The recent Cornell University/Hodes Weill’s 2024 Allocations Monitor report found that in 2023, institutions were more active allocating capital to REITs, as investors looked to capitalize on discrepancies between public and private market valuations.

Key takeaways from the report include:

- More than half of large institutions’ real estate teams ($50+ billion AUM) use REITs;

- More than half of large institutions allocated new capital to REITs in 2023, a large jump from 2022; and

- The largest increase in REIT usage was by sovereign wealth funds, government entities, and insurance companies.

This 12th annual report offers insights into the role of real estate in institutional portfolios and examines real estate allocation trends across different regions and institution types, with data collected anonymously from 186 institutional investors across 25 countries. These institutions, collectively managing over $13.6 trillion in assets, hold approximately $1.4 trillion in real estate investments.

The report found that institutions held target real estate allocations flat for the second consecutive year but expect to lower target allocations over the next 12 months. Investment conviction remained moderately positive, albeit down slightly year-over-year, as institutions are optimistic about real estate investment opportunities over the next several years.

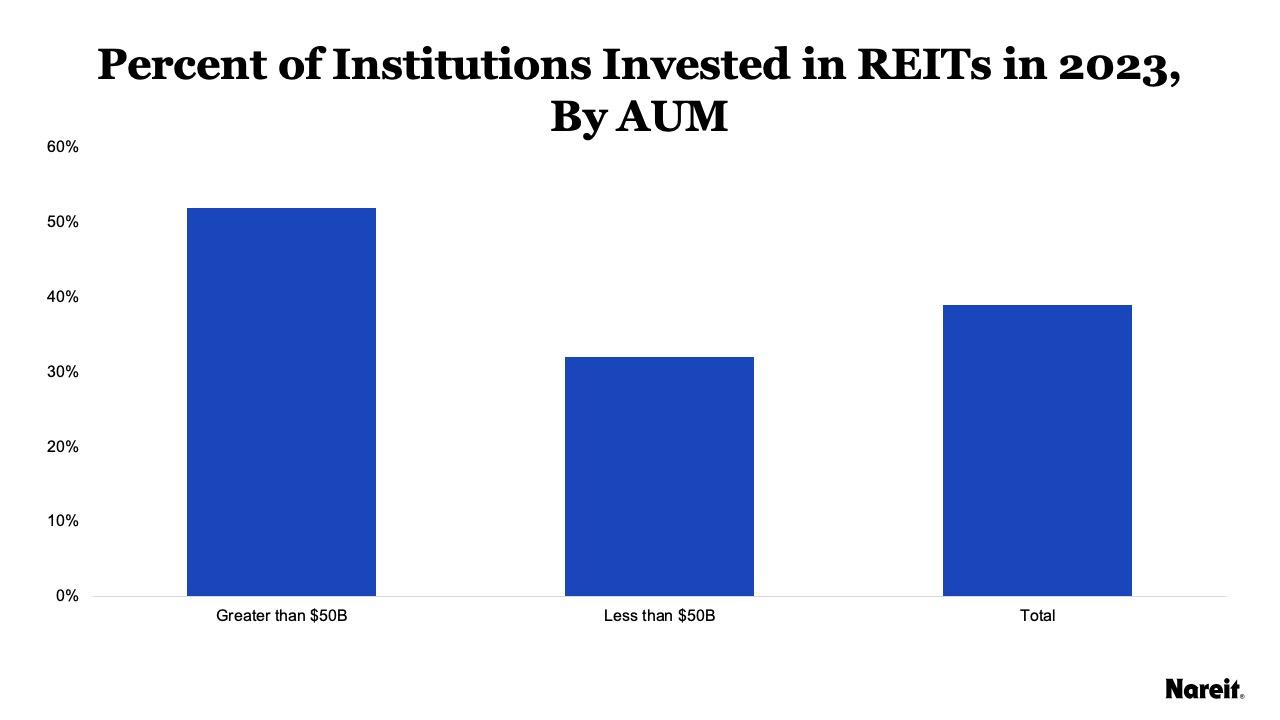

REITs are widely used in the real estate strategies of more than half of the largest and most sophisticated institutional real estate investors in the United States and globally. Approximately 39% of institutions surveyed reported investing in REITs in 2023. As the chart above shows, the survey uncovered that larger, more sophisticated plans tend to allocate more to REITs: More than 50% of larger institutions with $50 billion or more in AUM invest in REITs, whereas only 30% of institutions less than $50 billion AUM use REITs as part of their real estate mandate. These findings corroborate research that Nareit has conducted independently on the top 25 pension plans.

