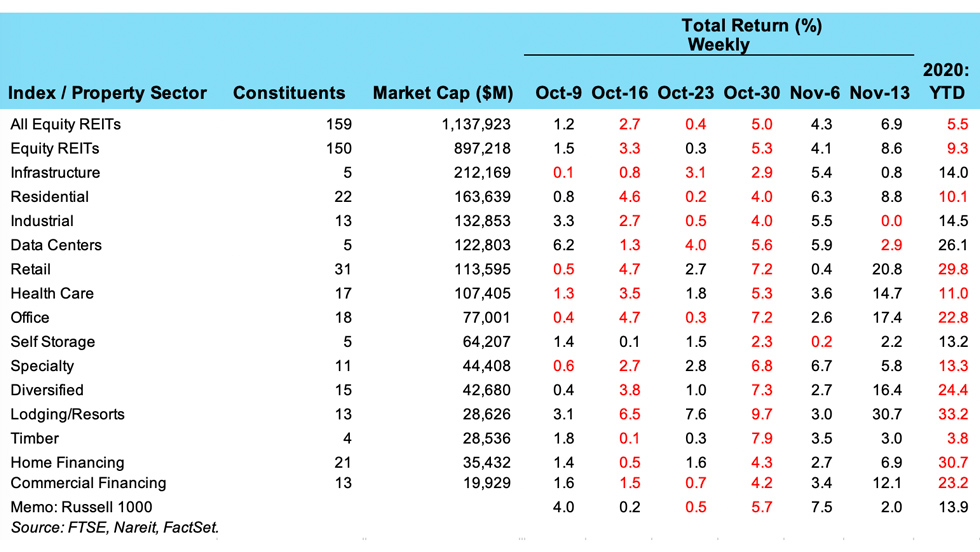

REIT stocks have rallied on reports of successful vaccine trials and hopes that many or most parts of the U.S. economy will return to pre-pandemic conditions by the middle of next year. The FTSE Nareit All Equity REITs index posted a total return of 6.9% last week, after a 4.3% gain the week before.

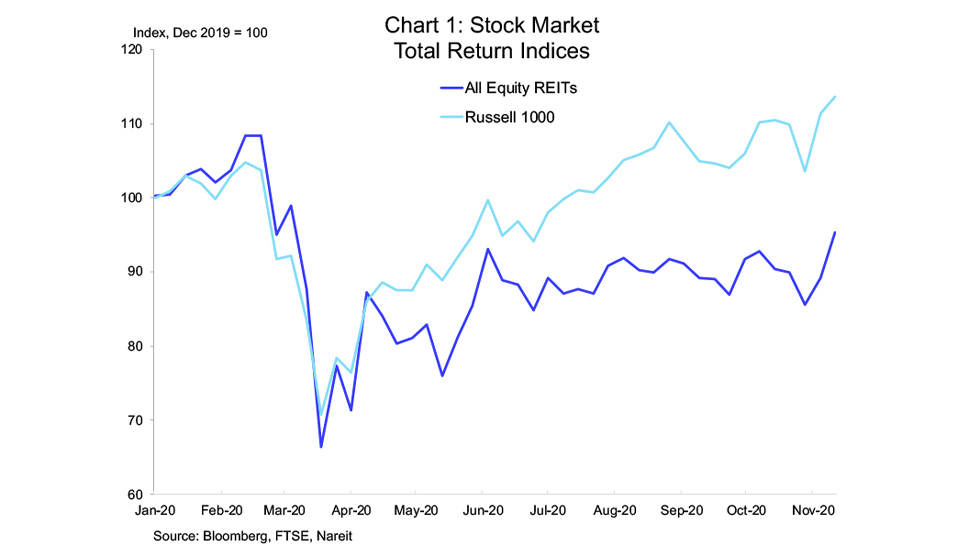

Rising share prices over the past two weeks lifted the total return index to the highest level since March 6, just as the economy was entering shutdown. REITs continue to lag the broader market, however, as the Russell 1000 and the S&P 500 have reached record highs.

Stock price increases have been spread broadly across most property sectors over the past two weeks. For the week ended Nov. 13, data centers had a total return of -2.9% and industrial was marginally lower, while the prior week the only decline was -0.2% for self storage. There were significant moves on the upside, however, led by lodging/resorts (up 30.7% last week), retail (20.8%), and office (17.4%). mREITs rallied as well, with commercial financing mREITs up 12.5% and home financing mREITs up 6.9%.