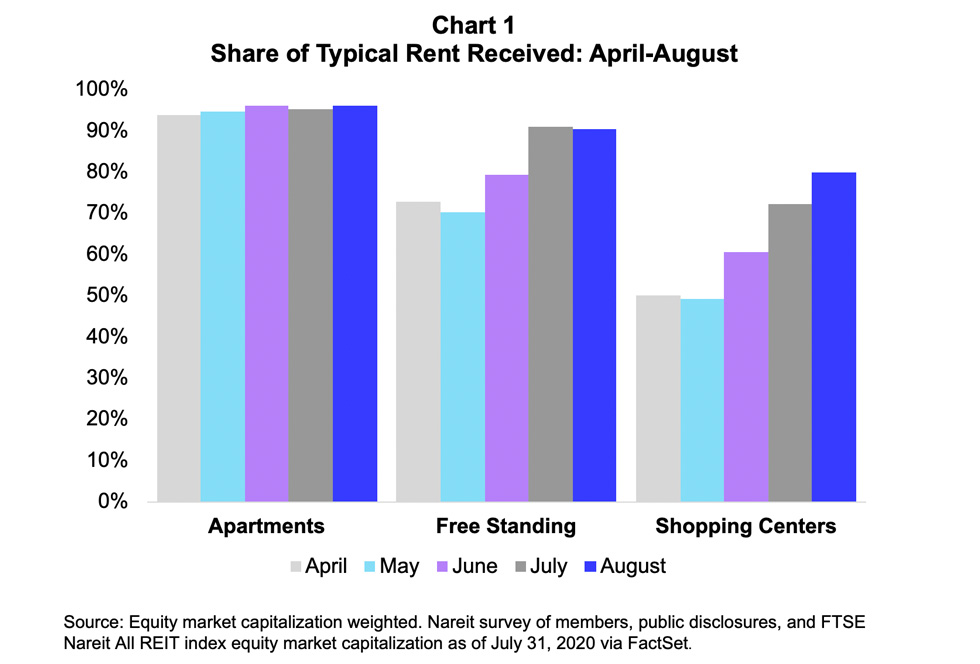

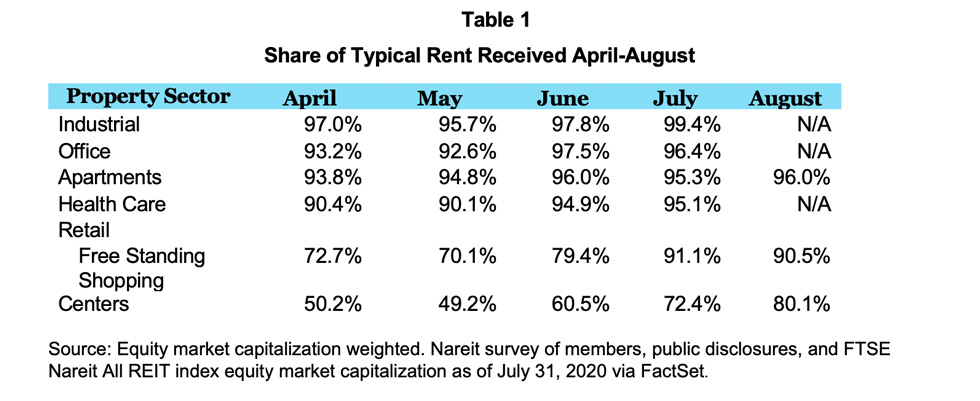

Nareit conducts a monthly survey of REIT rent collections in the wake of the COVID-19 pandemic and related economic dislocation. Given that rent collections in the industrial, office, and healthcare sectors have stabilized at high levels, the August survey focuses on three property subsectors: apartments, free standing retail, and shopping center retail. The results show gains made last month for retail have held steady for free standing and improved further for shopping centers. Apartments show no change despite the expiry of federally subsidized unemployment. Rent collections for apartments have remained high and steady over the whole five-month period.

Table 1 shows the estimated REIT rent collections from April to August as a share of typical rent collections. A visualization of the results is in Chart 1. The results are displayed by property sector and are weighted by respondent REIT equity market capitalization.

The survey participants represent 72% of the FTSE All REITs total equity market capitalization for the three covered property sectors (apartments, free standing retail, and shopping centers).