Private equity real estate (PERE) funds are a fast-growing style of real estate investing among institutional investors. New research by Thomas R. Arnold, David C. Ling, and Andy Naranjo provides a comprehensive examination of PERE fund returns relative to REITs. Arnold is the former Global Head of Real Estate of the Abu Dhabi Investment Authority. Ling and Naranjo are both professors specializing in real estate at the University of Florida.

The results of this study may prompt investors to consider using REITs in lieu of PERE funds to gain real estate exposure. The research was sponsored by Nareit.

This new research uses compares the returns of individual private funds with either U.S. or international investments against either U.S. or international equity REIT indexes over each private fund’s investment horizon. This “horse race” approach allows the authors to measure the head-to-head performance of PERE funds versus REITs.

The study, Private Equity Real Estate Fund Performance: A Comparison to Listed REITs and Open-end Core Funds, uses a unique data set comprising 375 U.S. and 255 international PERE closed end funds with vintages from 2000 to 2014.

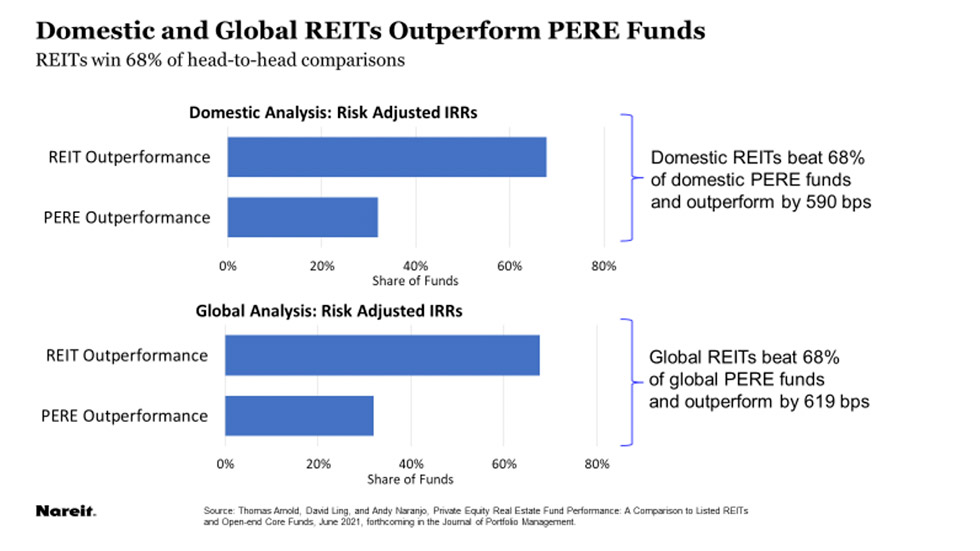

The study found REITs outperformed both U.S. and international PERE funds by a wide margin.

- In the US, REIT returns exceeded PERE risk-adjusted returns by 590 basis points, on average; and won 68% of head-to-head matchups on a risk adjusted basis.

- In global funds, REIT returns exceeded PERE risk-adjusted returns by 619 basis points, on average; and won 68% of head-to-head matchups on a risk adjusted basis.