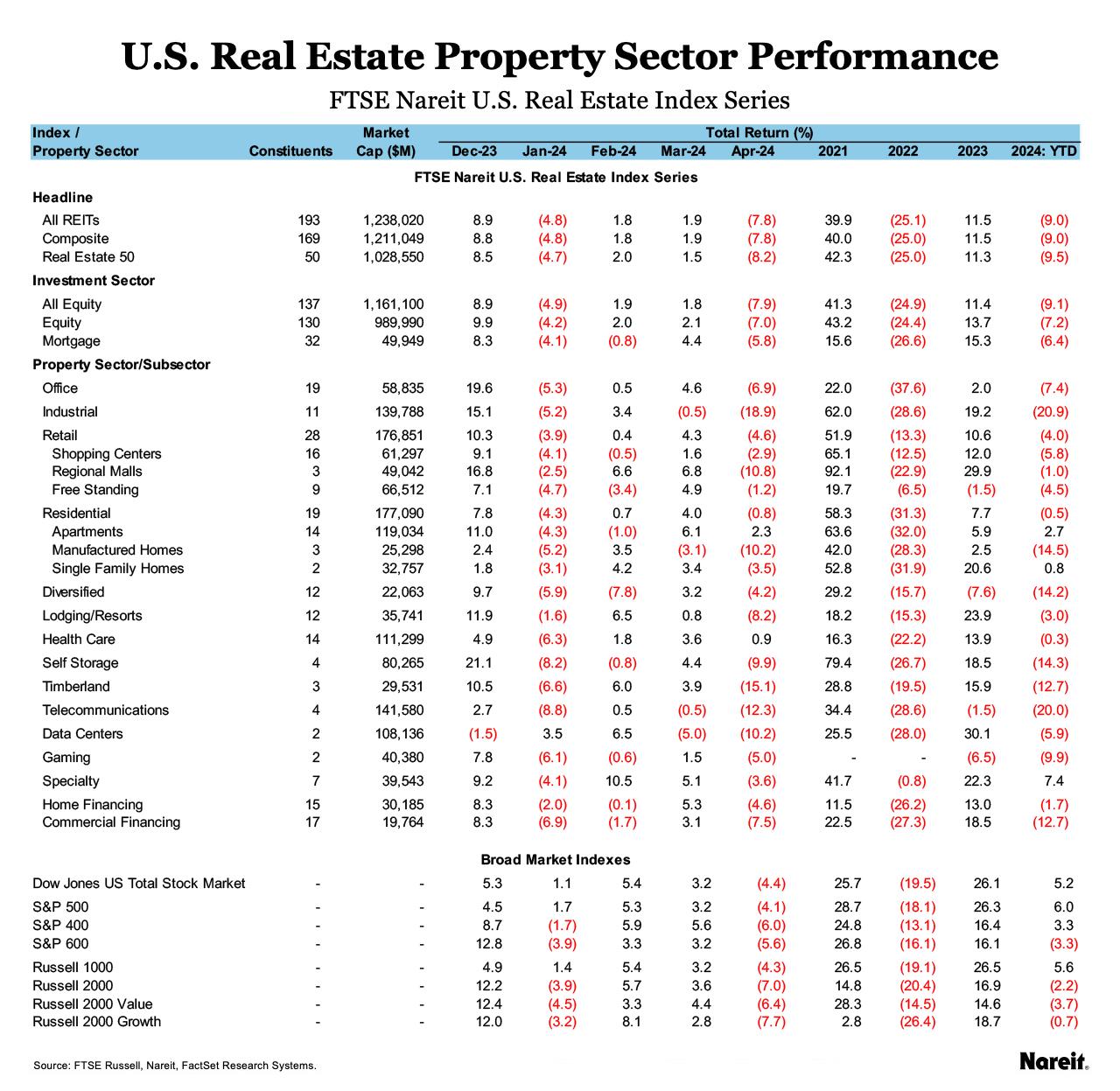

The FTSE Nareit All Equity REITs Index fell 7.9% in April as the yield on the 10-Year Treasury hit its highest level since October 2023. Broader equity markets also declined, as the Russell 1000 fell 4.3% and the Dow Jones U.S. Total Stock Market fell 4.4%. Inflationary measures were somewhat higher than expected in the first quarter of 2024, leading market expectations of rate cuts to be pushed to later in the year, with some investors questioning when and even if the Federal Reserve will cut rates this year.

