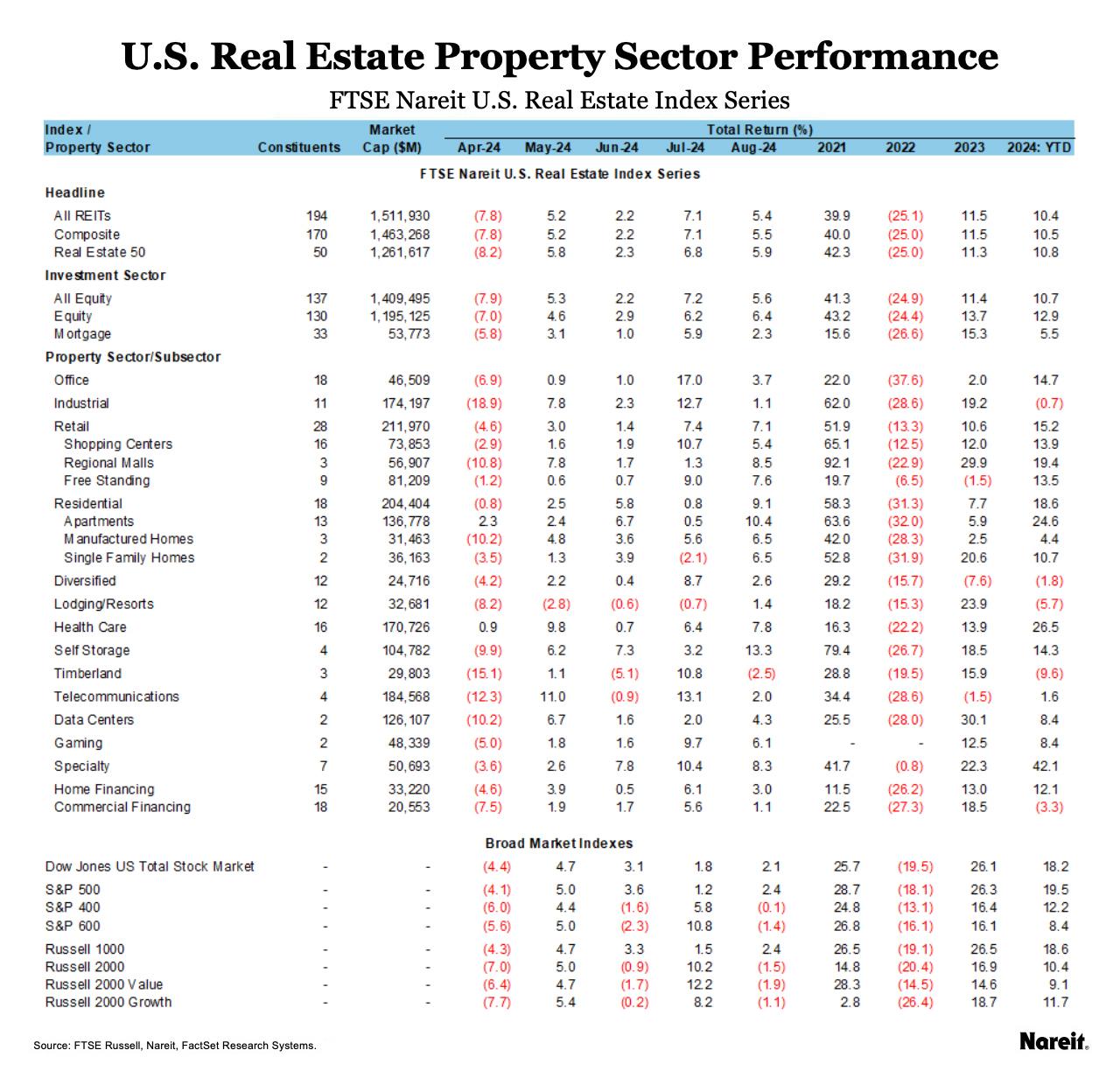

The FTSE Nareit All Equity REITs Index continued to outperform broader markets in August, posting a total return of 5.4% as the Russell 1000 and Dow Jones U.S. Total Stock Market rose 2.4% and 2.1%, respectively. The All Equity REITs Index has risen 13.2% in the third quarter and is up 10.7% on a year-to-date basis. Investors have embraced greater certainty that the Federal Reserve will begin to cut interest rates imminently, with the outstanding question largely centering on the size of the cut. Many investors have shifted their focus to concerns about an economic slowdown as inflationary measures continue trending downward.

