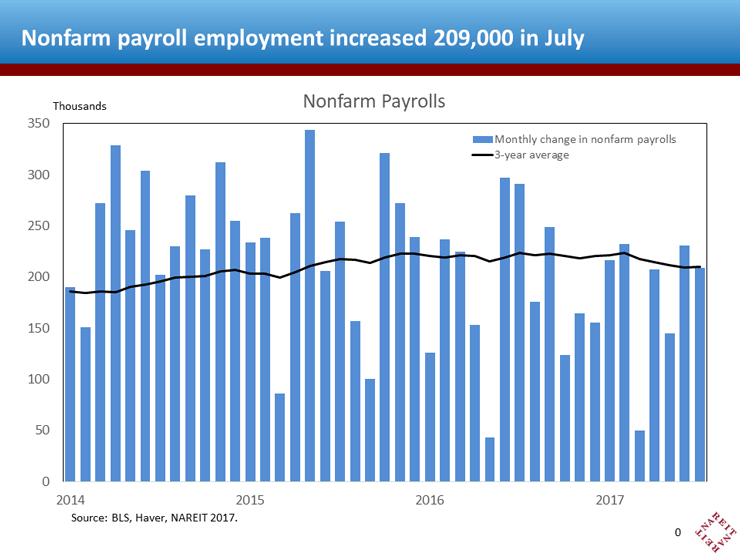

Nonfarm payroll employment rose 209,000 in July and the unemployment rate ticked lower, to 4.3 percent, further signs that the macroeconomy has good momentum at mid-summer. Job growth is important to all sectors of the economy and to all types of real estate because rising jobs and incomes boost demand throughout the economy. Employment gains have a more immediate impact on the office sector, though, as the need for office space is directly tied to job growth. The latest news on the jobs front is favorable for the outlook for office REITs and office property markets.

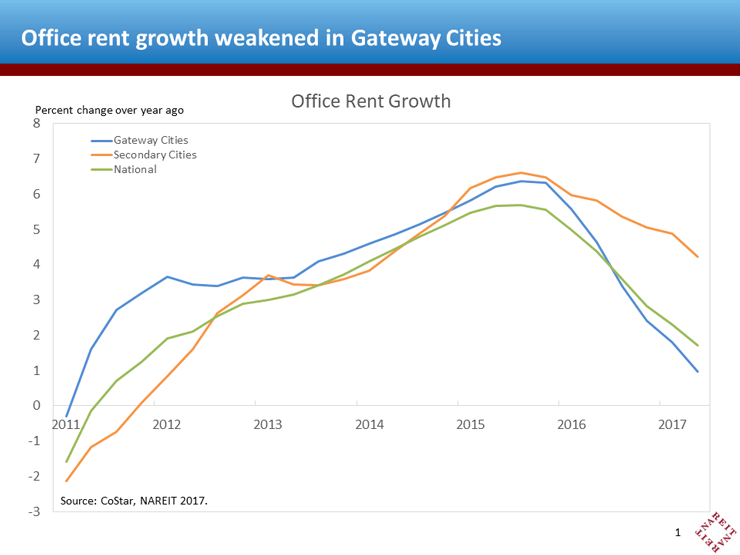

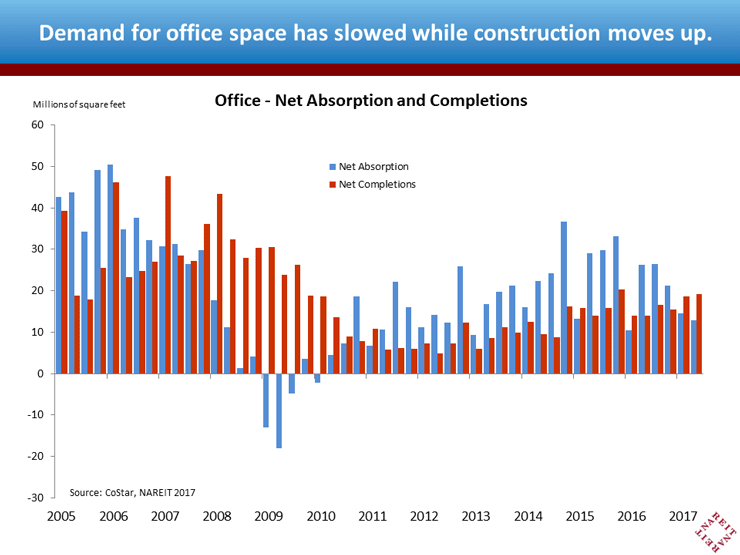

It has been somewhat surprising that, despite sustained overall job growth, conditions in the office sector softened in the first half of the year. Office rents in the second quarter were 1.7 percent above a year earlier, well off the rent growth of 4 percent and higher growth the sector enjoyed from 2014 through the middle of last year. New supply played some role in the slowdown, as completions of new office buildings in the first half of 2017 were 35 percent higher than during the first half of last year (chart below, red bars). Another factor damping rent growth was slack demand for office space, with net absorption in the first half of this year running well below last year’s pace (blue bars).

