Mortgage REITs (MREITs) are an investment in real estate finance that combine high current income with long-term total return and portfolio diversification. MREITs have delivered a 21.2 percent total return over the past year (through July, 2017), outpacing most other investments over this period. Many investors are less familiar with MREITs than their Equity REIT cousins, which own and manage portfolios of properties. This Market Commentary provides a brief overview of the sector and discusses its returns.

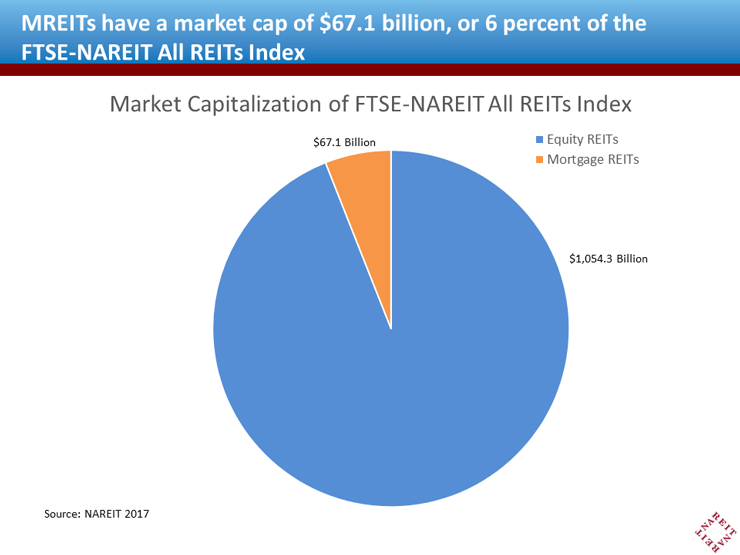

The MREIT sector in the FTSE-NAREIT All REITs Index includes 40 members with a market capitalization of $67.1 billion, compared to the market cap of $1.1 trillion for the 188 Equity REITs. MREITs employ a variety of different business models, and the composition of the sector has changed markedly over time. Home financing MREITs, or Residential MREITs, provide funding to the housing market by investing in mortgage-backed securities (MBS) or residential mortgage loans. Their role in raising capital to make credit available for home mortgages has assisted the housing market recovery. There are 24 Home Financing MREITs with a market cap of $48.6 billion. The vast majority of the assets of this sector today are MBS issued by the Government Sponsored Enterprises (GSEs) Fannie Mae, Freddie Mac and Ginnie Mae. These securities, also referred to as Agency securities or Agency MBS, are guaranteed for payment of interest and principal, and thus carry no credit or default risk. The MREITs that invest mostly or entirely in Agency MBS are referred to as Agency MREITs. It has not always been the case that Agency MREITs and Agency MBS dominated the home financing sector’s balance sheets, however, and we will examine below the importance of the presence or absence of credit risk exposures in understanding the longer term returns of the sector. Agency MREITs do have exposures to risks related to changes in interest rates and the mortgage prepayments that such changes often induce (see NAREIT’s Guide to Mortgage REITs for further discussion of the MREIT business model and how they manage these risks).

The MREIT sector today looks much different than it did a decade ago, when a majority of the sector’s assets were non-agency MBS or private-label MBS, that is, securities issued by private institutions rather than the GSEs. These non-agency MBS did not carry any GSE guarantee and were exposed to credit and default risks, including risks from subprime mortgages as well as interest rate risk, and the MREITs that invested mainly in such securities are frequently referred to as nonagency MREITs. It is no secret how poorly the subprime mortgages performed during the Great Financial Crisis, and the credit losses of the nonagency residential MREITs affected the reported performance of the overall FTSE-NAREIT MREIT Index. It is important to keep in mind this distinction between returns of MREITs that did not take on credit risk prior to the crisis versus those that did take on credit risk, particularly because nearly the entire residential MREIT sector today consists of MREITs investing in GSE-guaranteed MBS which do not have exposures to credit risk.

Finally, Commercial Financing MREITs provide financing for commercial properties including office buildings, malls and shopping centers, apartments, health care facilities and senior living, and others. There are 16 Commercial MREITs with a market cap of $18.5 billion. Commercial MREITs may invest in commercial MBS (CMBS) or whole-loan commercial mortgages. Unlike their residential MREIT brethren, some Commercial MREITs perform other services associated with financing commercial real estate, including originating commercial mortgage loans and mezzanine financing, servicing mortgages and arranging commercial mortgage securitizations (that is, creating newly-issued CMBS).

