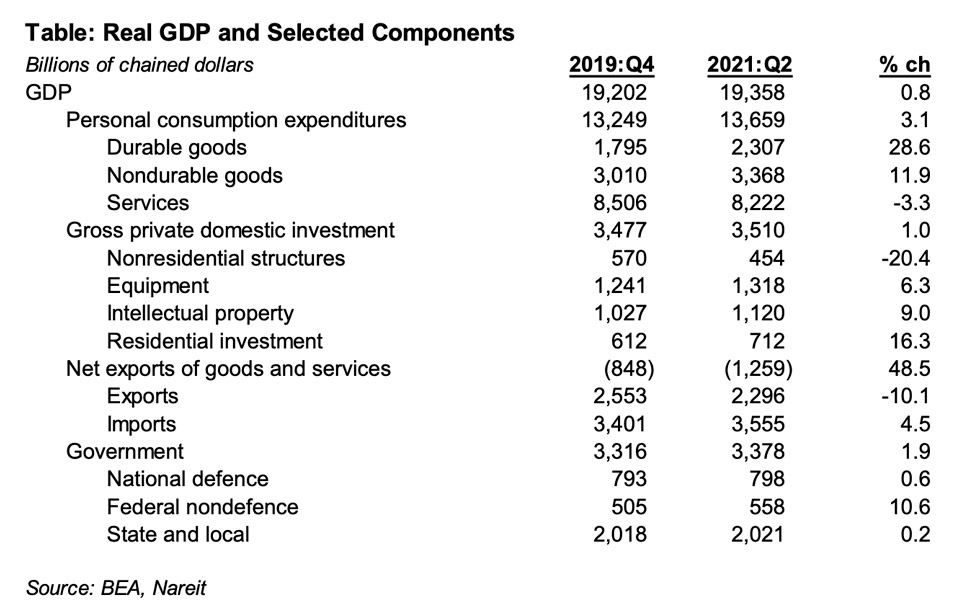

Real GDP rose at a 6.5% annual rate in the second quarter of 2021, as total output of the U.S. economy exceeded the pre-pandemic high by 0.8%. The major components of GDP have had very different trajectories, however, and the details of the GDP report have several positive implications for the outlook for commercial real estate markets and REITs.

Consumer spending on durable and nondurable goods. Purchases of goods have been robust, with spending on durable goods 28.6% above its level in 2019:Q4, and spending on nondurable goods 11.9% higher. A strong majority of these goods are purchased at in-store locations, and continued their robust growth in 2021:Q1.

This ongoing growth of spending on goods suggesting that demand for retail properties will strengthen and benefit retail REITs.

Consumer spending on services. Spending on services remains 3.3% lower than prior to the pandemic. In particular, spending on transportation services, recreation, and food service and accommodations has lagged the overall economic recovery, but have considerable upside potential once the pandemic is brought under better control and people resume their travel and entertainment plans.

Future increases in travel, recreation and dining will boost demand for hotels and related properties, to the benefit of lodging/resort and retail REITs.

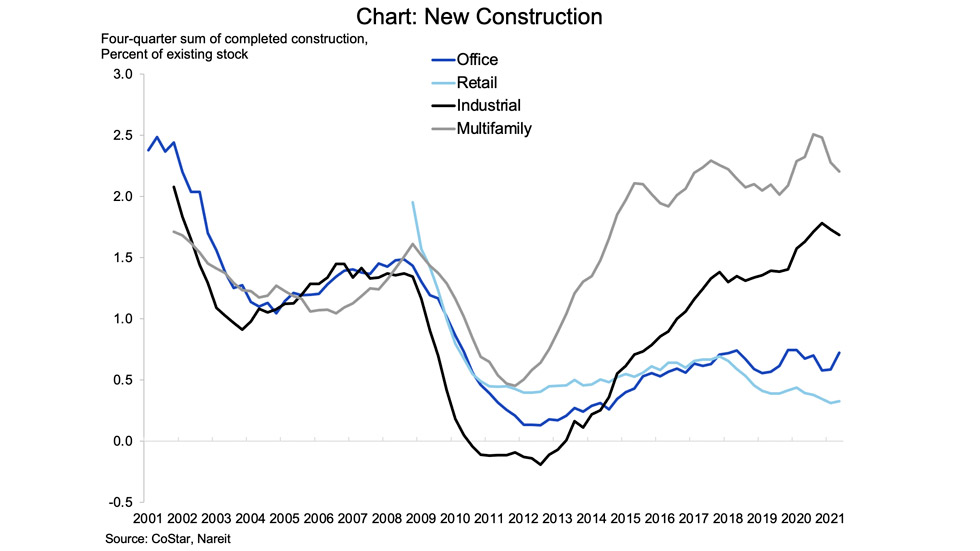

Investment in nonresidential structures. Construction slowed sharply during the recession, with total spending on nonresidential structures down 20.4% from its pre-pandemic peak. Within nonresidential structures, the construction of office and retail properties has slowed. (Note: the overall nonresidential structure category also includes mining and oil exploration structures, and religious and educational buildings.)

The level of construction of office and retail properties was not excessive prior to the pandemic. In addition to the dollar spending figures cited above, we can examine data on new construction, measured in square feet, from CoStar. New completions of office and retail properties in 2019 were equal to 0.7% and 0.4%, respectively, of existing stock, well below the level of supply of 1.5% to 2.0% preceding the recession in 2008. The declines in current spending on construction reported in the GDP accounts suggests there will be future reductions in new completions (measured in square feet) in coming years. These reductions will help improve the supply-demand balance for office and retail properties and help stabilize vacancy rates and support rent growth and property prices.

Construction of industrial and multifamily properties, in contrast, has been strong in recent years (note that multifamily is included in residential construction in the GDP accounts, not nonresidential structures). Market conditions for these properties are tight, with low vacancy rates and accelerating rent growth (see my recent market commentary on commercial real estate markets in the second quarter).

Finally, it is worth noting that the personal saving rate was 10.9% in the second quarter. This is down considerably from earlier during the pandemic, but is still well above the 7.4% saving rate in 2019. Consumers have plenty of additional spending power for more growth ahead.