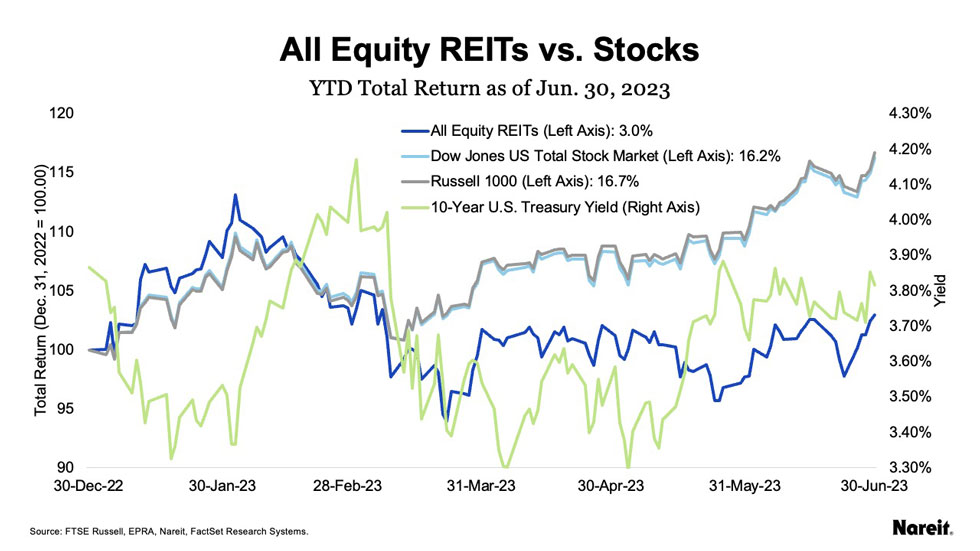

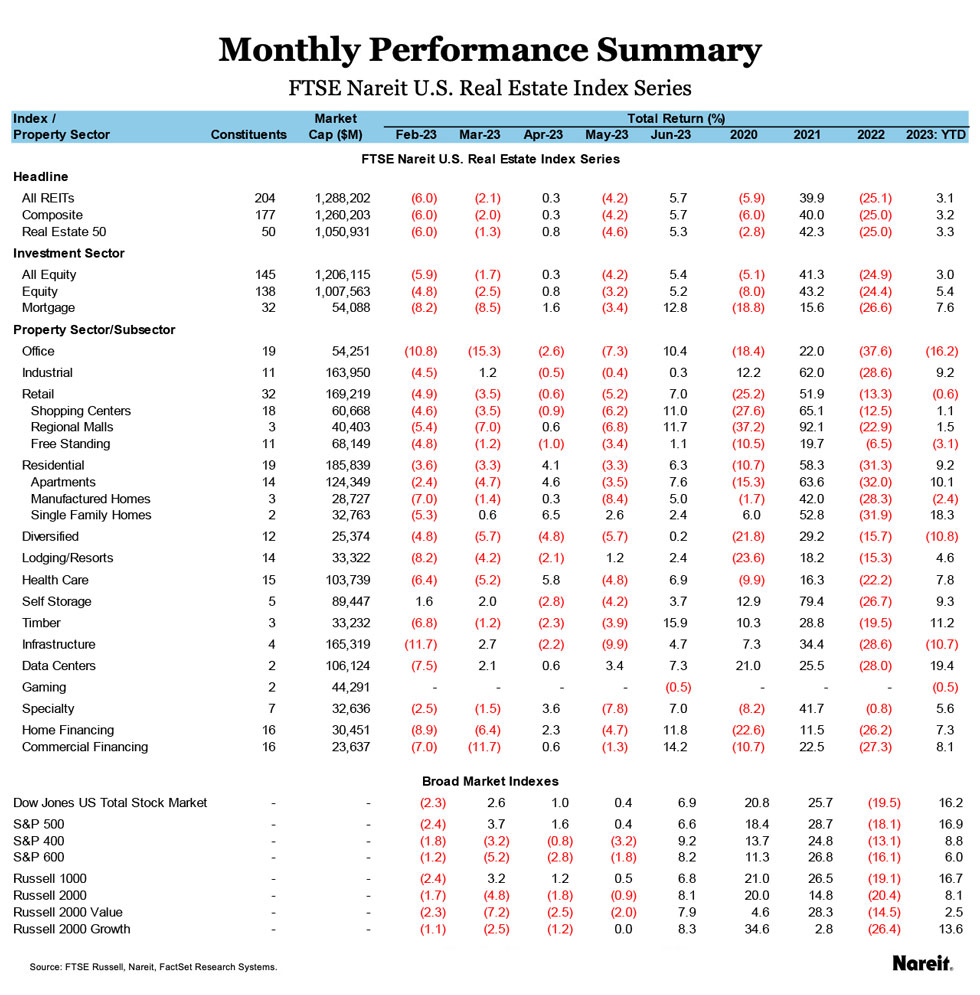

The FTSE Nareit All Equity REITs Index posted its strongest monthly performance since January with a total return of 5.4%, and the FTSE EPRA Nareit Global Extended Index rose 3.8% in June. While the Federal Reserve elected to pause its monetary policy-tightening, Fed Chair Jerome Powell indicated most members believe further rate hikes will be necessary in 2023. Broader markets also posted strong gains, as the Dow Jones U.S. Total Stock Market gained 6.9% and the Russell 1000 was up 6.8%. On a year-to-date basis, the All Equity REITs Index has returned 3.0% and the Global Extended Index is up 0.2%. The yield on the 10-Year Treasury traded in a narrow range, rising 100 basis points to end the month at 3.8%.

After declining every month since January, the office sector surged 10.4% in June, in part due to positive reception of a transaction involving a New York office asset. The deal terms alleviated some concerns of both lenders and investors, as the tepid transaction volume for New York office since the pandemic has made it difficult to get a clear view of asset prices.

As shown in the above chart, REITs continue to underperform broader markets on a year-to-date basis, with total returns as follows:

- All Equity REITs: 3.0%

- Russell 1000: 16.7%

- Dow Jones U.S. Total Stock Market: 16.2%

As laid out in the table above, property sector performance was strong across the board in June. Timber, office, and data centers led with returns of 15.9%, 10.4%, and 7.3%, respectively. Diversified lagged with a total return of 0.2%, followed by industrial at 0.3%, and lodging/resorts at 2.4%. The newly-launched gaming sector traded sideways, declining 0.5% from start of trading on June 20; from Dec. 31, 2019 through Jun. 30, 2023, gaming REITs posted a cumulative total return of 51.0%. On a year-to-date basis, data centers, timber, and self-storage have performed the strongest, with respective returns of 19.4%, 11.2%, and 9.3%. Mortgage REITs posted strong gains in June, rising 7.6%. Commercial financing mREITs were up 8.1% for the month and home financing mREITs rose 7.3%.