This is a guest commentary written by Annie Xiao, portfolio manager at the Employee Retirement System of Texas (Texas ERS).

The Employees Retirement System (ERS) of Texas is a U.S. public defined benefit retirement fund that serves employees of the state of Texas. ERS uses REITs alongside private real estate in its real estate strategy. REITs provide geographic and property sector diversification.

ERS has about $38.2 billion in total assets under management (AUM) as of February 29, 2024, and a 12.0% allocation to real estate comprised of public and private investments. Within this real estate strategy, REITs have a 25% target allocation.

History of REIT Usage

ERS has utilized REITs since 2005 via a stand-alone U.S. REIT portfolio. Prior to that, ERS’ investment in real estate was primarily through investment in listed real estate managed in the broader equity portfolio. In 2007, ERS expanded the real estate investment mandate from a domestic to a global one, which included REITs and REOCs, to gain exposure of the rapidly growing international real estate markets. In 2008, ERS formally created the real estate asset class allocation and started committing capital shortly thereafter.

Implementation Objective

ERS has used REITs as a return-seeking complement to private real estate, as a geographic and sector diversifier, and also to make opportunistic “short term” investment views on real estate that cannot be accomplished with private real estate due to the long-term nature of closed-ended vehicles and transaction costs. The public real estate program is a surrogate for core real estate and serves a complementary role while providing the benefits of diversification, liquidity, inflation hedge, tactical allocation, and appropriate total returns over the long-term for ERS.

The program Invests in both domestic U.S. and international listed real estate securities. The portfolio is allocated across property types, region, and market capitalization to ensure diversification.

ERS’ public real estate policy benchmark is the FTSE EPRA/NAREIT Developed Index. The objective for the real estate program is to outperform its policy benchmarks net of investment expenses over rolling five-year and 10-year periods, respectively. Investment performance is measured primarily over rolling five-year periods, though private market investments are evaluated over rolling 10-year periods using realized internal rates of return (IRR) and realized multiples on invested capital. For most trailing five-year periods, the REIT portfolio has delivered positive excess returns net of expenses. As of February 29, 2024, the rolling five-year return for the program had exceeded its benchmark by 132 basis points, with stock selection being the primary driver for that relative outperformance.

Through the public real estate program, ERS has benefited from the opportunity to gain exposure to high-quality properties at a discount to valuation given the current wide pricing gap between the public and private real estate markets. As part of this, ERS uses REITs tactically to “dial up” or “dial down” exposures. For example, during March 2021, ERS tactically allocated an incremental $200 million to the public real estate portfolio to take advantage of the market dislocations during the COVID-19 pandemic. During March 2022, ERS moved $250 million out of public real estate when market conditions normalized. And most recently, the fund modestly increased its allocation to the public real estate program in anticipation of interest rate normalization.

Geographic Diversification

Global real estate is an important component of the investable universe. Asia, especially, is becoming a bigger part of that picture. High-quality assets are being listed in foreign markets, representing a significant investment opportunity.

The listed real estate sector presents opportunities to access unique and scarce assets that are practically unattainable in private real estate. For example, most of the high-quality class A properties in Tokyo, Singapore, Hong Kong, and to a lesser degree London, are owned by listed real estate securities companies. These listed companies rarely, if ever, sell these highly prized trophy properties. For example, in Tokyo if one wants to have equity in an asset in Marunouci, Nihonbashi, or Ginza, the most efficient method is to buy the listed security to gain this exposure. Similarly in London, one needs to go through a listed REIT to access the preferred submarkets of Covent Garden or the West End. Through holdings in listed names that are dominant players in these markets, ERS gains access to these hard-to-access submarkets and can easily dial up or dial down its exposure due to the liquid nature of listed real estate securities.

Furthermore, ERS is permitted to invest in “out of index” listed names, allowing it to invest opportunistically in emerging markets. While REITs and real estate securities are still growing across the world, they have established themselves in certain countries. Emerging markets are notoriously volatile and ERS doesn’t necessarily want to make a long-term play investing in private real estate with the associated 5- to 10-year time horizon. The listed security market can present opportunities to add alpha to the portfolio by investing in an emerging market country when it’s heavily out of favor and to sell when prices normalize.

