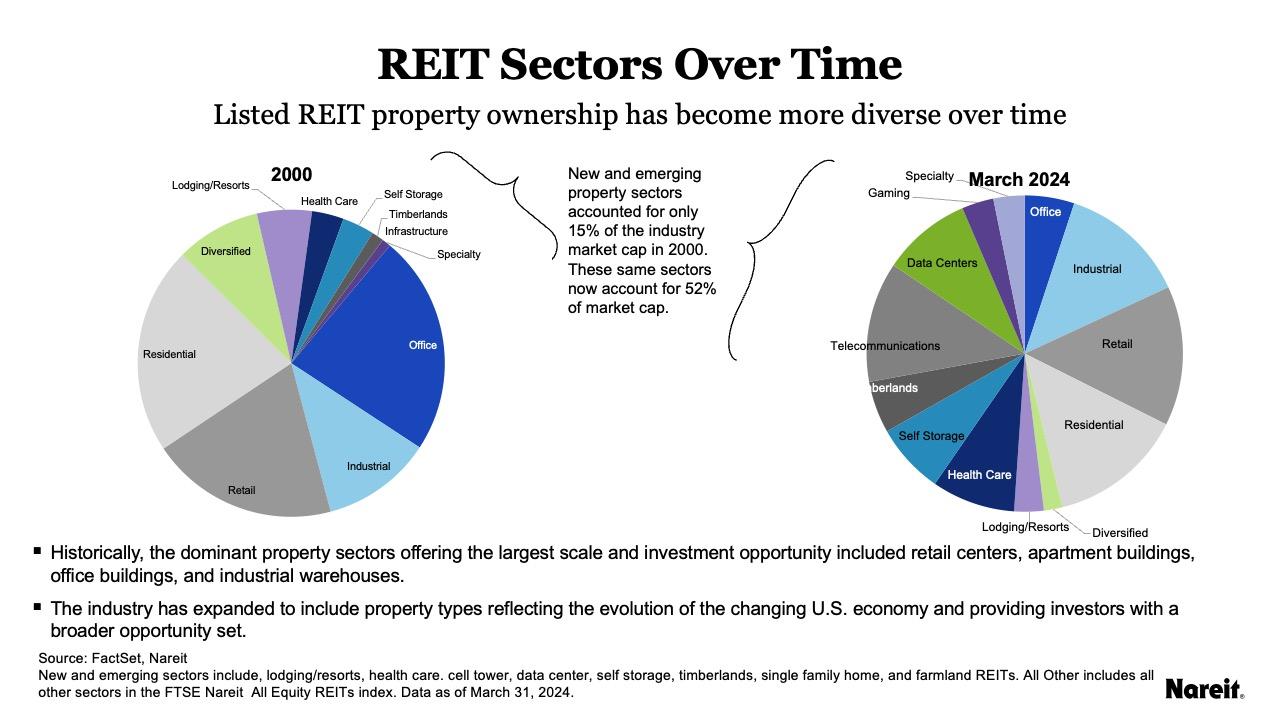

REITs invest in a broad range of traditional property types, including retail centers, apartment buildings, office buildings, and industrial warehouses. In addition, the REIT industry has expanded to include infrastructure, data centers, cell towers, timberlands, and single-family housing. These property types reflect the evolution of the changing U.S. economy into a more modern economy.

Exhibit seven above shows that while new and emerging property sectors accounted for only 15% of the REIT industry market capitalization in 2000, these same sectors account for more than half (52%) of the market capitalization today.

While a limited number of TDFs in the U.S. invest in real estate through direct or private investment vehicles, most asset allocation products provide real estate exposure exclusively through investments in REITs. Usually this is because REITs offers low-cost access to real estate, daily market pricing, liquidity, and a strong long-term performance record. From the perspective of a DC plan sponsor, implementation of REITs can be as simple as adding any other fully liquid mutual fund or ETF to their platforms. In short, REITs are bought and sold like other stocks, mutual funds, and ETFs.

What is an Appropriate Allocation to Listed Real Estate, including REITs?

Since 2002, Nareit has been conducting sponsored research with multiple firms, including Ibbotson Associates, Morningstar Associates, and Wilshire Funds Management, to study the role listed real estate can play within diversified portfolios. These firms have come to similar conclusions, finding that the optimal portfolio allocation to listed real estate may be between 5% and 15%. The appropriate allocation will vary depending on the investor’s goals, risk tolerance, and investment horizon. An example of this research is a new Morningstar Associates analysis, which found that the optimal portfolio allocation to REITs ranges between 4% and 20%.

