Recent research by Nareit shows that REIT returns have tended to bounce back—and even surge—after significant public and private real estate market divergences. However, timing is not the only major difference between REITs and common private real estate benchmarks.

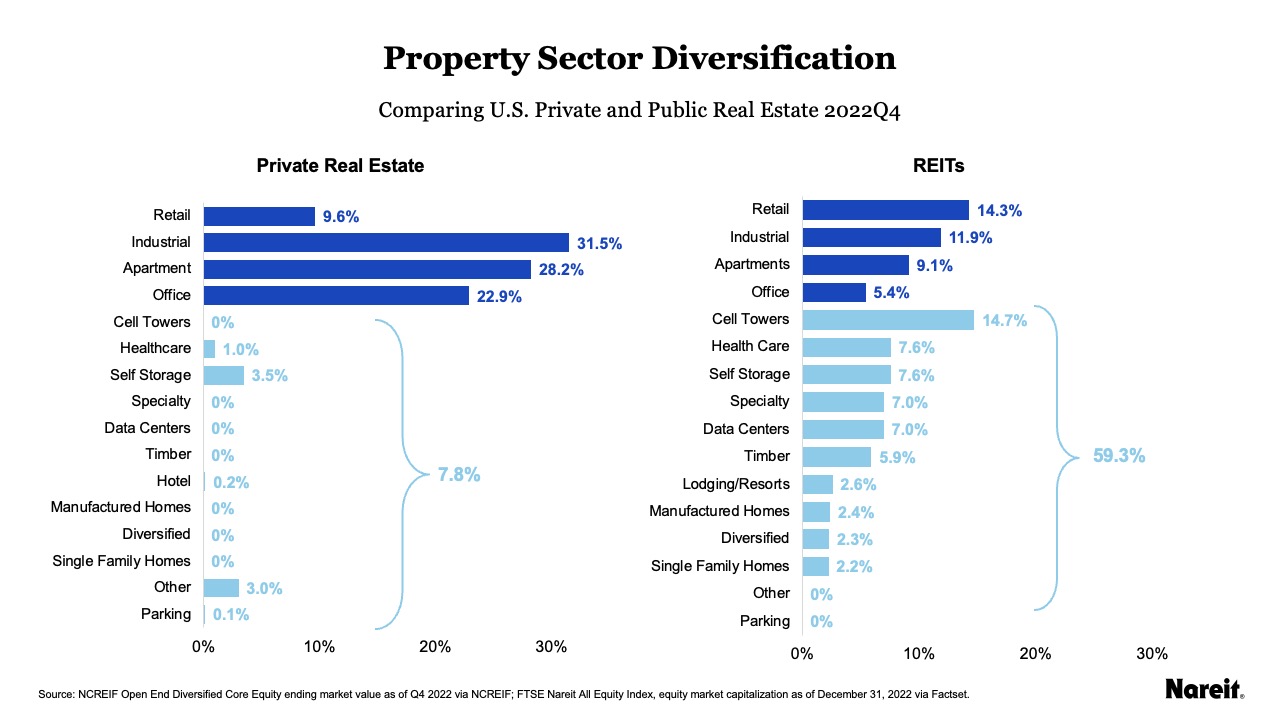

REITs and private real estate are also different in the property sectors they cover. Over the past two decades, REITs have innovated into a broader set of property sectors. The FTSE Nareit Equity REIT index has 12 property sectors, reflecting the diversity of REIT property specialization. Equity REITs cover new and emerging property types including cell towers, data centers, self-storage, and health care, and have manufactured housing and single-family rentals in the residential sector along with apartments.

Private real estate and the private real estate benchmarks are still predominantly invested in residential (in the form of apartments), office, retail, and industrial properties (sometimes referred to as RORI).

The chart above compares property sector investment by equity REITs and the private real estate benchmark, NCREIF’s Open End Diversified Core Equity (ODCE) fund. The FTSE Nareit All Equity REITs index had 41% of equity market capitalization in apartment, office, retail, and industrial at the end of 2022, down from 74% in 2000. NCREIF’s Open End Diversified Core Equity (ODCE) fund had 92% of end-of-month value in the RORI sectors as of the fourth quarter 2022. Benchmarking performance between REITs and ODCE obscures that REIT returns are based on a wider variety of property types and may not be directly comparable.