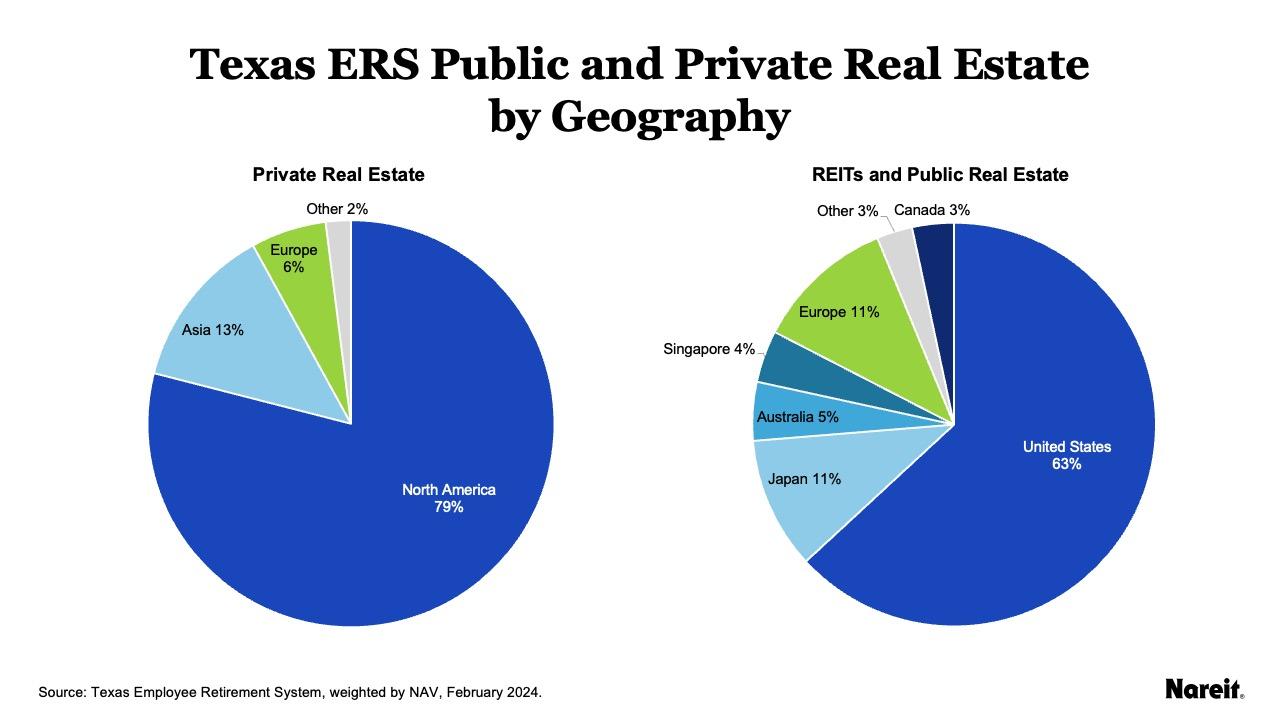

The chart above shows the geographic diversification provided by the REIT strategy. The public real estate portfolio has 37% exposure to foreign real estate compared with just 21% in the private real estate portfolio. Japan accounts for a significant portion of the REIT non-U.S. strategy. Investing in Japanese REITs allows the portfolio to participate in Japan’s resilient real estate fundamentals. For the first time in many years, Japan is moving away from deflation, with corporations having started to post higher profit growth. Japan has a 10% weight in the FTSE EPRA Nareit Global Real Estate Index, so using this index/benchmark gives ERS the latitude to invest in Japan as part of a goal to outperform the benchmark.