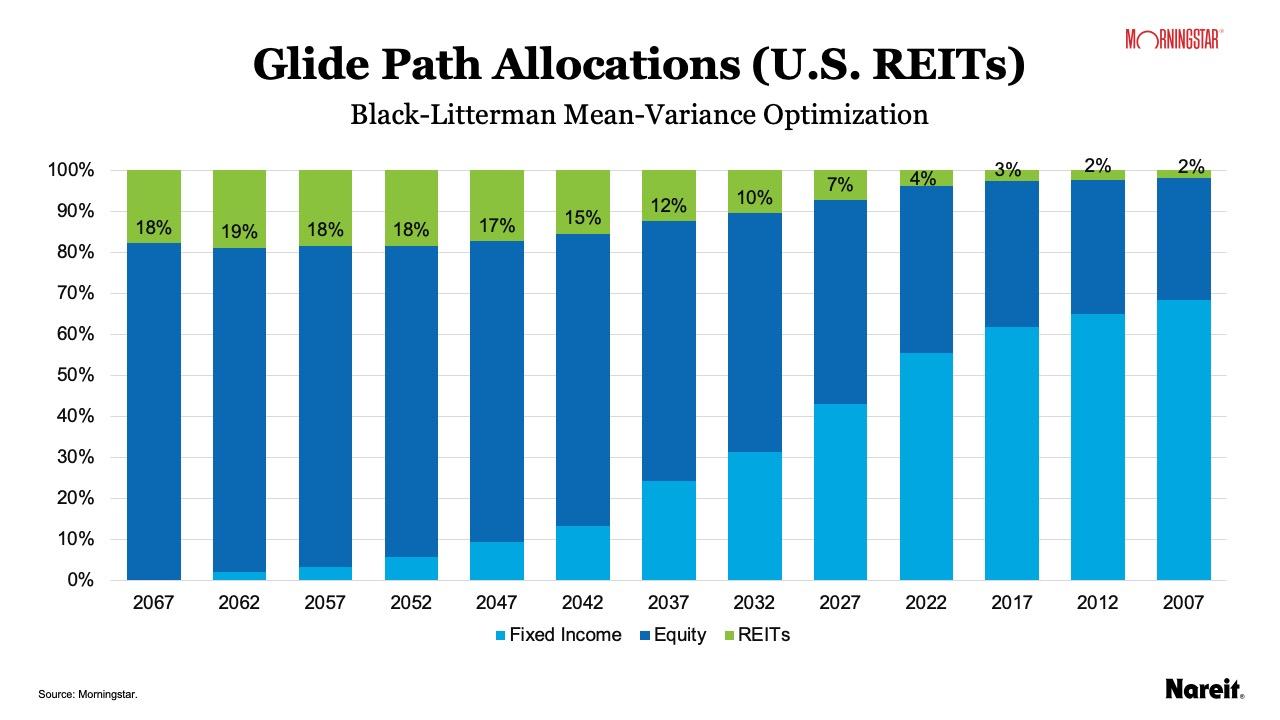

As illustrated in the Morningstar analysis in exhibit eight above, U.S. REIT allocations in a TDF portfolio begin at 20% for an investor with a 40+ year investment horizon and gradually decline (along with other equities) as the investment horizon shortens, but ultimately remain meaningful at 11% at the beginning of retirement.

In this analysis, Morningstar used the Black-Litterman methodology, a mean-optimization methodology well-respected by the institutional investment community. Portfolio managers use this methodology as a tool to understand how to optimally allocate investments across different asset classes. The Black-Litterman model is an extension of mean-variance optimization, which asserts that an investment’s risk and return characteristics should not be viewed alone but should instead be considered based on how the investment impacts the overall portfolio’s risk and return. Black-Litterman seeks to avoid the often extreme unconstrained portfolio allocations that result from mean-variance optimization. The Black-Litterman approach produces stable, optimal portfolios based on an investor’s insights. Using the Black-Litterman mean-variance optimization, the table identifies efficient asset mixes that provide the greatest expected return for a given amount of expected risk. The inputs used are based on Morningstar Investment Management’s assumptions.

