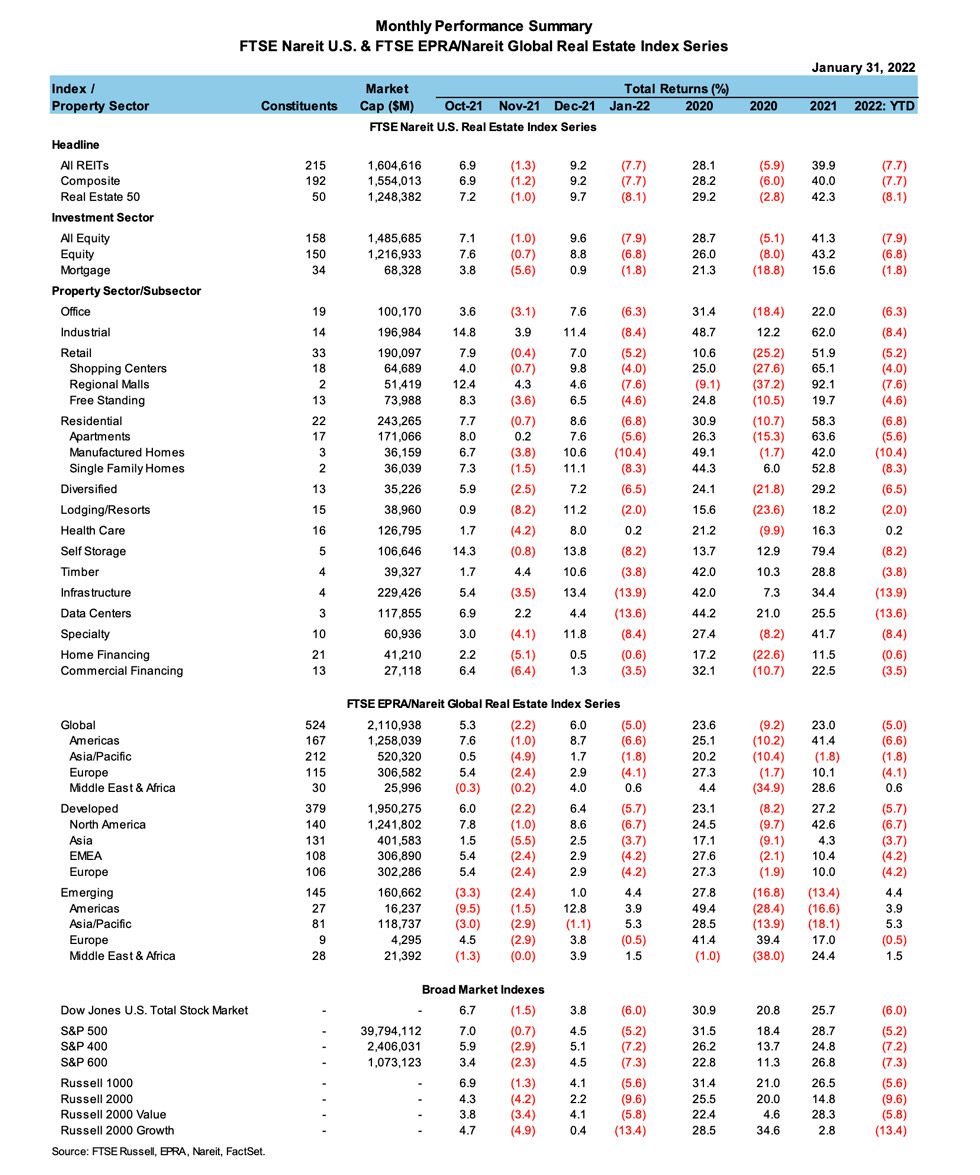

After a year of strong performance which saw REITs hit an all-time closing high on December 31st, REITs fell sharply in January 2022 as the Omicron variant of the COVID-19 Pandemic persisted and the Federal Reserve indicated its readiness to tighten monetary policy. For the month, the FTSE Nareit All Equity REITs index fell 7.9% on a total return basis, after gaining 41.3% in 2021, while the Equity REITs index fell 6.8%, after gaining 43.2% last year. However, after a difficult start to the year, the month ended on a more positive note. Through January 27th the All Equity REITs index was down 11.9%, then rallied 4.0% in the final two trading sessions. While this was the worst month for REITs since March 2020, the All Equity REITs index remains 21.9% above it’s January 31, 2020 pre-Pandemic close and 97.7% above the Pandemic low set on March 23 rd, 2020.

Broader markets also struggled in January, with a total return of -6.0% on the Dow Jones U.S. Total Stock Market and -5.6% on the Russell 1000. Small cap stocks faced stiffer headwinds, with the Russell 2000 returning -9.6%. Small-cap growth performed notably worse than small-cap value with returns of -13.4% from the Russell 2000 Growth compared to -5.8% from the Russell 2000 Value.

All property sectors were flat or negative in January, led by health care with a return of 0.2% and lodging/resorts at -2.0%. Infrastructure was the worst performing sector in January with returns of -13.9%, followed by data centers at -13.6% and industrial at -8.4%. In 2021, these sectors returned 34.4%, 25.5%, and 62.0%, respectively. Mortgage REIT returns were muted in January, with returns of -0.6% for home financing mREITs and -3.5% for commercial financing mREITs. In 2021, the commercial financing sector posted a total return of 15.6% while the home financing sector returned 11.5%.

Globally, real estate was negative in January as well. The FTSE EPRA/Nareit Global index was down 5.0% in January after putting up a total return of 23.0% in 2021. Developed markets performed similarly with returns of -5.7% for the month after returning 27.2% last year. Emerging markets were positive in January with a return of 4.4% after a return of -13.4% in the prior year.