Diversification by Property Type

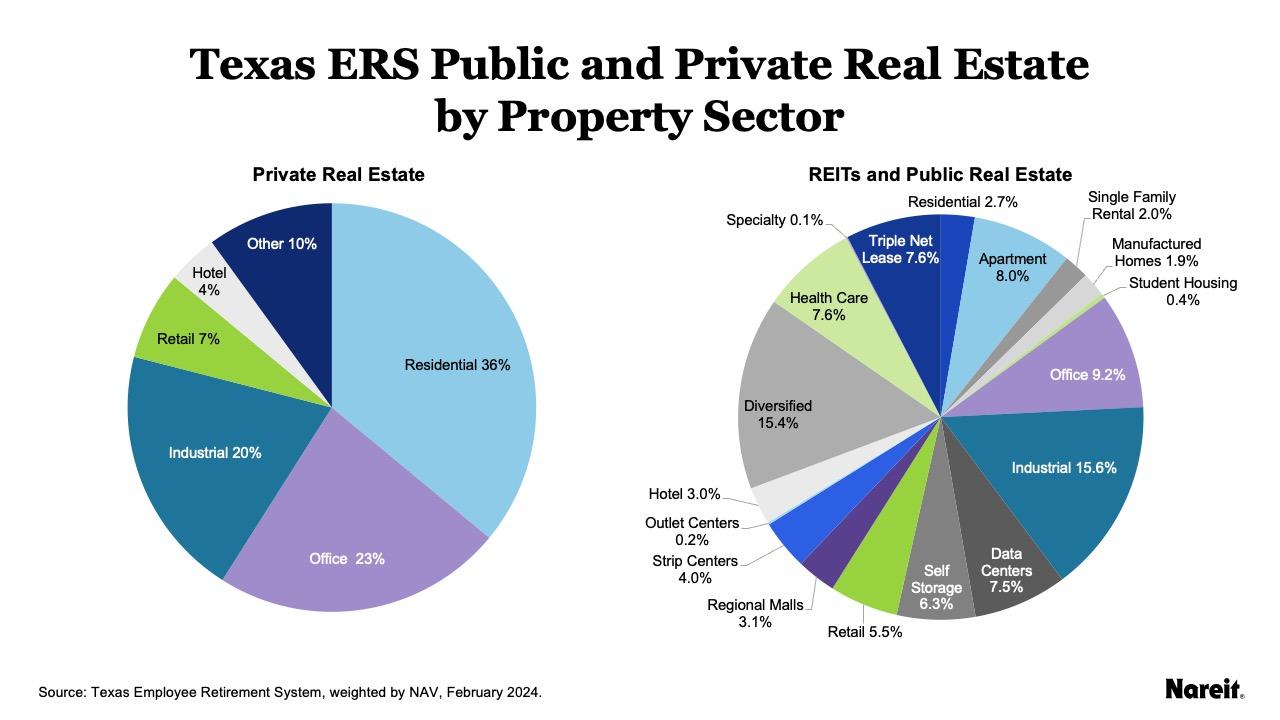

In addition to the geographic diversification benefit, public real estate provides opportunities to access a wider range of property types, including niche sectors like data centers, manufactured housing, student housing, self-storage, and health care facilities. Furthermore, it allows ERS to take views on certain markets or subsectors due to perceived mispricing in the public markets that is nearly impossible to replicate in private real estate. For example, ERS can take a view on West Coast office for a month, a year, or two years, depending on market conditions and perceived value of the security without having to commit “long-term” capital as it would with private real estate vehicles. This is especially true in the U.S. and Europe where specialization by geography and property type is more pronounced than Asia, but the ability is there in Asian markets, too, via listed REITs.

As a result of the factors discussed above, the charts here show that the ERS private real estate portfolio maintains more exposure to the “traditional” real estate sectors, whereas the public real estate portfolio has more “modern economy” exposure.

In summary, REITs have played and continue to play an important role in helping ERS achieve portfolio geographic and property sector diversification, while allowing it to make short-term opportunistic plays that are otherwise unachievable in a private real estate portfolio. REITs have been especially useful in achieving ERS’s goal of maintaining significant non-U.S. real estate exposure.

Read additional portfolio completion case studies