The tenure of the recovery from the current divergence in public and private real estate valuations is now approaching two years. Over this time, market forces have kept REIT implied cap rates elevated, while private real estate investment managers and appraisers appear to have been steadfast in their strategy of making regular modest quarterly upward adjustments to private appraisal cap rates in hopes that the market may come to them. Although progress has been made in rectifying this dislocation, the public-private cap rate spread remains wide. With expectations of target federal funds rate cuts on the horizon and generally declining interest rates, REITs have posted solid total returns since Q2 2024. If REITs maintain these gains and private real estate investors continue their modest and measured appraisal cap rate increases, commercial real estate may finally be able to say goodbye to its valuation divergence.

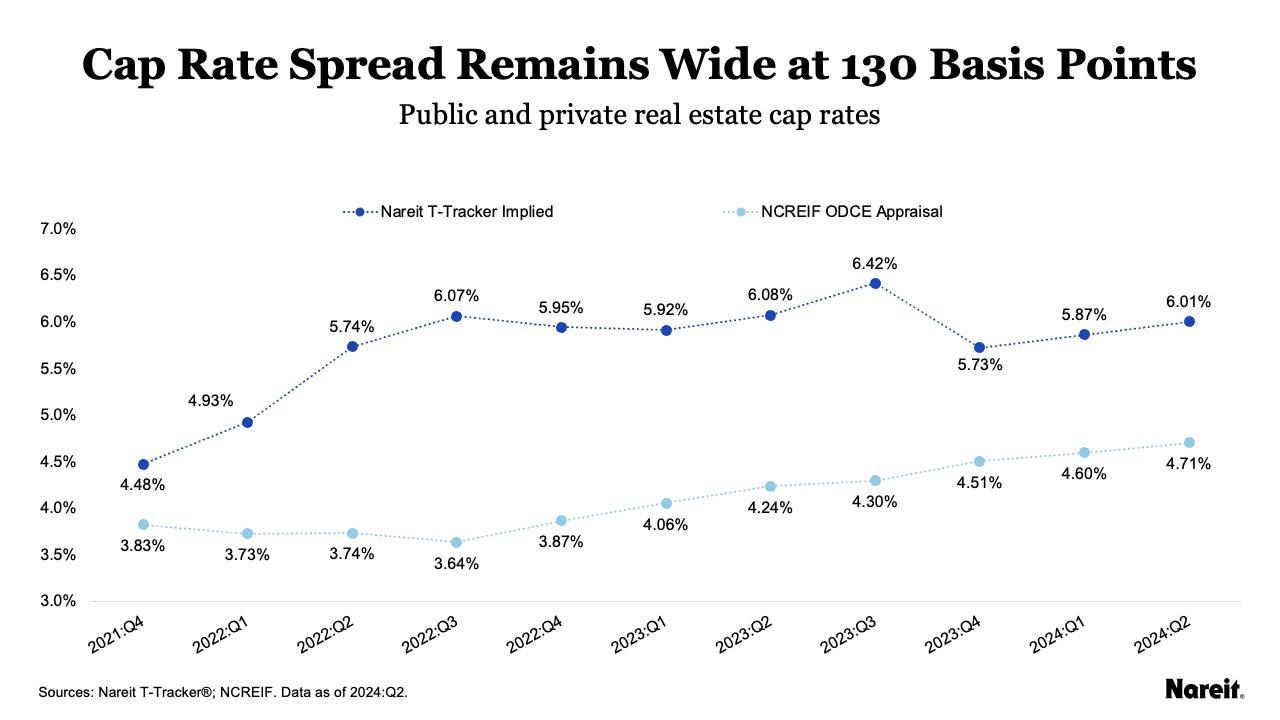

The chart above displays public and private real estate cap rates from Q4 2021 to Q2 2024. REIT implied cap rates are from the Nareit Total REIT Industry Tracker Series, or T-Tracker®. Private appraisal cap rates focus on properties from open end diversified core equity (ODCE) funds from the National Council of Real Estate Investment Fiduciaries (NCREIF).

During the current valuation divergence, the gap between public and private real estate cap rates has been stubbornly slow to close. The spread reached a crest of 243 basis points in Q3 2022. Over the next seven quarters, the private appraisal cap rate followed a modest and measured upward trajectory with average increases of just 15 basis points per quarter, while the REIT implied cap rate generally remained elevated. The only significant drop in the public real estate cap rate occurred in the last quarter of 2023. After monetary policy tightening ended in Q3 2023, REIT total returns surged in the following quarter and the REIT implied cap rate plunged by 69 bps. As of Q2 2024, the cap rate spread remained wide at 130 basis points.

Since 2022, REIT performance has generally followed an inverse relationship with movements in the 10-year Treasury. As the 10-year Treasury yield has fallen, REIT total returns have typically risen, and vice versa. The 10-year Treasury yield has recently been following a downward trend: ending Q2 2024 at 4.4%; falling to 4.1% at the end of July; and standing at 3.9% by the end of August. With these declines, and the expectation that the target federal funds rate will likely be cut at the Federal Open Market Committee’s next meeting, REITs have posted solid total returns since midyear. July and August 2024 total returns for the FTSE Nareit All Equity Index were 7.2% and 5.6%, respectively.

If REITs maintain these gains and private real estate investors continue their modest cap rate increases, commercial real estate may finally find closure to its public-private valuation problem. With these assumptions, the REIT implied and private appraisal cap rates can be estimated to be 5.5% and 4.9%, respectively, in Q3 2024. The resultant cap rate spread of 60 basis points is less than half its Q2 2024 value and akin to the average spread across time periods since 2000 that did not experience a public-private real estate valuation divergence.

As public and private property values become more in sync with one another, REITs will likely maintain investment performance and acquisition advantages over their private market counterparts. The closing of the public-private real estate cap rate gap is anticipated to fuel continued REIT outperformance through the remainder of 2024. As the transaction market regains its footing, REITs are also expected to be in the catbird seat when it comes to acquisitions due to their well-structured balance sheets and efficient access to cost-advantaged capital. Although the U.S. commercial real estate market has been saying a long goodbye to its current valuation dislocation, it appears that a fond farewell may finally be on the horizon.