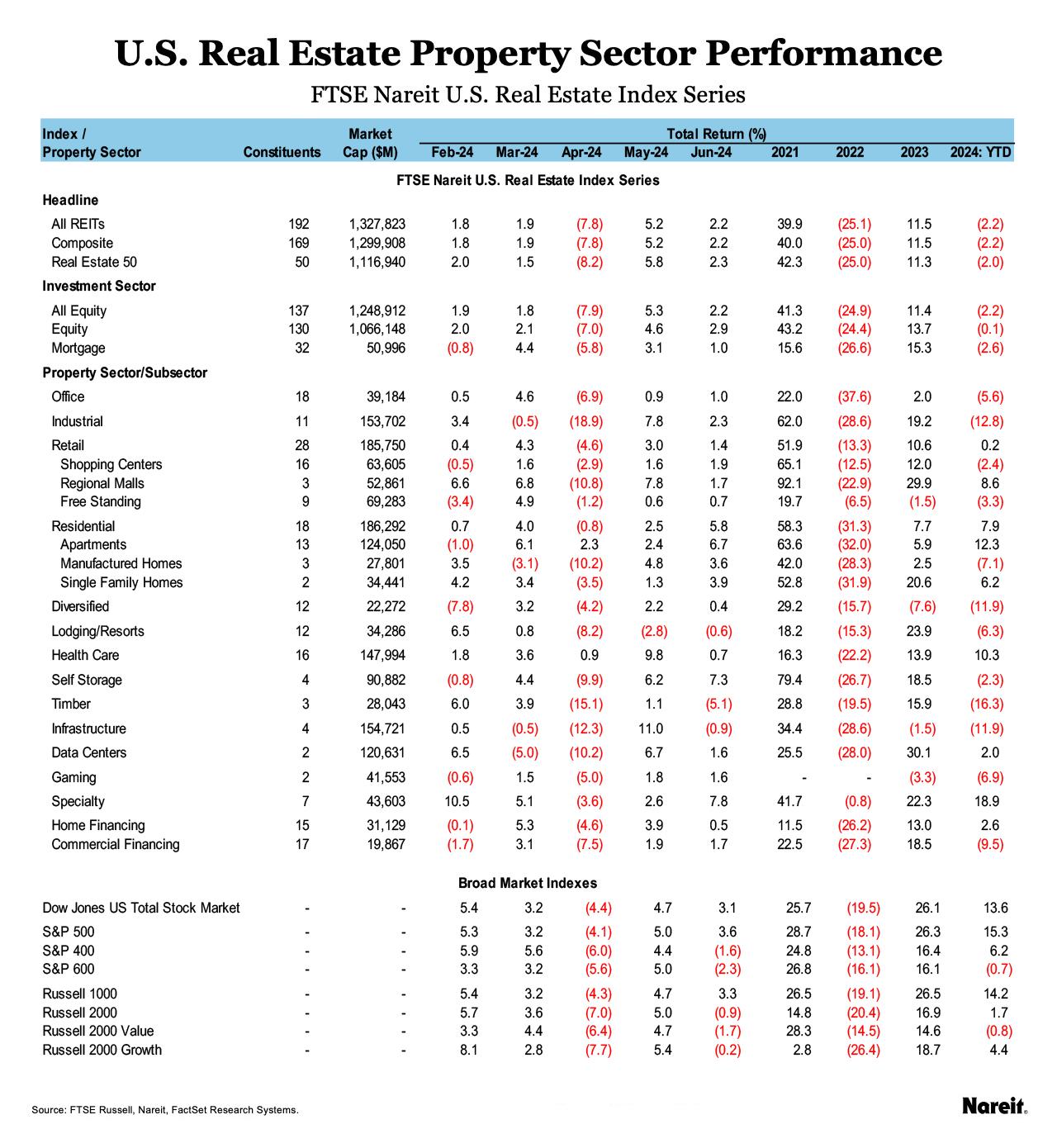

The FTSE Nareit All Equity REITs Index built on the standout performance of May, with a gain of 2.2% in June. The Russell 1000 and Dow Jones U.S. Total Stock Market outperformed with respective returns of 3.3% and 3.1%. It remains unclear when the Federal Reserve will take a more accommodative monetary policy, though most investors expect any rate cuts this year to occur later in the third or fourth quarter.

