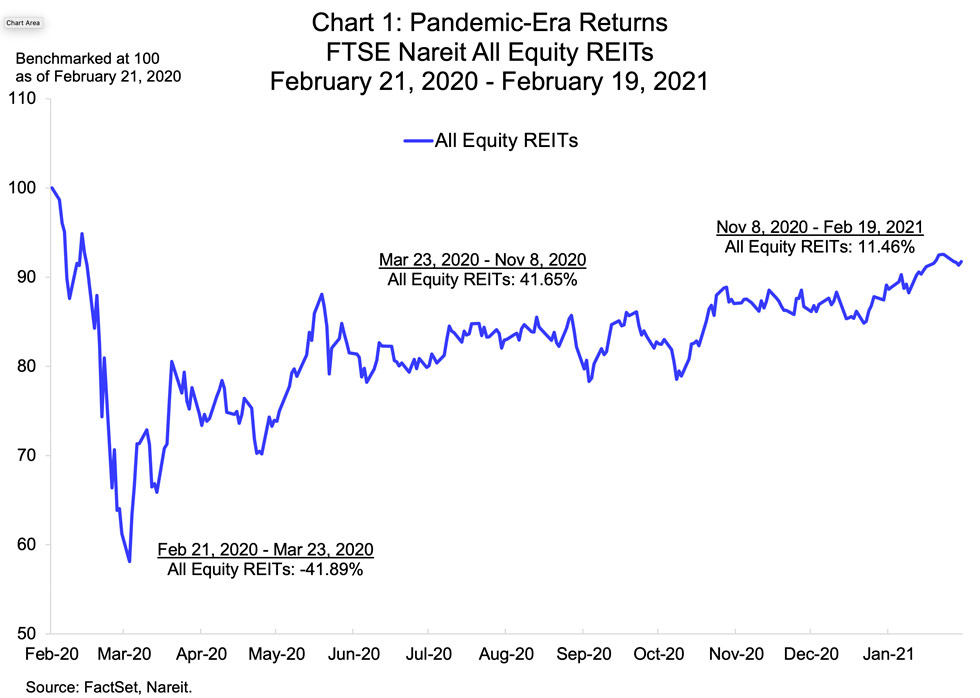

One year has now passed since the sudden spread of the pandemic first prompted a sharp fall in stock markets, including REITs. These 12 months have seen high levels of volatility and sharp swings in sentiment. This period divides fairly cleanly into three segments: the initial downturn last February and March; stabilization from April through November; and the post-vaccine world from November to today.

Let’s examine these phases of the market’s reaction to the pandemic, as they contain hints about risks and opportunities in the year ahead:

