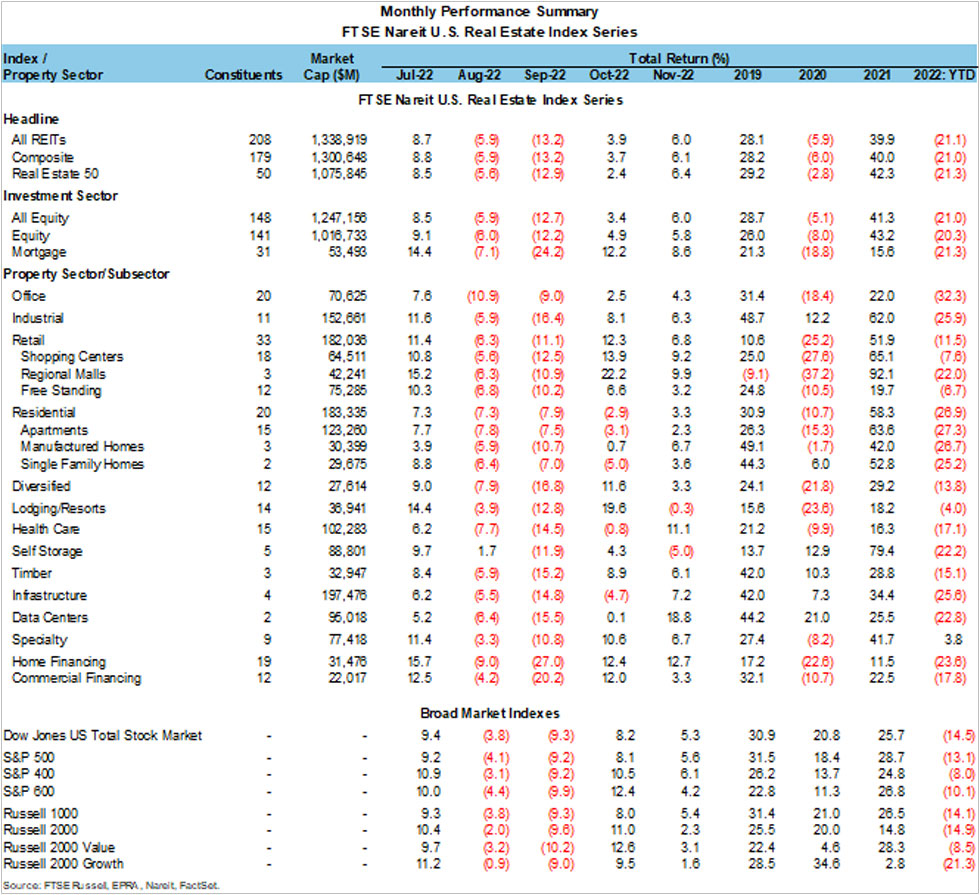

REITs posted positive results for the second consecutive month in November and outperformed stocks for the first time since April, as the FTSE Nareit All Equity REITs Index rose 6.0% and the FTSE Nareit Equity REITs Index gained 5.8%. Broader markets rose as well, as the Russell 1000 and Dow Jones U.S. Total Stock Market were up 5.4% and 5.3%, respectively.

Roughly 60% of the gains for both REITs and stocks came in the final two trading sessions of the month as optimism increased that the pace of monetary policy tightening could slow as early as December. The yield on the 10-year Treasury fell 40 basis points to end the month at 3.7%.

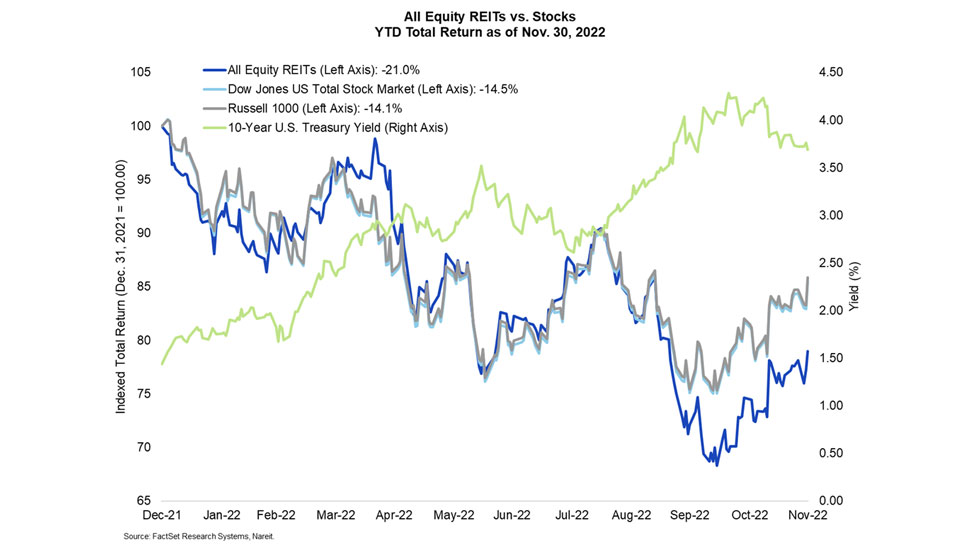

Through the end of the month, total returns year-to-date were:

- All Equity REITs: -21.0%

- Russell 1000: -14.1% ;

- Dow Jones U.S. Total Stock Market: -14.5%

Most property sectors posted strong performance in November, led by data centers at 18.8%, health care at 11.1%, and infrastructure at 7.2%. Lodging/resorts fell 0.3% for the month after rising 19.6% in October, and self-storage fell 5.0%.

Mortgage REITs continued to post strong returns in November, with a total return of 8.6% following a gain of 12.2% in October. Home financing mREITs returned 12.7% and commercial financing mREITs returned 3.3% for the month.