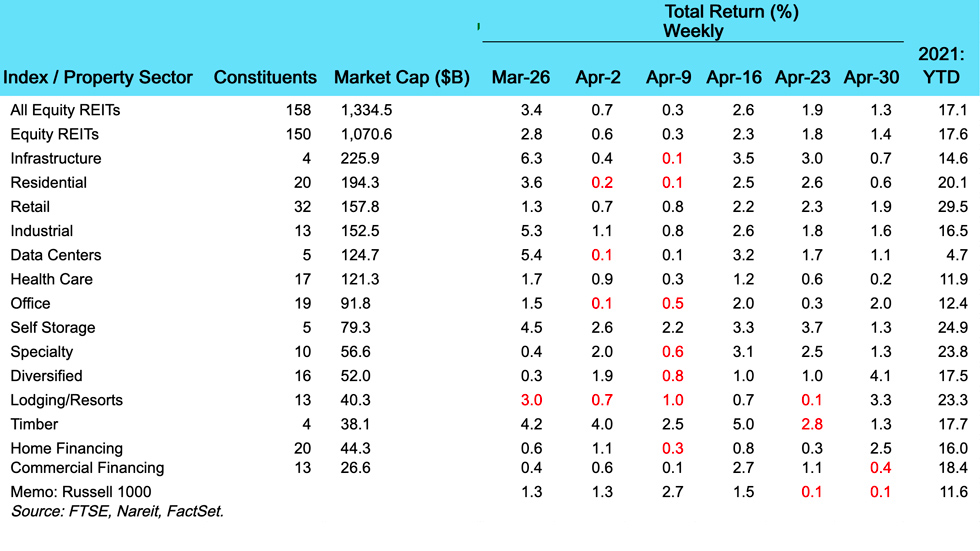

REIT share prices rose last week, extending the weekly winning streak to six weeks. The FTSE Nareit All Equity REITs Index posted a total return of 1.3%. Broader markets, in contrast, were flat-to-down, with negative 0.1% returns on the Russell 1000 for the second week in a row.

Every REIT property sector rose last week, ranging from a modest 0.2% return for health care, to a 4.1% total return for diversified REITs. mREITs were mixed, with a 2.5% return for the home financing subsector but a 0.4% decline for commercial financing mREITs.

Nearly all property sectors have double-digit gains for the year to date. 2021 remains a near mirror image of 2020, as those sectors that were most negatively affected by shutdowns and social distancing in the early months of the pandemic are among the leaders in the recovery this year. Retail REITs have a total return of 29.5% so far this year, and lodging/resorts have a return of 23.3%. Other property sectors with year-to-date returns of 20% or greater include residential (20.1%), specialty (23.8%), and self storage (24.9%).