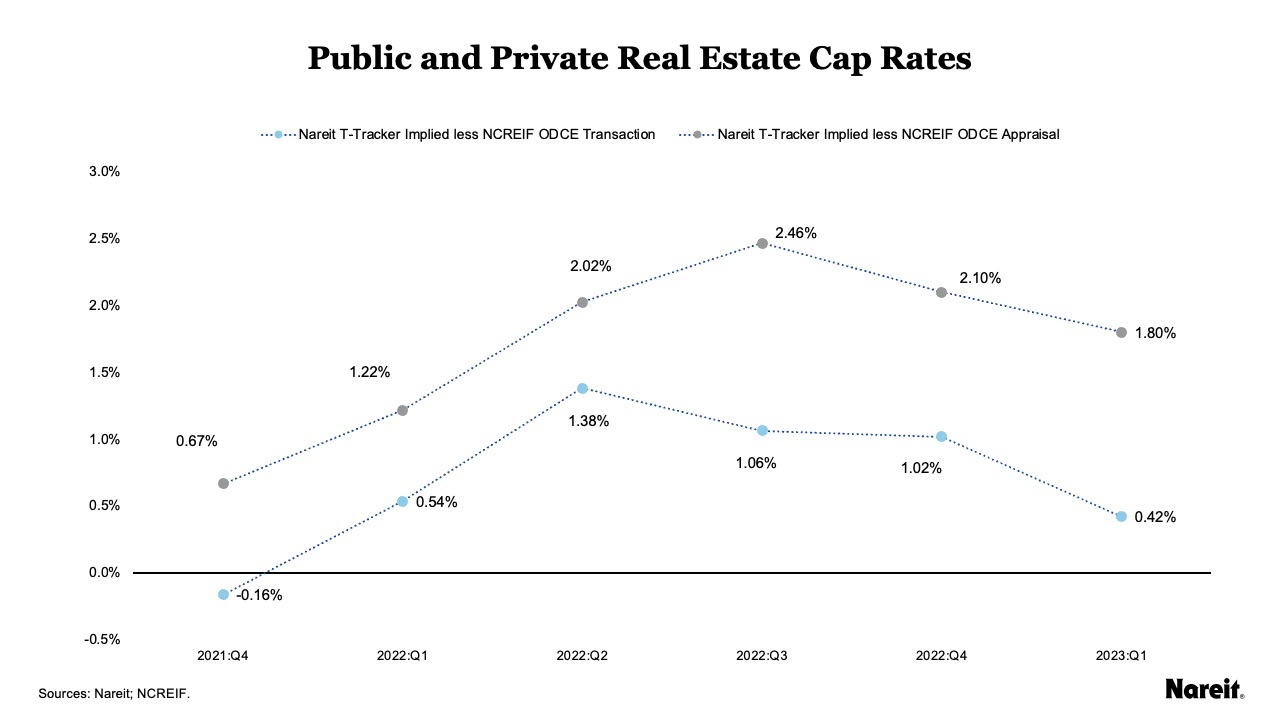

Differences in cap rates capture the divergence that occurred between U.S. public and private real estate markets in 2022, with public real estate cap rates (REIT implied) higher than their private real estate counterparts (transaction and appraisal). As expected, the gaps between REIT implied and transaction cap rates have been narrowing through time, with changes in both REIT and private market valuations.

While welcome news, these transactions account for a mere sliver of private real estate capital. Appraisal cap rates, which represent the bulk of private capital, have shown little movement since the end of 2021, resulting in differences between REIT implied and appraisal cap rates remaining wide. Closing these gaps will likely take time and further material private real estate write-downs. Although transaction cap rates demonstrate progress in the price discovery process, appraisal cap rates highlight that the wheels of progress turn slowly.