The survey’s REIT-specific findings indicated that institutions, especially larger ones, were more actively allocating capital to REITs, as these investors looked to capitalize on discrepancies between public and private market valuations. Large institutions ($50 billion AUM or greater) continue to allocate capital into REITs, with 52% reporting they invested additional capital in 2023, compared to 32% of smaller institutions. This is a big jump from last year’s survey, which showed that large investors were on the sidelines with only 27% planning to invest the same or more capital into REITs for 2023. This move can be attributed to some larger institutions taking advantage of an attractive entry point for REIT investments.

According to the report, all institution types invest in REITs, including more than 70% of sovereign wealth funds (SWF) and government entities. These entities have dedicated teams and longer investment horizons that can make them more agnostic to investment structures and more open to investing in REITs versus private funds. Interestingly, insurance companies showed the greatest pick-up in REIT investment in 2023.

The vast majority of surveyed investors (approximately 89%) invest in REITs out of their real estate allocation, while the remaining 11% invest in REITs out of their allocation to public equities. Notably, investment activity in REITs shows a modest divergence based on the originating allocation. Of those institutions investing in REITs from their real estate allocation, 41% committed additional capital to REITs in 2023, whereas only 33% of those viewing REITs as part of their allocation to public equities did so.

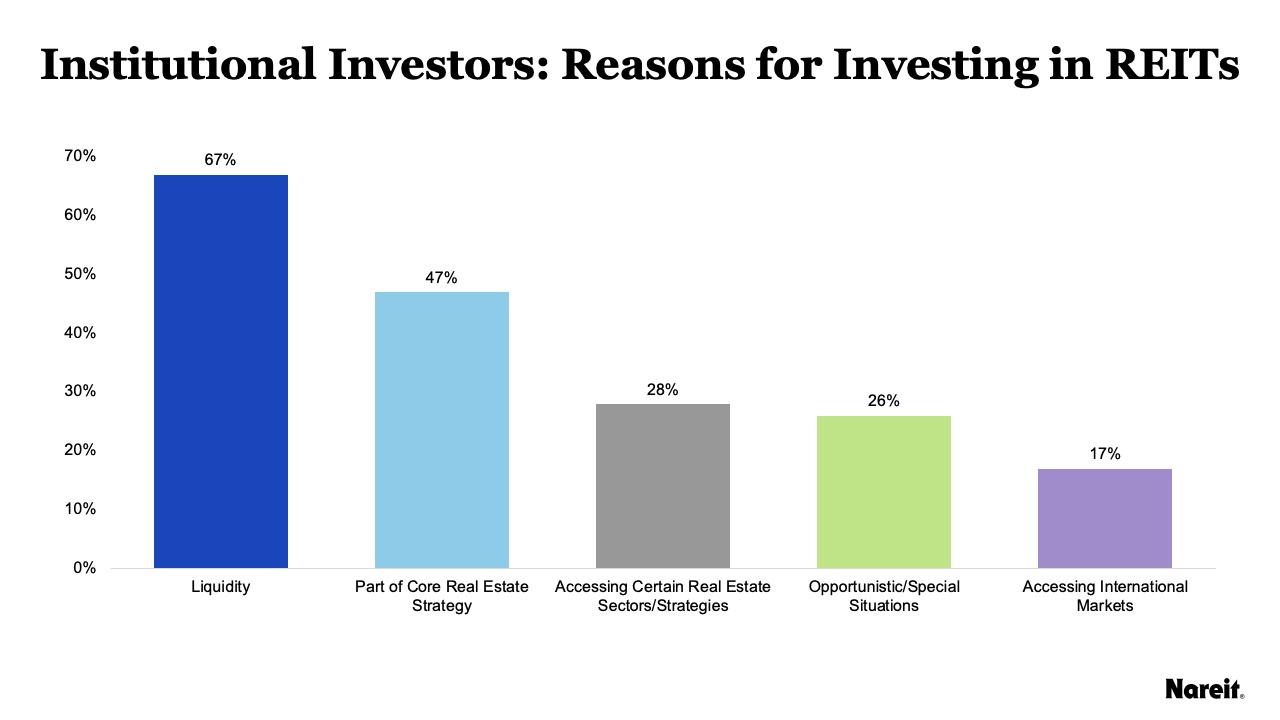

As shown in the chart above, reasons for investing in REITs varied, but notably, 67% of investors cited liquidity as their primary consideration, up from 46% in 2023. It is important to note that accessing certain real estate sectors and/or geographies also figured prominently in investors’ reasons to invest in real estate via REITs. These facts are borne out in investor case studies that Nareit has recorded. For example, an Australian superannuation fund partnered with PGIM to utilize REITs in addressing gaps in property types and geographies in its real estate portfolio. Furthermore, Norges Bank Investment Management uses REITs to enhance diversification, access new and emerging property sectors, and optimize cost management.

On average, approximately 50% of institutions reported that their REIT portfolios are managed by third parties, while 30% and 20% are managed in-house by their real estate and public equity teams, respectively.

Read the full 2024 Allocations Monitor here.