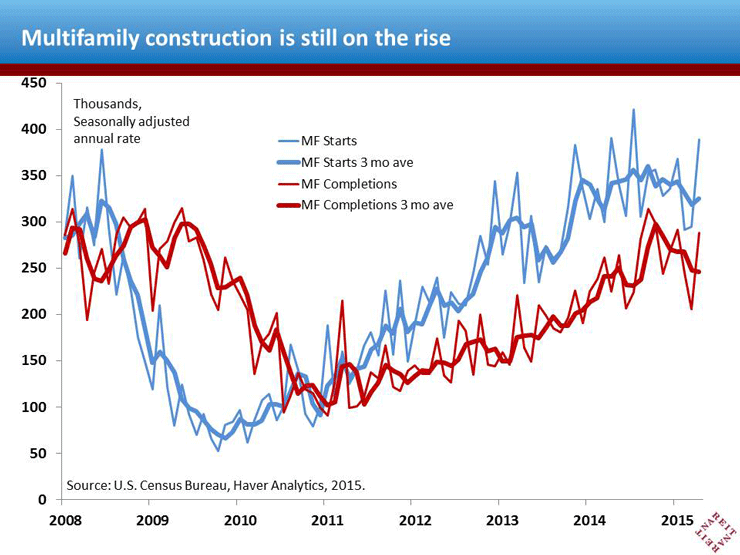

Builders took advantage of spring weather and broke ground on 389,000 (annualized) multifamily units in April, a 32% increase from March. After a long and snowy winter season kept many new projects on hold, the strong uptrend in construction from the past several years appears to be underway again.

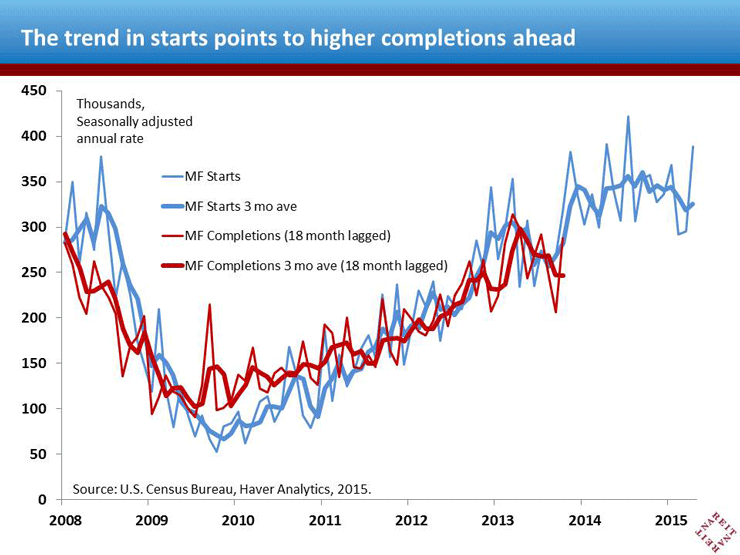

Since it takes a year or more to complete a project, the new supply pipeline continues to swell, and completions are likely to rise further to catch up with starts (second chart has completions lagged 18 months to line up with the trend in starts). Since starts are already well above where they were a year and a half ago, the increase in new supply will be considerable—indeed, the trend in starts and completions suggest that new supply will rise 30% or more from its recent pace, raising questions about whether it will be “too much”.

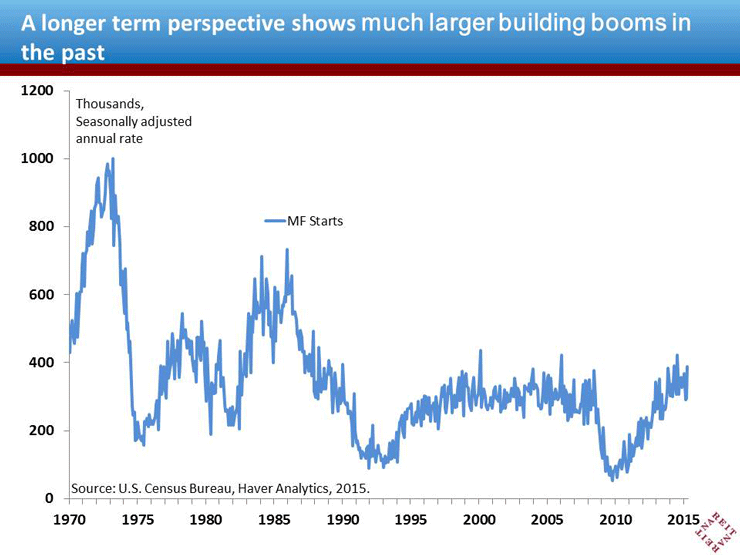

A longer time perspective can provide a better feel for how much new construction might be “too much”. The third chart shows that in the 1970s, construction of multifamily units was three times as high as the recent pace, and in the mid 1980s it was double what is taking place today. Of course, those were periods when the demographic trends (in particular, Baby Boomers entering early adulthood and moving out on their own) supported demand.

The most critical issue for the outlook for apartment markets is whether the pent-up demand that arose during the housing crisis, and the dearth of construction early in the recovery, will translate into enough new demand to absorb this supply. To date the market has taken it in stride, with low vacancy rates and solid rent growth. We expect the job market to regain momentum in the months ahead, helping release more of the pent-up demand for apartments and supporting occupancy and rents even in the face of this new supply.