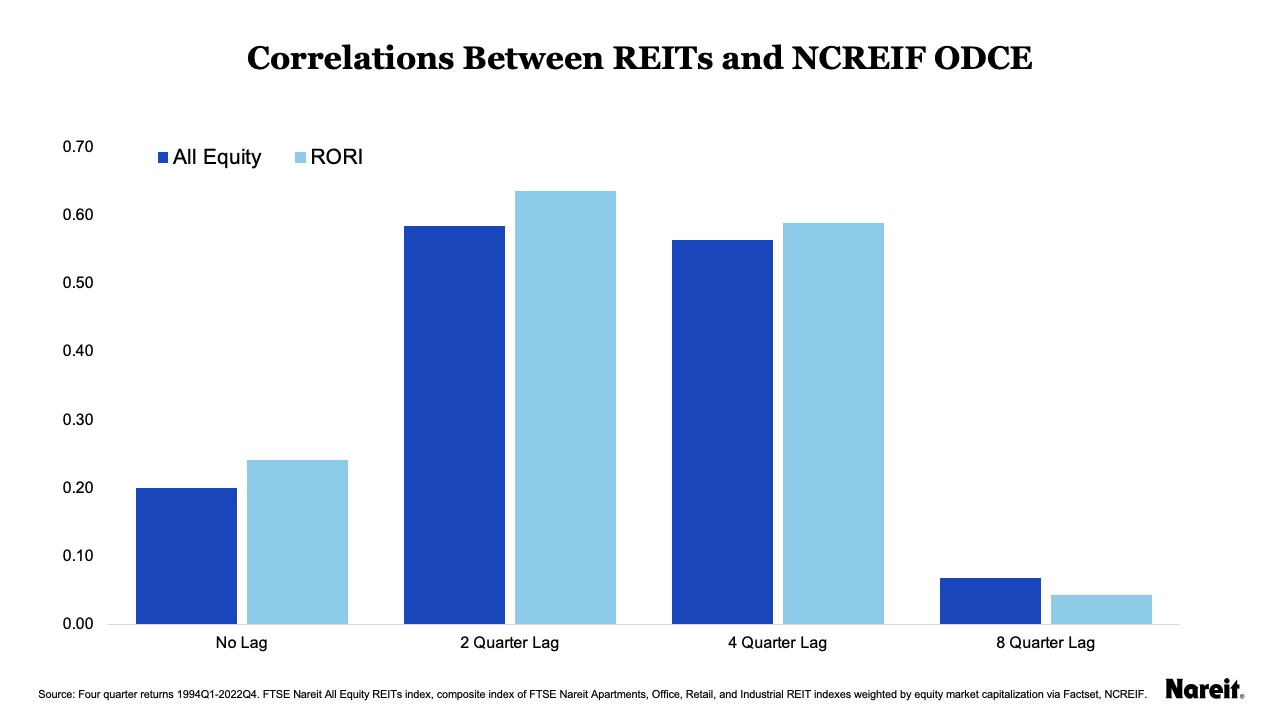

Both the composition of the indexes and the lagged return structure play a role in the low contemporaneous correlation of public and private real estate. The chart above compares four-quarter returns between ODCE and the FTSE Nareit All Equity REITs Index or a composite index of RORI REITs in the apartment, office, retail, and industrial property sectors. The contemporaneous correlation between All Equity REITs and ODCE is 0.20 and between ODCE and RORI REITs is 0.24.

Lagging REITs improves the correlations with ODCE reflecting the lagged private returns. The two quarter lagged return correlation between ODCE and All Equity REITs is 0.59 and the correlation between ODCE and the RORI REITs composite is 0.64. Lagging to one year slightly decreases the correlations. At two years, the correlation is less than no lag. CEM Benchmarking uses a more precise method of de-lagging private real estate and finds a 0.91 correlation between REITs and unlisted real estate returns held in defined benefit pension funds from 1998 to 2020.

Commercial real estate remains highly correlated across all property sectors, and investors can expect that REITs will remain a leading indicator of private real estate performance. However, REITs provide important diversification benefits, offering a wider range of property sectors. When tracking benchmarks in listed and unlisted real estate, some of the difference will be in composition, not just in timing.