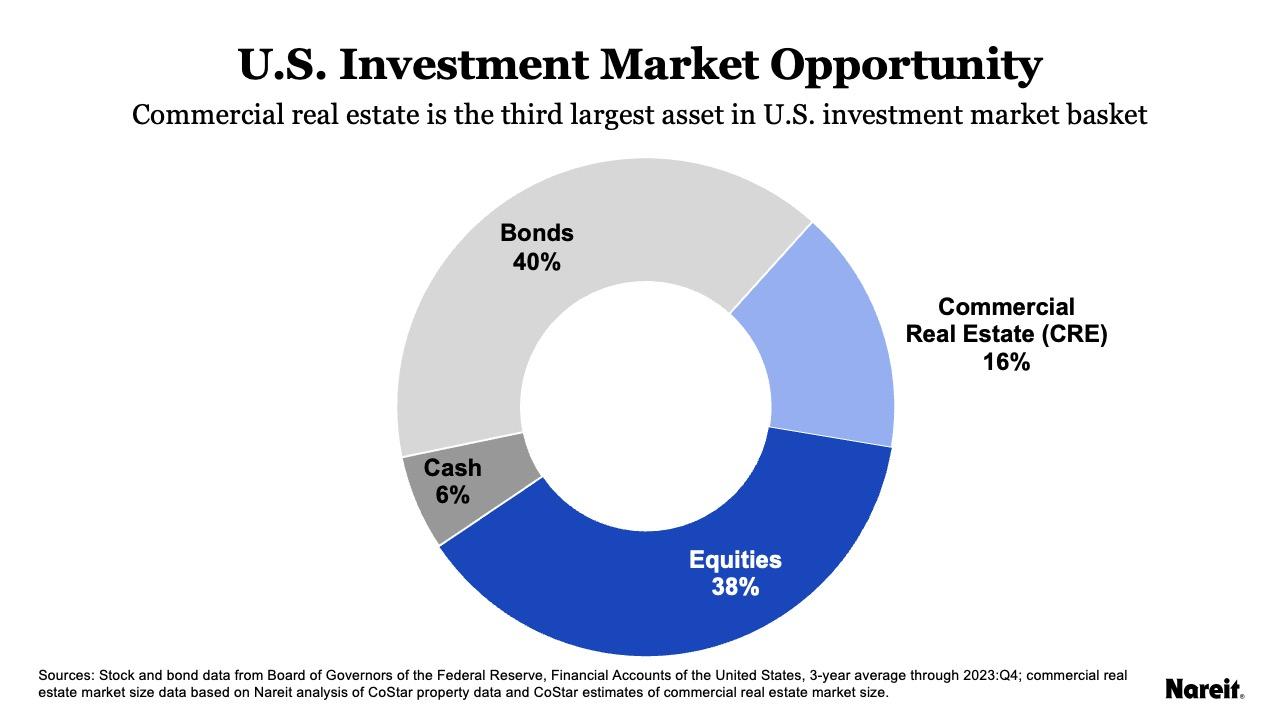

The fact that the optimized model portfolios produced by Morningstar, Wilshire, and others feature meaningful REIT allocations is not a surprise given the size of the commercial real estate market. Modern portfolio theory emphasizes the importance of diversification within a portfolio (maximizing returns and reducing volatility); and well-diversified investment portfolios should include meaningful allocations to all assets in the entire market basket, including real estate.

As illustrated in exhibit nine above, commercial real estate is the third largest asset (16%) in the U.S. investment market, after U.S. equities (34%) and U.S. bonds (42%). It is important to note that while REITs only represent an estimated 10% to 20% of the real estate asset figure, research by organizations such as CEM Benchmarking have found that equity REIT returns are highly correlated with other forms of commercial real estate. It is for this reason that REITs are used to gain commercial real estate exposure in a U.S.-based portfolio. REITs may also be used to gain meaningful exposure to the global commercial real estate market basket.

In the U.S., most DB plans and financial advisors have recognized the fact that, like stocks, bonds, and cash, commercial real estate is a core asset class and should be included in well-diversified portfolios. DC plans presently lag in their use of real estate, but are catching up rapidly. Currently, the best means by which DC plan sponsors can provide their participants access to real estate is through incorporating this important asset class in the plan’s TDFs offering. While TDFs have several perceived advantages over other investment options, one of the most significant is that they make it possible for investors to invest in the real estate asset class through listed real estate, including REITs, at some level approaching the optimal allocation.

In order to ensure plan participants are meeting their retirement income goals, plan sponsors would benefit from ensuring that a meaningful allocation to real estate—a sizable asset class—is made available through their investment platforms. As a practical matter, the simplest, lowest-cost, and fully liquid means of doing this is to make TDFs available to plan participants and ensure these funds include an allocation of at least 5%, and up to 15% or more, to REITs.