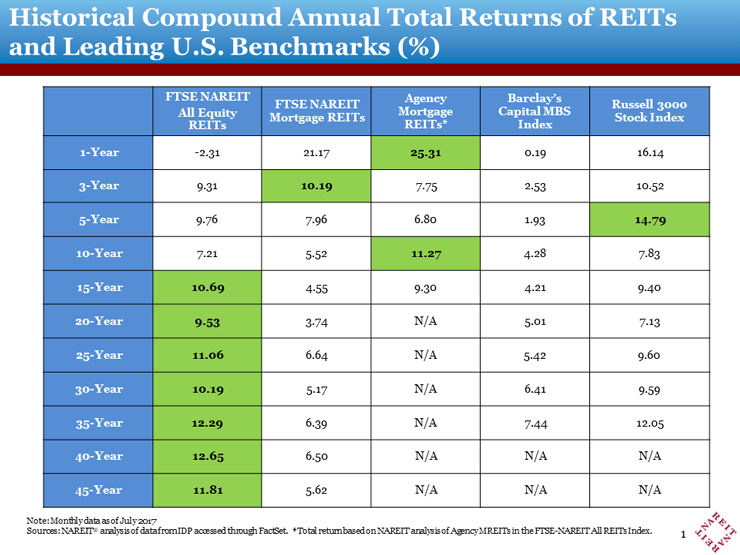

The MREIT sector has delivered good stock market performance for investors over both near-term and longer time horizons. As mentioned above, the total return of the FTSE-NAREIT MREIT Index was 21.2 percent over the past year. Returns for longer holding periods are more moderate, but still impressive: 10.2 percent (annualized) over the past three years, and 5.5 percent over a 10-year horizon (chart, column 2). The Agency MREITs have delivered even stronger returns of 25.3 percent over the past year (column 3). Comparing the returns of Agency MREITs to the broader FTSE NAREIT Mortgage REIT index highlights the impact that credit risk had on the performance of the headline index. Indeed, the 10-year total return of Agency MREITs was 11.3 percent, nearly twice the return on the overall MREIT sector. This differential was driven by the losses on private-label MBS and reflects a business model that is no longer present in the MREIT sector. As such, the return history of the Agency MREITs better reflects the performance of the MREITs that currently constitute the home financing MREIT sector. Notably, the performance of Agency MREITs over the past decade exceeds that of either the Russell 3000 equity index or the S&P 500.

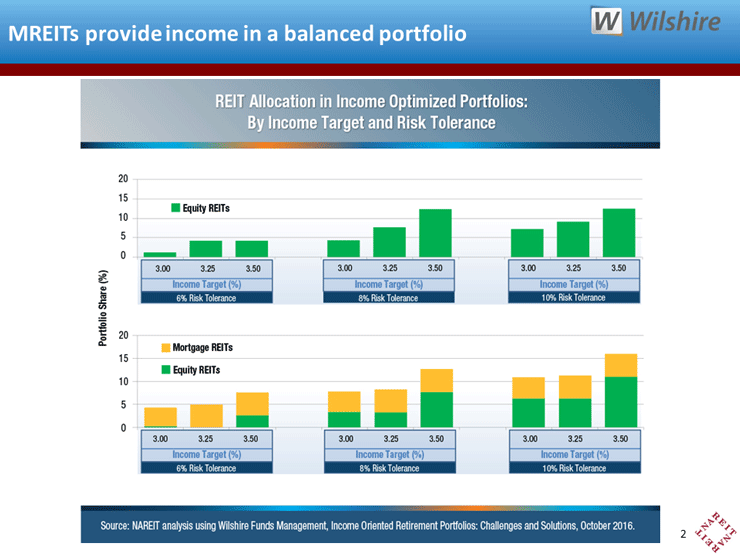

A large portion of these total returns come in the form of dividends. MREITs generally pay high dividends, providing current income for investors, including retirees, who desire income in addition to capital gains from their portfolio. The dividend yield on the FTSE-NAREIT Mortgage REIT index is 9.74 percent, compared to 3.81 percent for Equity REITs and 1.99 percent for the S&P 500. This high income yield has led some analysts to recommend including MREITs in portfolios designed to generate both current income and long-term total return. For example, a study prepared by Wilshire Funds Management and sponsored by NAREIT (Income-Oriented Retirement Portfolios: Challenges and Solutions) utilized portfolio optimization techniques to construct such an income-generating portfolio, and found that such a portfolio would include a 5 percent allocation to MREITs. This analysis consistently found a role for MREITs in income-oriented portfolios, including those across a range of income targets and risk tolerances (yellow bars, chart below).

MREITs can reduce risks in a diversified portfolio due to their low correlation with other investments. The double-digit returns on an investment in MREITs have different fundamental drivers than those for the Equity REIT sector or for the broader stock market or bond market. As a result, MREIT returns have a low correlation with other sectors. For example, the monthly total returns on MREITs had a correlation of 0.63 with Equity REITs over the past five years. Correlations with broader equity market returns were even lower, with a correlation of 0.45 with the S&P 500 and 0.47 with the Russell 3000. Adding any asset with a correlation below 1 helps reduce risks by decreasing overall portfolio volatility, and such low correlations of MREITs with these other sectors enhances their ability to improve diversification.