At the end of June, the dividend yield on the FTSE Nareit All Equity REITs index was 4.13% and the FTSE Nareit Mortgage REITs Index yielded 16.63%, compared to 1.27% for the S&P 500. The yield on the 10-Year Treasury continued to fall, declining 12 basis points to end the month at 4.37%.

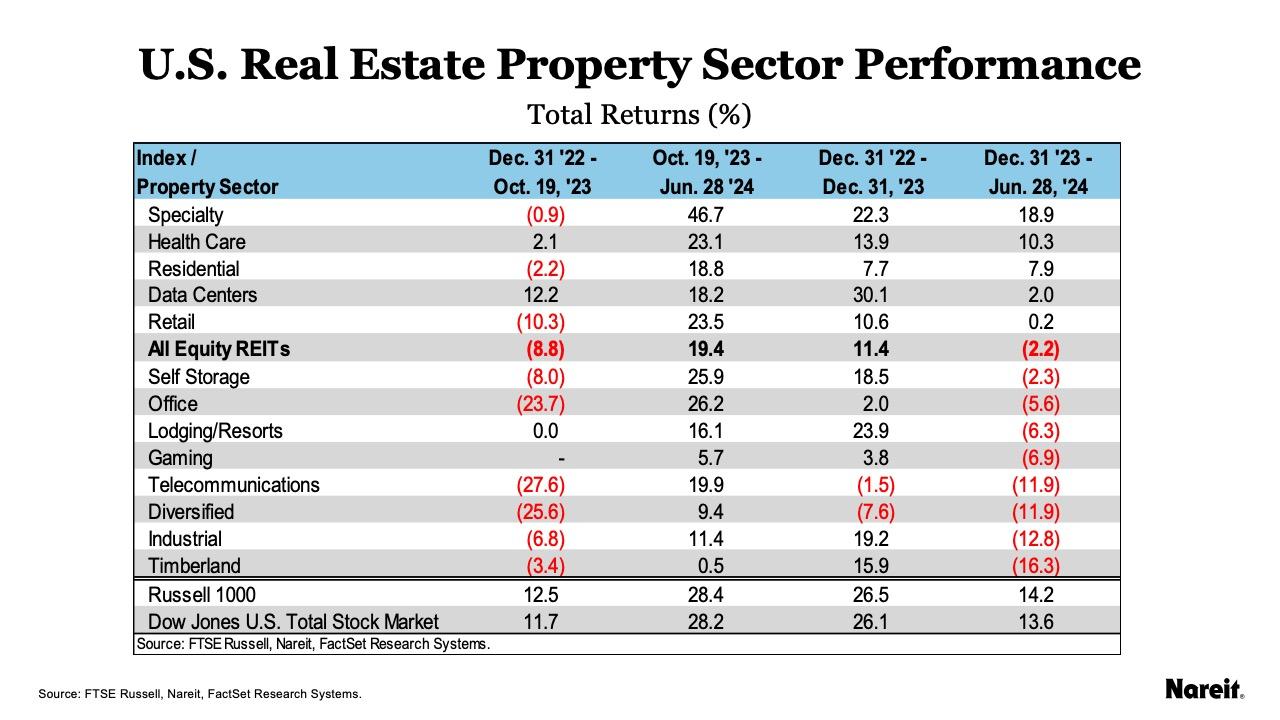

The All Equity REITs index is up 19.4% since October 2023. On a year-to-date basis, the index has returned -2.2%. Also since October 2023, the Russell 1000 is up 28.4% and the Dow Jones U.S. Total Stock Market is up 28.2%. On a year-to-date basis, the Russell 1000 is up 14.2% and the Dow Jones U.S. Total Stock Market is up 13.6%.

Specialty led in June with a total return of 7.8%, followed by self-storage at 7.3% and residential at 5.8%. At the subsector level, apartments and single family homes led with respective returns of 6.7% and 3.9%. Lagging sectors included timberland with a return of -5.1%, followed by telecommunications at -0.9% and lodging/resorts at -0.6%. On a year-to-date basis, specialty continues to post strong returns and is up 18.9%, followed by health care at 10.3% and residential at 7.9%.

The FTSE Nareit Mortgage REITs Index rose 1.0% in June and is down 2.6% year-to-date. Home financing rose 0.5% in June and commercial financing was up 1.7%. Year-to-date, home financing is up 2.6% and commercial financing is down 9.5%.