As of April 30, the dividend yield on the FTSE Nareit All Equity REITs index was 4.40% and the FTSE Nareit Mortgage REITs Index yielded 12.81%, compared to 1.39% for the S&P 500. The 10-Year Treasury yielded 4.68% at the end of April, hitting its highest level since the beginning of October 2023.

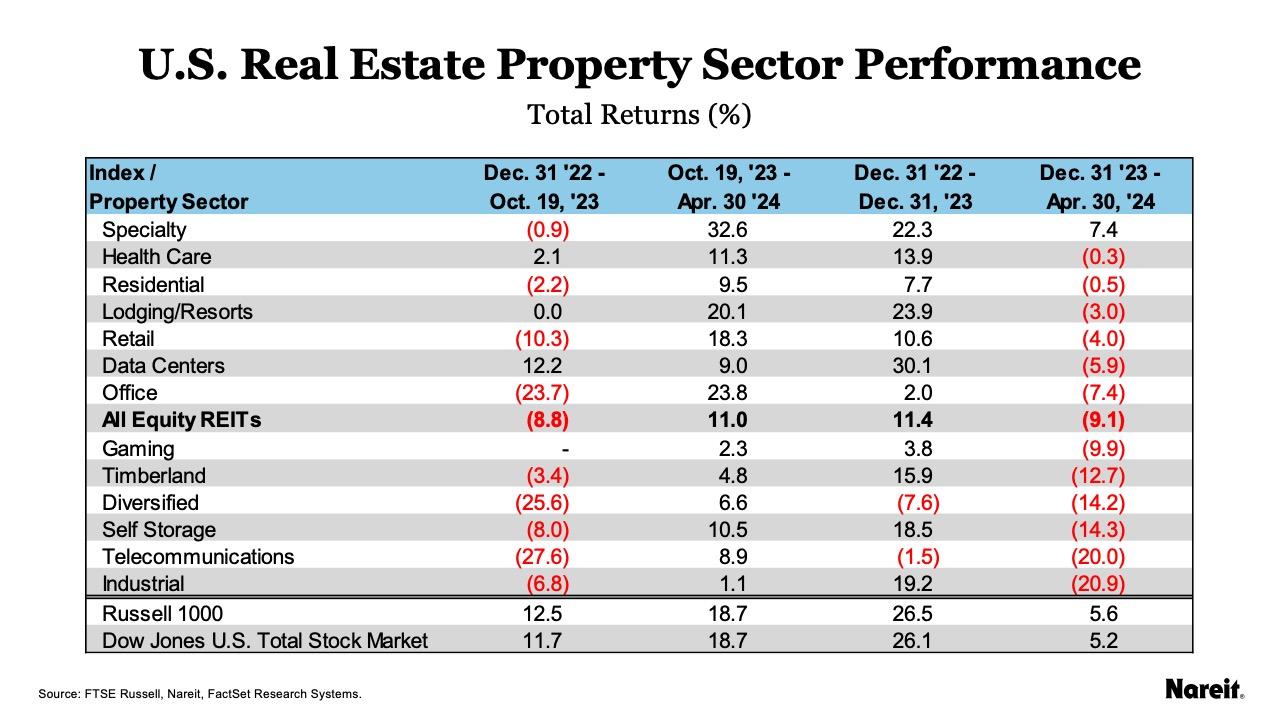

As shown in the above table, since Oct. 19, 2023, the All Equity REITs index is up 11.0%, while declining 9.1% year-to-date in 2024. Since the middle of October 2023, the Dow Jones U.S. Total Stock Market is up 18.7%, as is the Russell 1000. On a year-to-date basis, the Russell 1000 is up 5.6% and the Dow Jones U.S. Total Stock Market is up 5.2%.

Health care led all property sectors in April with a return of 0.9%, followed by residential at -0.8% and specialty at -3.6%. At the subsector level, apartments returned 2.3%, free standing declined 1.2%, and shopping centers fell 2.9%. Industrial lagged with a return of -18.9%, followed by timberland at -15.1%, and telecommunications at -12.3%. On a year-to-date basis, specialty leads with a return of 7.4%, followed by health care at -0.3%, and residential at -0.5%.

The FTSE Nareit Mortgage REITs Index fell 5.8% in April and is down 6.4% year-to-date. For the month, home financing and commercial financing mREITs fell 4.6% and 7.5%, respectively. Year-to-date, home financing is down 1.7% and commercial financing has declined 12.7%. As of April 30, the yield on the FTSE Nareit Mortgage REITs Index was 12.81%, home financing yielded 13.25%, and commercial financing yielded 12.14%.