No sector was spared in the initial downdraft

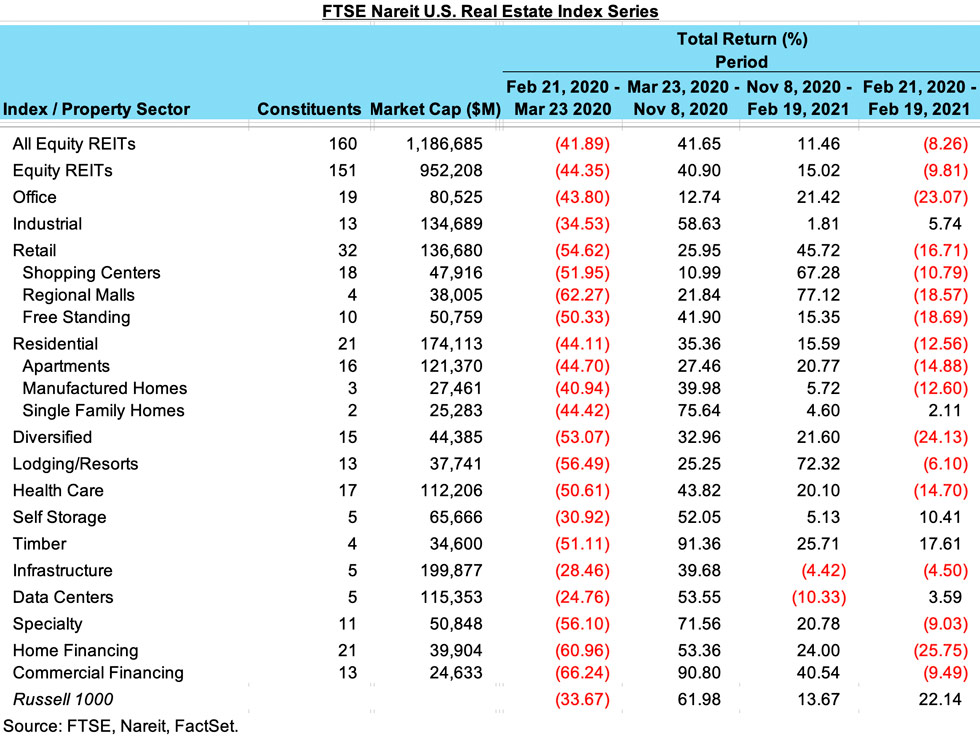

The first month of the pandemic saw one of the most sudden and steep stock market declines in memory. The FTSE Nareit All Equity REITs index had a total return of 41.9% from Feb 21, 2020 to Mar 23. Every property sector was down 25% or more, and the broader equity market (as measured by the Russell 1000) lost one-third of its value (table, center column).

The near-total shutdown of large swaths of the U.S. economy during these early weeks had no historical precedent, and these market declines were driven by fears of how the economy—corporations, households, banks, property owners—would survive the sudden cutoff of cash flows.

Stabilization in the spring and summer was also broad-based

It quickly became apparent, however, that many forms of economic activity could safely be carried out either with appropriate social distancing, or online—who knew about Zoom before last March? The spring and summer saw a stabilization of the underlying economy, as job losses stopped as suddenly as they had started, and online commerce and next-day delivery replaced many forms of in-person business activity.

Share prices rose by double-digits across all property sectors during this stabilization period. Gains were not evenly spread, however, and some sectors began to emerge as clear winners from the shift of economic activity to the digital realm.

Among the market leaders were data centers and infrastructure REITs, which own facilities that house servers that host web pages and process digital communications, and the cell towers that transmit both voice and data messages. Data centers and infrastructure REITs had total returns of 53.5% at 39.7%, respectively, from March 23 to early November. Industrial REITs, which own logistics facilities used for delivering goods bought on the internet, had a total return of 58.6% over this period. These sectors, along with self storage, had fully recovered from the initial downturn and were back to pre-crisis levels or were in positive territory by November.

Other sectors, however, had only a partial recovery during this period. The rebound in share prices still left the retail and lodging/resort sectors, and home financing mREITs, more than 40% below their pre-pandemic levels. Between the two extremes of the digitally-oriented REITs and the retail and lodging sectors, other property types had posted a partial recovery as of last fall.

Vaccines give new hope

The success of more than one vaccine in preventing new COVID-19 infections, and especially in reducing severe cases requiring hospitalization and causing deaths, has signaled a possible end to the pandemic in the not-too-distant future. The property sectors that had lagged during the initial stabilization period benefitted disproportionately from this good news. Lodging/resort REITs posted a 72.3% total return from Nov 8, 2020 to Feb. 19, 2021, while retail REITs had a 45.7% return—including 77.1% for regional malls and 67.3% for shopping centers. Most other sectors enjoyed double-digit returns, although data centers and infrastructure REITs declined and industrial REITs were little changed.

The year ahead still holds upside potential

The rebound of lodging/resorts and retail on the vaccine news brought these sectors much closer to pre-pandemic levels, with total returns of -6.1% and -16.7% (right column of table), respectively, since the pandemic began. This highlights that several other property sectors appear to have upside potential as the pandemic winds down. Office REITs (total return of -23.1%), diversified REITs (-24.1%), and residential REITs (-12.6%) displayed solid operating performance and sound market fundamentals prior to the pandemic disruption. While there are lingering concerns about potential long-term impact of work-from-home, these sectors are likely to continue to recover in the year ahead, and may hold an attractive risk-reward potential.