The yield on the 10-Year Treasury continued its recent decline, falling 14 basis points to end the month at 3.92%. The dividend yield on the FTSE Nareit All Equity REITs index was 3.67% and the FTSE Nareit Mortgage REITs Index yielded 11.87%, compared to 1.24% for the S&P 500.

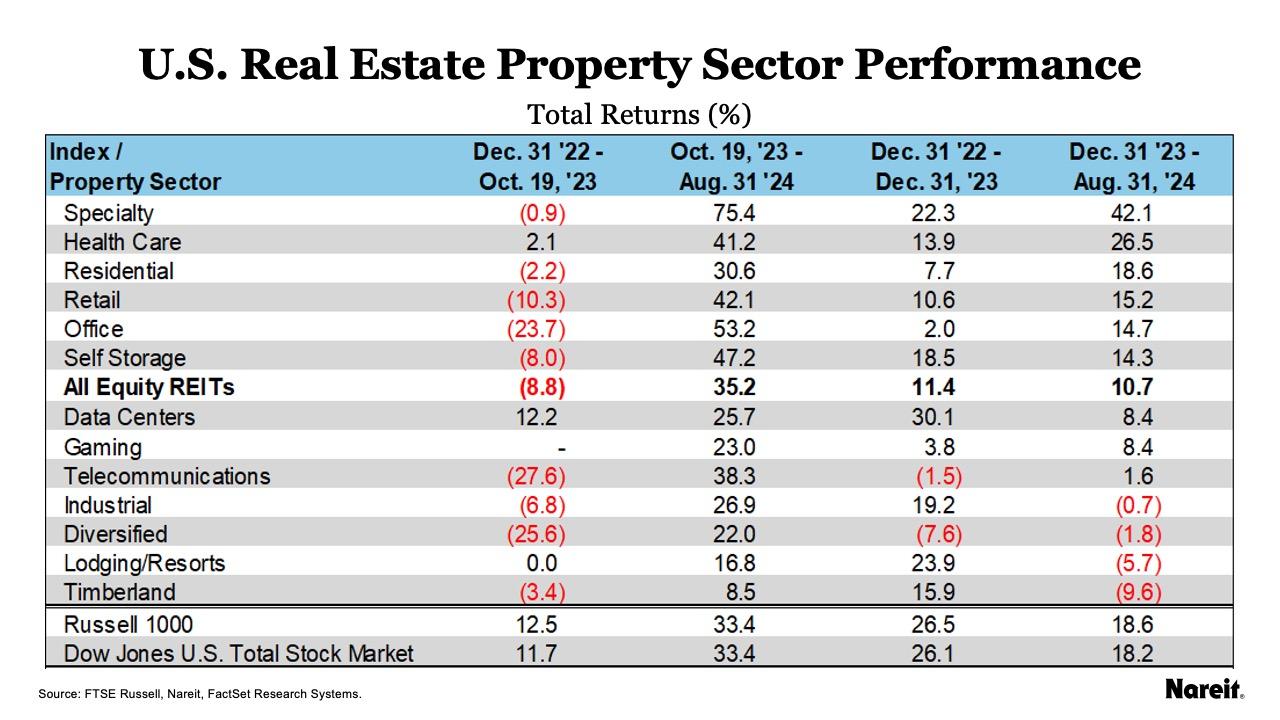

The All Equity REITs index is up 35.2% since Oct. 19, 2023, when the yield on the 10-Year Treasury approached 5%. Since October 2023, the Dow Jones U.S. Total Stock Market and Russell 1000 have narrowly lagged REITs, each returning 33.4% over that period. In 2024, the Russell 1000 is up 18.6% and the Dow Jones U.S. Total Stock Market is up 18.2%.

Nearly all sectors rose in August, as self-storage led with a total return of 13.3%, followed by residential at 10.4% and specialty at 8.3%. At the subsector level, apartments led with a return of 10.4% and regional malls followed with a return of 8.5%. Timberland was the lone negative sector, posting a return of -2.5%. On a year-to-date basis, specialty leads all sectors with a total return of 42.1%, followed by health care at 26.5% and residential at 18.6%.

The FTSE Nareit Mortgage REITs Index rose 2.3% in August and is up 5.5%, year-to-date. Home financing rose 3.0% for the month and commercial financing was up 1.1%. Year-to-date, home financing is up 12.1% and commercial financing is down 3.3%.