The 2023 Real Estate Allocations Monitor—a joint effort by Cornell University's Baker Program in Real Estate and real estate investment advisory firm Hodes Weill & Associates—recently presented its latest findings on institutional real estate investment allocations and trends.

The survey of 175 institutional investors across 25 countries with a combined total assets under management (AUM) of more than $10.2 trillion and approximately $1.1 trillion invested in real estate now includes questions on REIT investments.

The Allocations Monitor focuses on the role of real estate in institutional portfolios, and the impact of institutional allocation trends on the investment management industry. It is an internationally recognized, comprehensive annual assessment of institutions’ allocations to, and objectives in, real estate investments. It analyzes trends in institutional portfolios and allocations by region, type, and size of institution. Key findings relating to REIT investments include:

Overall, U.S. real estate remains an important asset class for institutional investors.

- Institutions are maintaining their allocations to real estate, holding target allocations at 10.8%, flat year-over-year. When asked about investment intentions regarding REITs, 42% of institutions reported that they are planning to allocate additional capital to REITs, led by sovereign wealth funds and government entities at 64%.

- After declining in 2022, real estate investor conviction is on the rise, as institutions begin to focus on the potential to take advantage of a favorable investment environment over the next several years.

- The United States remains the preferred destination for capital allocations from both North American and international investors; this may make U.S. REITs more attractive to foreign institutional investors.

Additionally, key findings from the Real Estate Allocations Monitor relating to U.S. REITs include:

- REITs and other real estate public equities are an increasingly important component of institutional portfolios, with approximately 84% of institutions that actively invest in REITs including REITs as part of their real estate allocation.

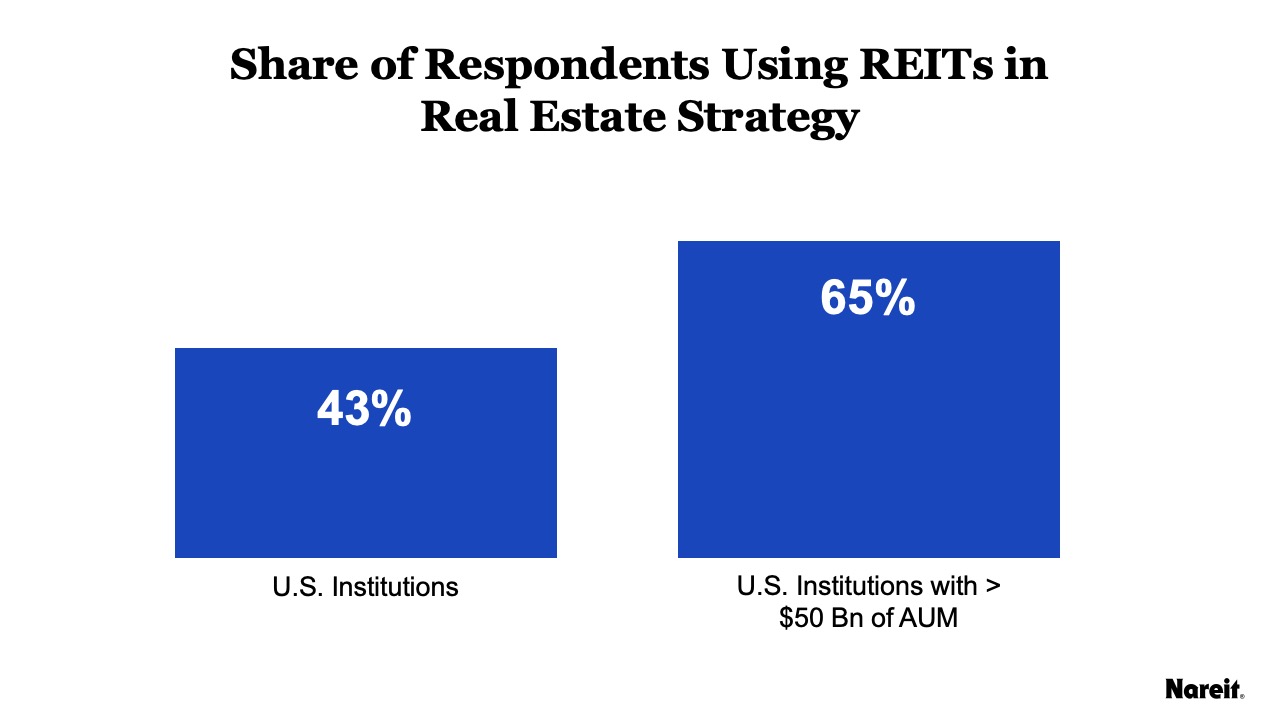

- Share of U.S.-only respondents using REITs is 43%. But for the largest and most sophisticated U.S. institutions with more than $50 billion of AUM, the share of REIT investor rises to 65%. This result is in line with prior research that Nareit has conducted independently on the 25 largest U.S. and global public plan investors.

