The following is excerpted from a Forbes.com column published March 11, 2021

One year ago, financial markets were peering over the edge of a cliff of unprecedented magnitude. Commercial real estate markets braced for impact as the pandemic caused a complete shutdown of many stores and businesses, starving them of the cash flows they needed to pay their employers, their suppliers—and their landlords.

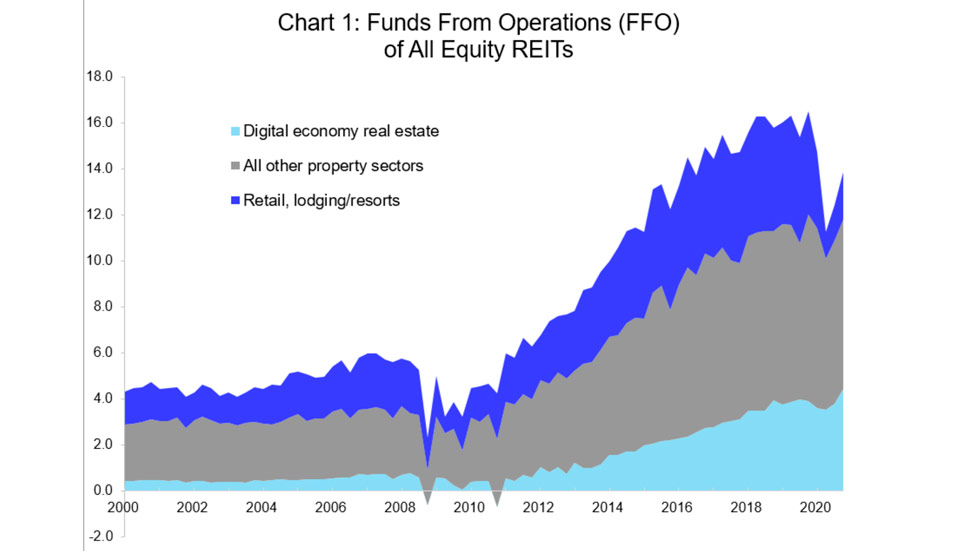

Today, markets are getting another surprise as recent earnings news from publicly-listed real estate—REITs—shows that an earnings recovery is already well underway. Indeed, in the overall U.S. listed REIT sector, earnings (as measured by funds from operations, or FFO) have recovered half the decline that took place last spring as shutdowns spread across the country. Significantly, this recovery was well underway even before the rollout of vaccines against COVID-19 had begun, and promises to continue as shops, travel, and other businesses return to more normal operations over the rest of this year and into 2022.

Large parts of the commercial real estate universe are held in private portfolios, and public information on the performance of these properties is scarce. In contrast, publicly-listed REITs, which hold about one-fifth of all institutional-grade commercial real estate in the country, are highly transparent and report their quarterly earnings and operating performance to investors and in detailed filings with the SEC. REITs hold properties in the traditional sectors that dominate private portfolios, including retail, office and apartment, as well as newer sectors that support the digital economy but have little presence in private portfolios, like data centers, cell towers and logistics facilities. Earnings performance of REITs, as summarized in the Nareit T-Tracker can yield insights into the property markets overall, including private real estate.

Visit Forbes.com for the full article examining the hardest-hit sectors, the digital economy real estate burst in business, and how other property types fared and more on their FFO rising nearly $800 million from Q2 to Q4, recovering fully half of the decline that occurred during the shutdowns.