REITs average higher returns over multi-year time horizons compared to private real estate with a broader allocation across innovative property sectors, according to Nareit analysis of past performance. The greater diversification in REIT property sectors has allowed overall REIT performance to reflect economic changes including the rise of e-commerce and the increasing digitization of economic activity.

Over longer time horizons, as private real estate has the chance to fully incorporate past economic conditions, REITs have had higher returns and growth rates. One of many reasons for this is REITs have been innovators in new property sectors such as data centers and cell phone towers and, in general, are far more broadly diversified across real estate sectors and representative of the built environment.

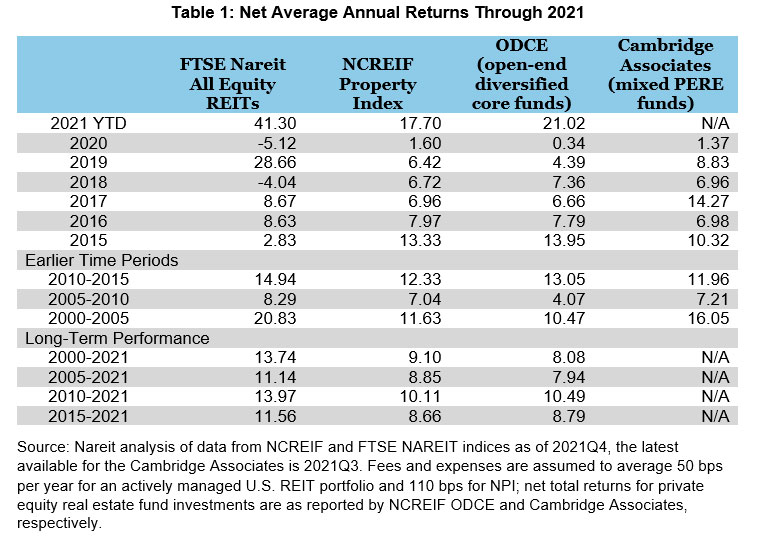

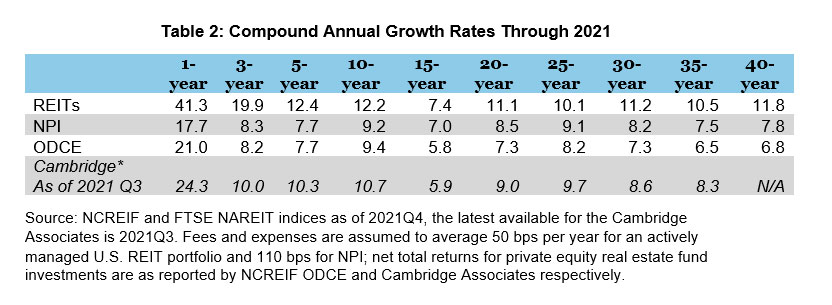

Short and long-term average returns for REITs and private real estate indexes are in Table 1. For the 11-year period from 2010 to 2021, REIT returns averaged 14.0% compared to 10.1% for NCREIF’s Property Index (NPI) and 10.5% for NCREIF’s Open End Diversified Core Equity Fund Index (ODCE). Over the 21-year period from 2000 to 2021, REIT returns averaged 13.7% compared to 9.1% or 8.1% for the NCREIF indexes. Growth rates are given in Table 2. The 10-year growth rate for REITs is 12.2% and 11.1% for the 20-year growth rate. Private real estate grew at 9.4% for ODCE over 10 years and 7.3% over 20 years.

A previous market commentary compared REIT and private real estate performance during the pandemic. By the end of 2021, REITs had outperformed during the pandemic, and private real estate appeared to be slow to incorporate existing economic conditions into prices.

One of the contributing factors to REITs’ outperformance is the diversification in property sectors for REITs. Private real estate remains overwhelmingly comprised of properties in the “RORI” (residential, office, retail, and industrial) sectors. For example, ODCE’s share of total value is 94.5% in RORI. While there are many REITs in these sectors, there are also REITs that own 21st century real estate like data centers and cell phone towers.

Additionally, the FTSE All Equity REITs Index is more balanced in allocating among property sectors, with higher allocations to sectors like health care, self storage, and lodging/resorts. The share of total equity market capitalization outside RORI sectors in the FTSE All Equity REITs Index is 51.3%. REIT returns have been boosted by the inclusion of cell phone tower REITs in the infrastructure sector (10-year average returns 17.7%) and data centers (five-year average returns 18.2%) and a higher allocation in self-storage (20-year average return 19.1%).