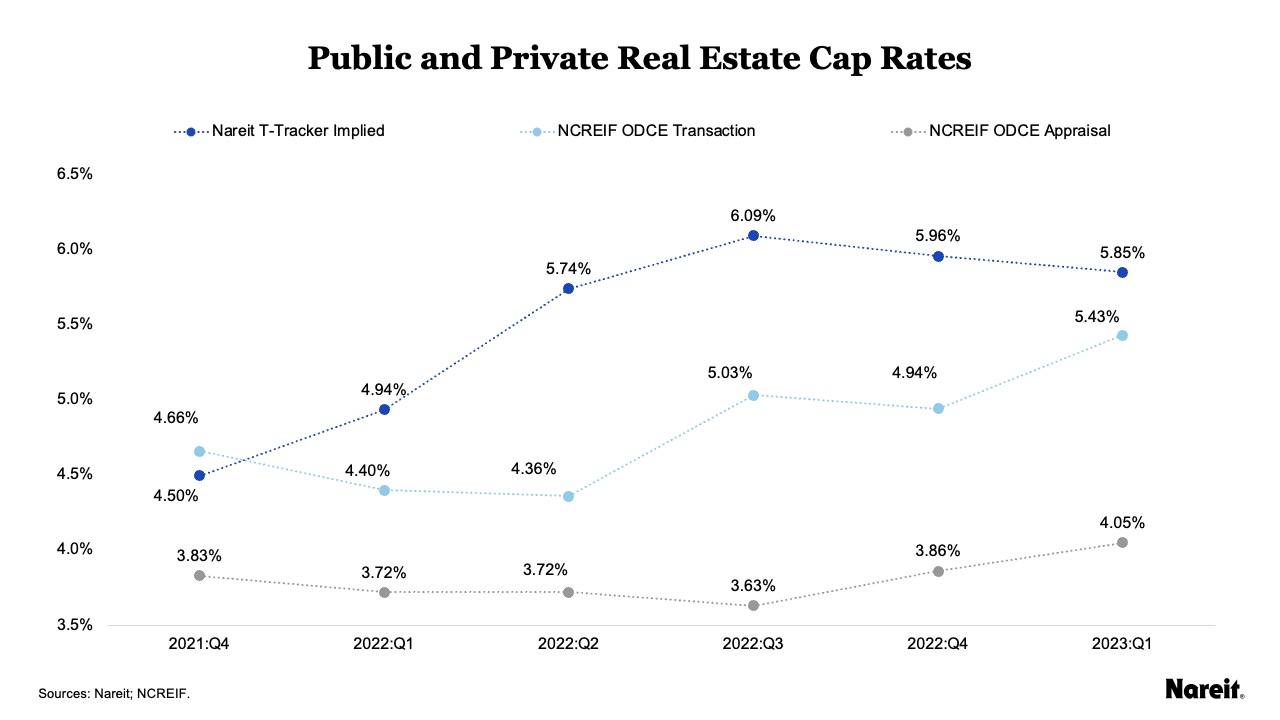

The chart above displays public (REIT implied) and private real estate (transaction and appraisal) cap rates from the fourth quarter of 2021 to the first quarter of 2023, using data from Nareit’s T-Tracker® and the National Council of Real Estate Investment Fiduciaries (NCREIF). The NCREIF transaction and appraisal cap rates solely focused on properties from Open End Diversified Core Equity (ODCE) funds. All the cap rate calculations utilized historical, or backward-looking, net operating incomes (NOI).

From the fourth quarter of 2021 to the first quarter of 2023, the U.S. 10-year Treasury yield surged by 212 basis points to 3.65%. REIT implied cap rates had a meaningful response to this movement, increasing by 135 basis points to 5.85%. Over the same timeframe, private real estate cap rates were less responsive. Transaction cap rates increased by 77 basis points to 5.43% in the first quarter of 2023. Appraisal cap rates showed little movement since the end of 2021, increasing by just 22 basis points to 4.05%.

Property appraisals have been incredibly slow to adjust to changing market realities. In the first quarter of 2023, the difference between the NCREIF ODCE transaction and appraisal cap rates was 138 basis points. All else equal, closing this gap would require a value decline of more than 25%. An adjustment of this magnitude would likely need to be drawn out over several quarters. This potential decline has diminished the attractiveness of NCREIF ODCE funds by creating an impediment for new or increasing investment and, at the same time, providing an impetus for existing investors to exit.

As presented in the chart above, the relationship between REIT implied and transaction cap rates shows that the real estate valuation adjustment process has been working. As expected, the difference between REIT implied and transaction cap rates has been narrowing with changes in both REIT and private market valuations. The gap reached a maximum of 138 basis points in the second quarter of 2022; three quarters later it stood at 42 basis points. Yet, the difference between REIT implied and appraisal cap rates has remained wide; it was 180 basis points in the first quarter of 2023. While the price discovery process has been making progress, it has only been reflected in a minute portion of NCREIF ODCE valuations. In the first quarter of 2023, the transaction and appraisal cap rates represented market values of approximately $1.4 billion and $327.9 billion, respectively.

Recognizing the need for appraisal cap rates to adjust upward to reflect market realities, further material write-downs are likely on the horizon for the private real estate market. With property transaction activity throttled and many private real estate investment managers reluctant to accept brokers’ opinions of value that are significantly below current carry values, this process will likely take time. Although the real estate valuation adjustment process has made progress, its slowly-turning wheels are unlikely to accelerate anytime soon.