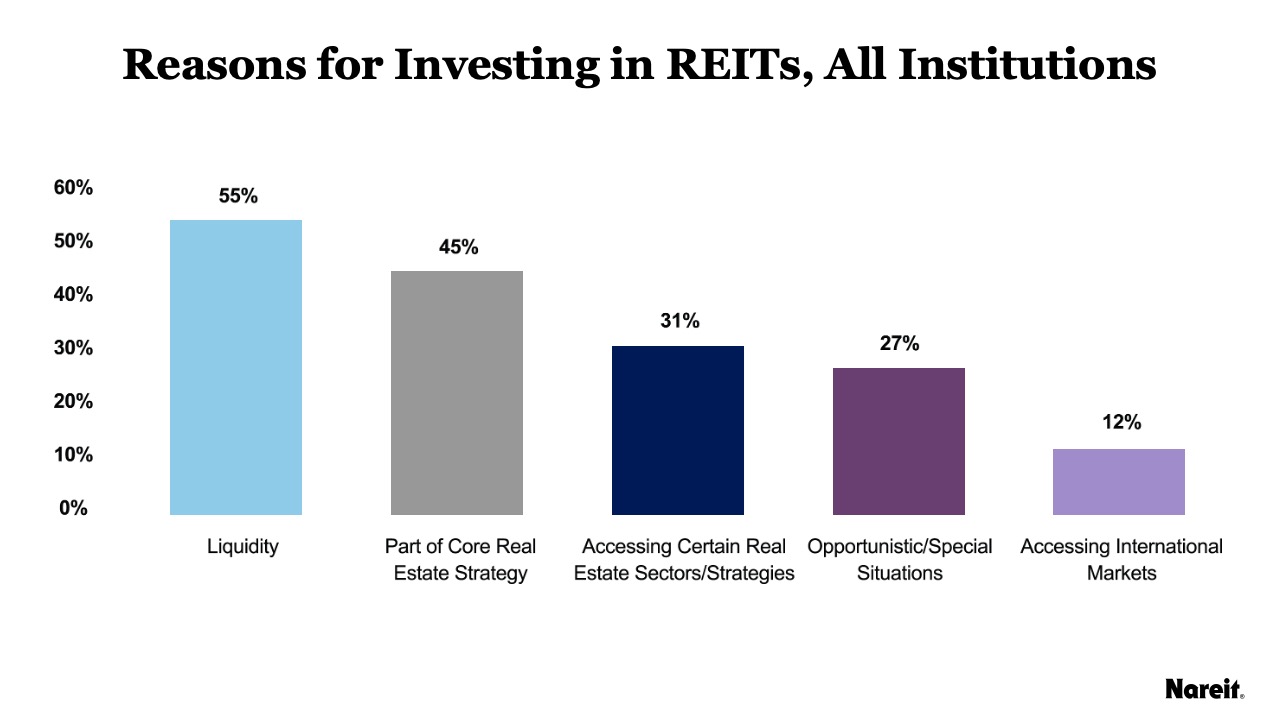

- In addition to the benefit of liquidity, REITs are a frequently used proxy for core real estate holdings. For many institutions, particularly larger ones, REITs enable tactical allocations to certain real estate sectors, strategies, and geographies, and the ability to allocate opportunistically to take advantage of discounts to intrinsic value and special situations. Of the institutions investing in REITs, 55% of respondents identified liquidity as a leading objective for investment. Approximately 45% of respondents indicated they invest in REITs as part of their core real estate strategy, and 31% indicated their investments are driven by an objective to broaden exposure to certain real estate sectors and strategies.

- Reasons for investing in REITs vary across size of institution. Approximately 56% of large institutions indicated that their investments in REITs are driven in part by an objective to access certain real estate sectors and strategies, compared to 18% of small institutions. Additionally, 50% of large institutions indicated they are investing in REITs to achieve opportunistic and special situations exposure, compared to 15% of small institutions. This suggests that larger institutions take a more tactical approach to allocating to public real estate securities.

- Geographically, institutions based in the Americas are the most active REIT investors, with 40% of participants having exposure. Asia-Pacific (APAC) followed the Americas, with 38% of institutions allocating to REITs; and Europe, the Middle East, and Africa (EMEA) was the least active with 26% of institutions investing in REITs.

A full copy of the 2023 Real Estate Allocations Monitor is available online; as well as a recent episode of Nareit’s REIT Report podcast, with Douglas Weill sharing highlights of the findings.