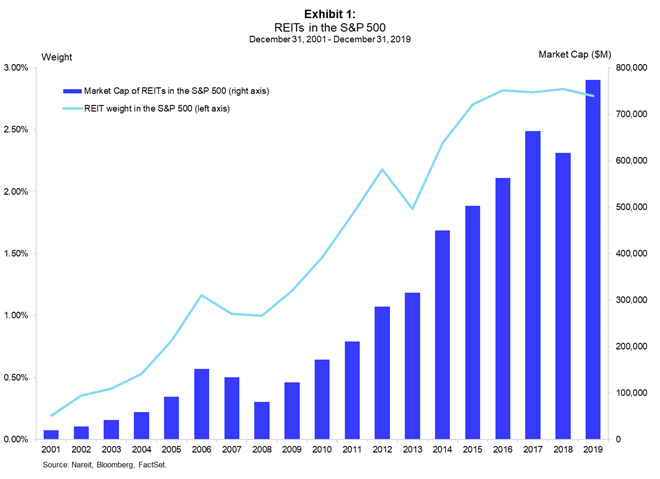

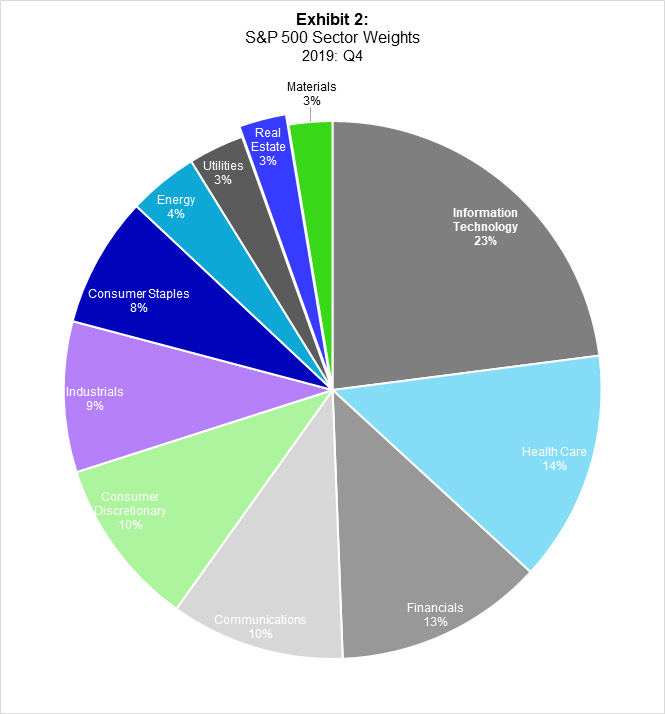

REITs were first deemed eligible for inclusion in the S&P 500 in October 2001. Since 2001 the representation of REITs in the S&P 500 has grown from .2% to 2.8% as of December 31, 2019 (see Exhibit 1). During this time the market value of the constituent REITs grew from $20 billion to $773 billion. This growth has been fueled in part by newer adoptees of the REIT model, with $294 billion of this market cap represented by Infrastructure, Data Centers, Specialty, and Timberland REITs. For a comparison of how the Real Estate sector compares to other GICS sectors in the S&P 500, see Exhibit 2.

REIT constituents of the S&P equity indexes are updated monthly and can be found in REITWatch.

This post has been updated with data through Dec. 31, 2019.