Nareit published the Global REIT Approach to Real Estate Investing study (PDF) documenting the global growth of REITs and the benefits, especially to developing nations, of enacting a REIT regime. This study summarizes the dramatic growth of REITs around the world since their inception more than 60 years ago and the benefits of the REIT model for communities, economies, and investors. There are currently 41 countries and regions, accounting for 85% of global GDP with a combined population of nearly 5 billion people, that have enacted REIT legislation.

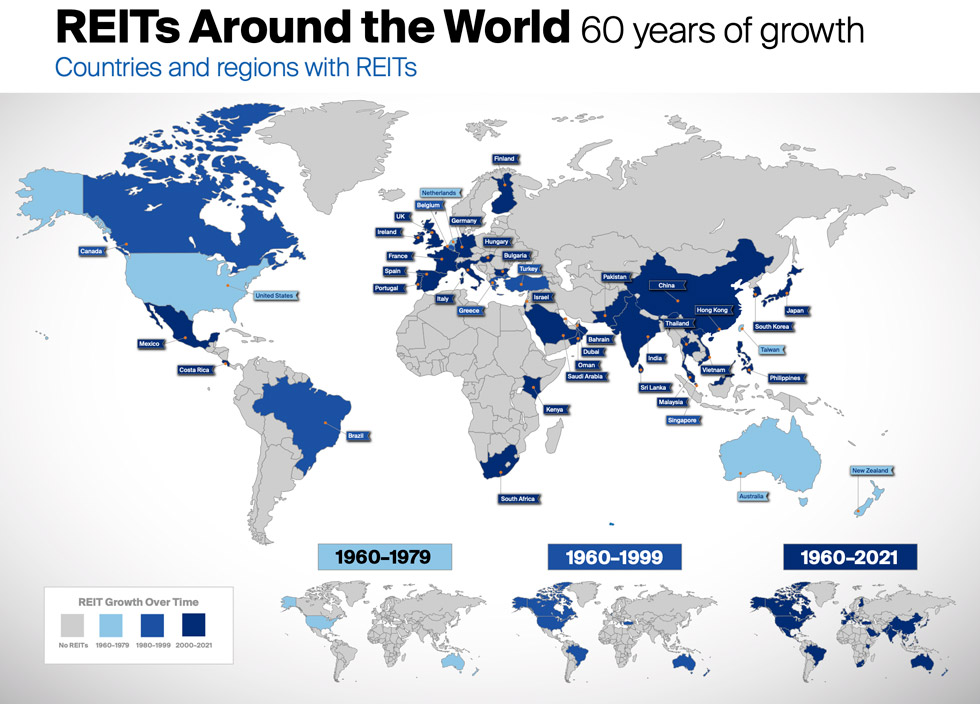

Figure 1 maps the global growth of REITs over the past six decades. REITs began in the U.S. in 1960, with the Netherlands, New Zealand, Taiwan, and Australia all adopting REITs before 1970. REITs continued to spread throughout North America, Europe, and Asia during the 1970s and 1980s. Brazil became the first country to adopt REITs in South America in 1993. REITs reached the Middle East in 2006 with adoption by Israel and the Emirate of Dubai in UAE. The 2013 adoption of REITs by South Africa was the first in Africa followed shortly by Kenya in 2014. China is the most recent country to adopt REITs in 2021.

