Leverage can be a double-edged sword, potentially amplifying investment gains on the upside and losses on the downside. In an environment of declining property valuations and higher interest rates, too much leverage can also threaten the viability of a real estate investment. Recent data from the Nareit Total REIT Industry Tracker Series (T-Tracker®) show that, on average, REITs have maintained a modest leverage ratio and a low interest expense to net operating income ratio. Today, through continued balance sheet discipline, REITs are facing less stress and enjoying greater operational flexibility than their counterparts with higher debt loads and costs.

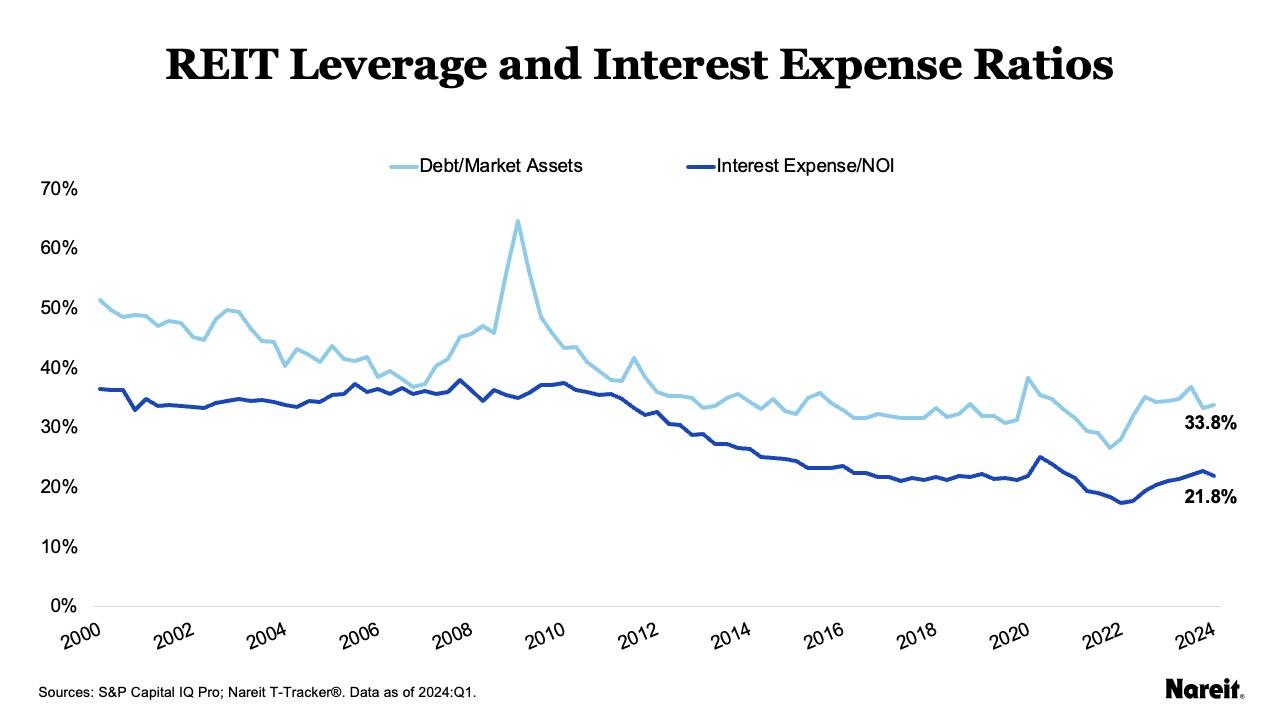

Using quarterly data from Nareit’s T-Tracker, the chart above displays average debt to market assets and interest expense to net operating income ratios since 2000. From its peak during the Global Financial Crisis, the average leverage ratio has dropped by nearly half to 33.8% in the first quarter of 2024; a level akin to those used in lower risk private real estate investment strategies. The average interest expense ratio has followed a similar downward trend; it was a low 21.8% in the first quarter of 2024.

Long-term, well-structured balance sheets with low leverage ratios that predominantly use unsecured debt and fixed interest rates have served REITs well in the current interest rate environment. Today, REITs are facing less stress and enjoying greater operational flexibility than their counterparts with higher debt loads and costs.