To understand how the demand for office space slowed even as headline national job numbers kept pace, it is helpful to dig into two details: what types of jobs are being created, and where they are located:

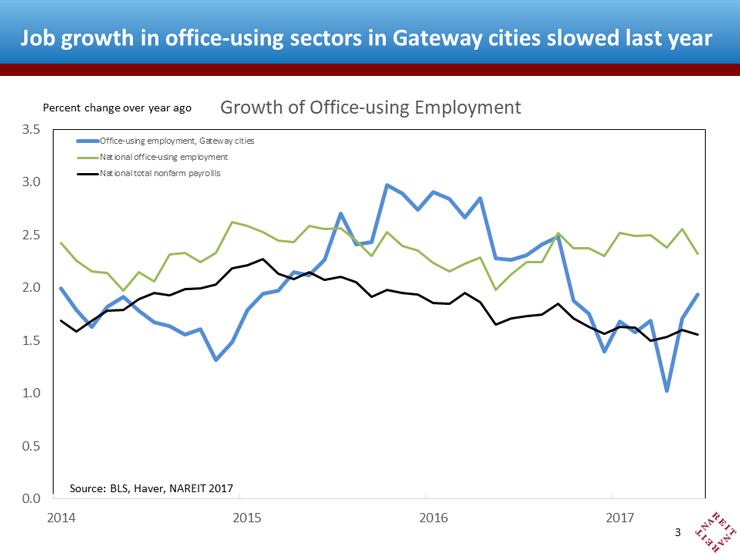

- Office jobs versus other employment sectors. Only 20 percent of total payroll employment is in office-based jobs (professional and business services, financial sector, and information); the remaining 80 percent is in sectors including manufacturing, construction, retail trade, leisure and hospitality. Trends in office employment and these other sectors often diverge.

- Gateway cities versus the rest of the country. About half of the total value of the nation’s stock of office buildings is concentrated in a few major “Gateway” cities (New York, Washington, Chicago, Los Angeles, Boston and San Francisco), and these cities often set the tone for the national job market. Gateway cities, however, contain only about one-fifth of all office-based employment, and trends in office employment in Gateway cities at times differ from the rest of the country.

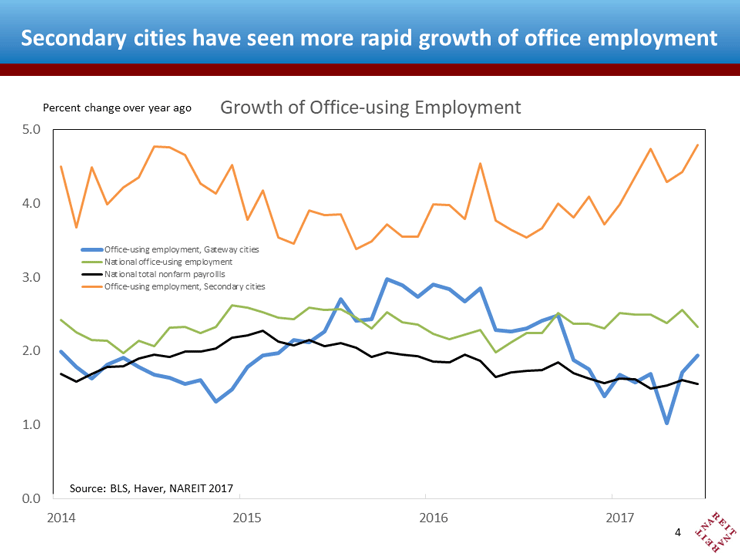

Indeed, growth of office jobs in Gateway cities weakened last year (blue line, chart above) even as overall national employment trends remained solid. Financial sector jobs in New York were essentially flat in 2016, and the growth of tech jobs in San Francisco cooled from their previous rapid pace; other major cities were also sluggish. Given the prominent position of these cities in the national office market, the pace of office job growth in these cities played a significant role in the overall slowdown.

The recent soft spot in office markets may be short lived, however, as office jobs in Gateway cities rebounded in the spring. In fact, growth in office employment in Gateway cities accelerated in the most recent three months to the largest quarterly gain in two years. Growth of office employment outside of the main cities has outpaced the national average, and has accelerated further over the past year (chart above, orange line). These recent trends in office employment suggest that conditions in office markets in both Gateway cities and other metro areas are likely to firm.

For more detailed analysis of the trends in supply, demand and REIT portfolios in Gateway cities and secondary markets, see Alexandra Thompson’s recent Market Commentary.