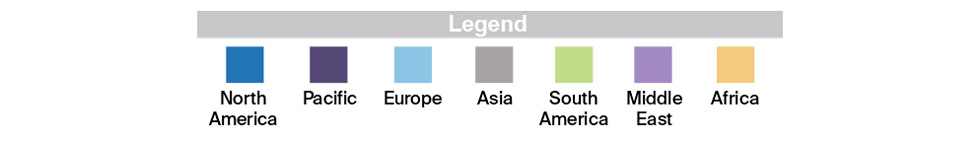

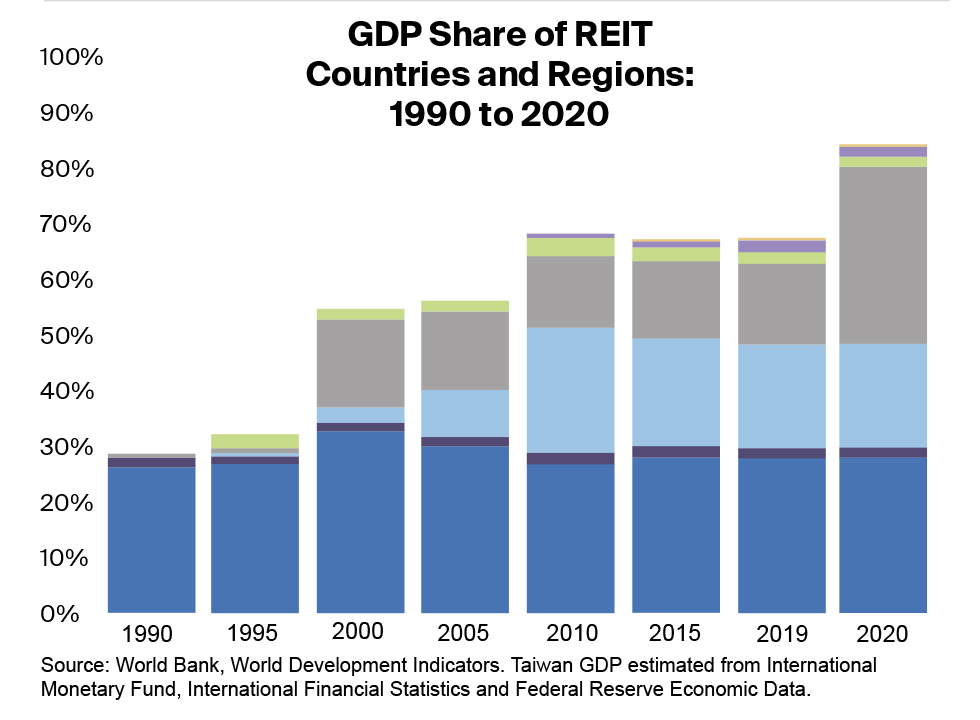

As the REIT model has spread globally, the current countries and regions with REITs represent 85% of 2020 global GDP, increasing from 28% of global GDP in 1990 as shown in Chart 2. The GDP of REIT countries and regions has increased from $6.5 billion to almost $72 trillion in this time frame for the current REIT countries and regions. The growth by population is shown in Chart 3. In 1990, REIT countries and regions had just a 6% share of global population, and currently, they account for 64% of the world’s 2020 population. Asia has driven the growth in population for REIT countries and regions, most notably with the adoption of REITs in India in 2014 and China in 2021.

Chart 3 shows the growth in the number of REITs since 1990. A total of 865 listed REITs with a combined equity market capitalization of approximately $2.5 trillion at the end of 2021 are in operation around the world. REITs have grown dramatically in both number and equity market capitalization over the past 30 years. The number of REITs has grown from 120 listed REITs in two countries in 1990 to 865 listed REITs in 41 countries. Asia has seen dynamic growth over the past 16 years with the number of REITs growing from 31 REITs in six countries in 2005 to 216 REITs in 11 countries today. The Middle East also has demonstrated meaningful growth since 2015 with the addition of REIT regimes in Saudi Arabia and Oman.

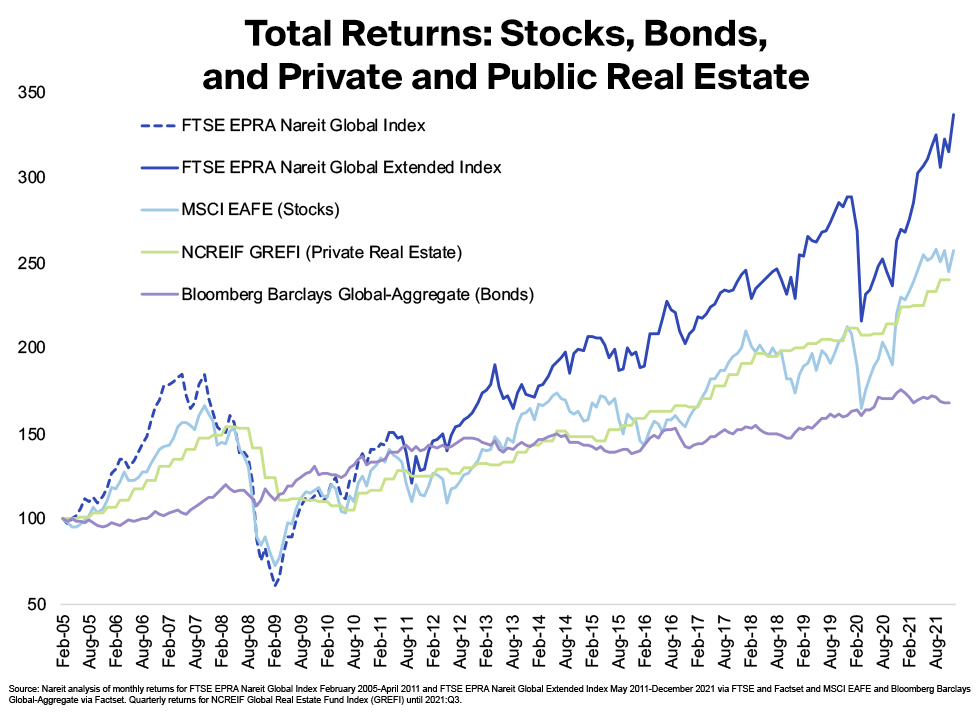

The study also shows that over the long term, global listed real estate, including REITs, has generally outperformed both global stocks and global bonds. The compound annual growth rate in returns from February 2005 to December 2021 is 6.9% for the FTSE EPRA/Nareit Global Index, compared with 5.8% for the broader global stock market (represented by MSCI EAFE), 5.4% for private real estate (NCREIF’s Global Real Estate Index through September 2021), and 3.1% for global bonds (Bloomberg Barclays Global-Aggregate bond index). Chart 4 shows the growth in returns. REITs have also had low correlation with other stocks and bonds, with FTSE EPRA Nareit Global REITs having a 0.79 correlation with MSCI EAFE.

For more information on the global growth and benefit of REITs, see the full study (PDF).