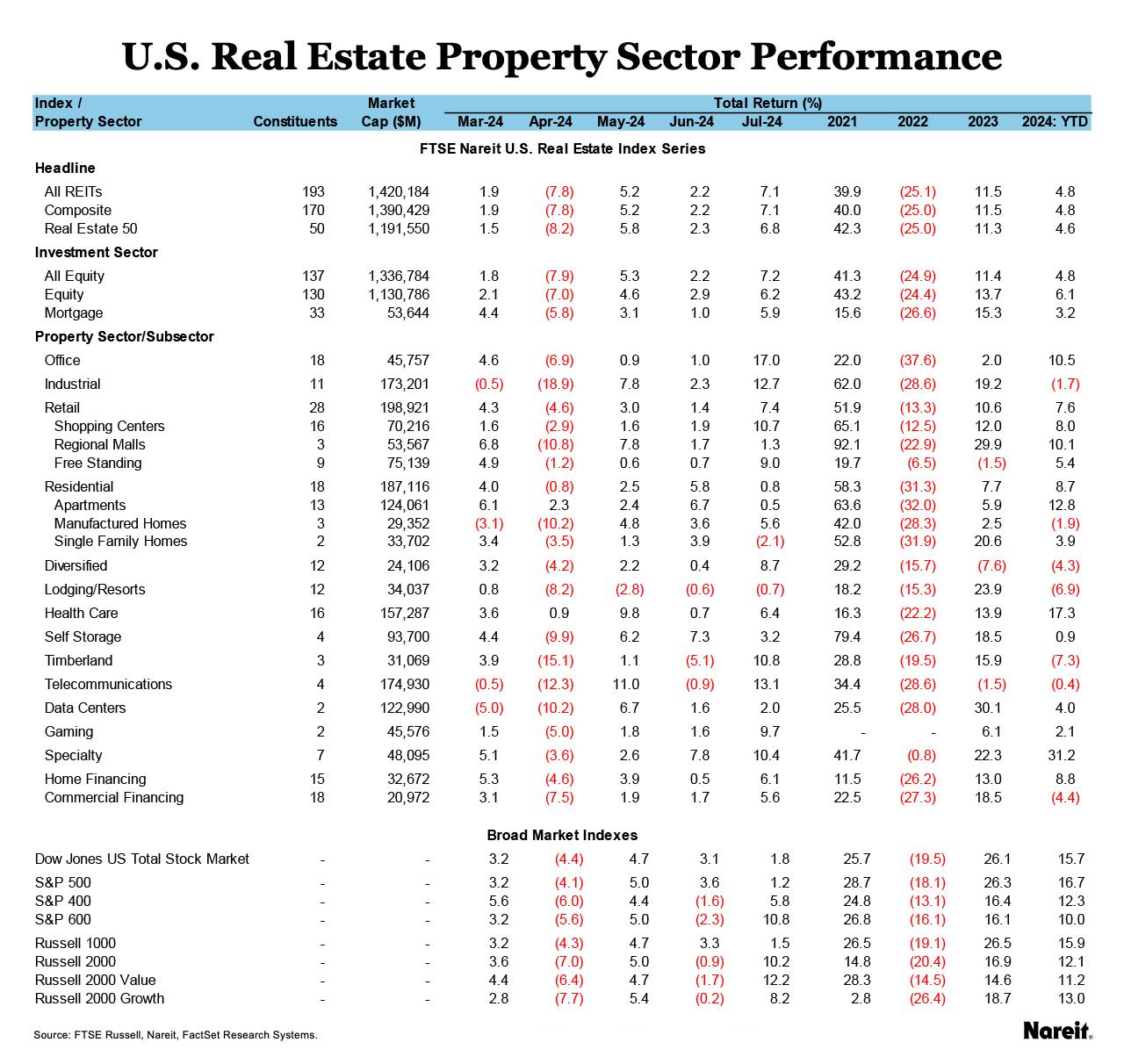

The FTSE Nareit All Equity REITs Index returned its strongest monthly performance of the year in July, posting a total return of 7.2% and outperforming broader markets. The Dow Jones U.S. Total Stock Market and Russell 1000 rose 1.8% and 1.5%, respectively. While it remains unclear when the Federal Reserve will begin to cut interest rates, most investors are beginning to expect a cut in September, as inflationary measures continue to approach the central bank’s target range.

The yield on the 10-Year Treasury declined 32 basis points in July to end the month at 4.05%. The dividend yield on the FTSE Nareit All Equity REITs index was 3.86% and the FTSE Nareit Mortgage REITs Index yielded 11.97%, compared to 1.27% for the S&P 500.

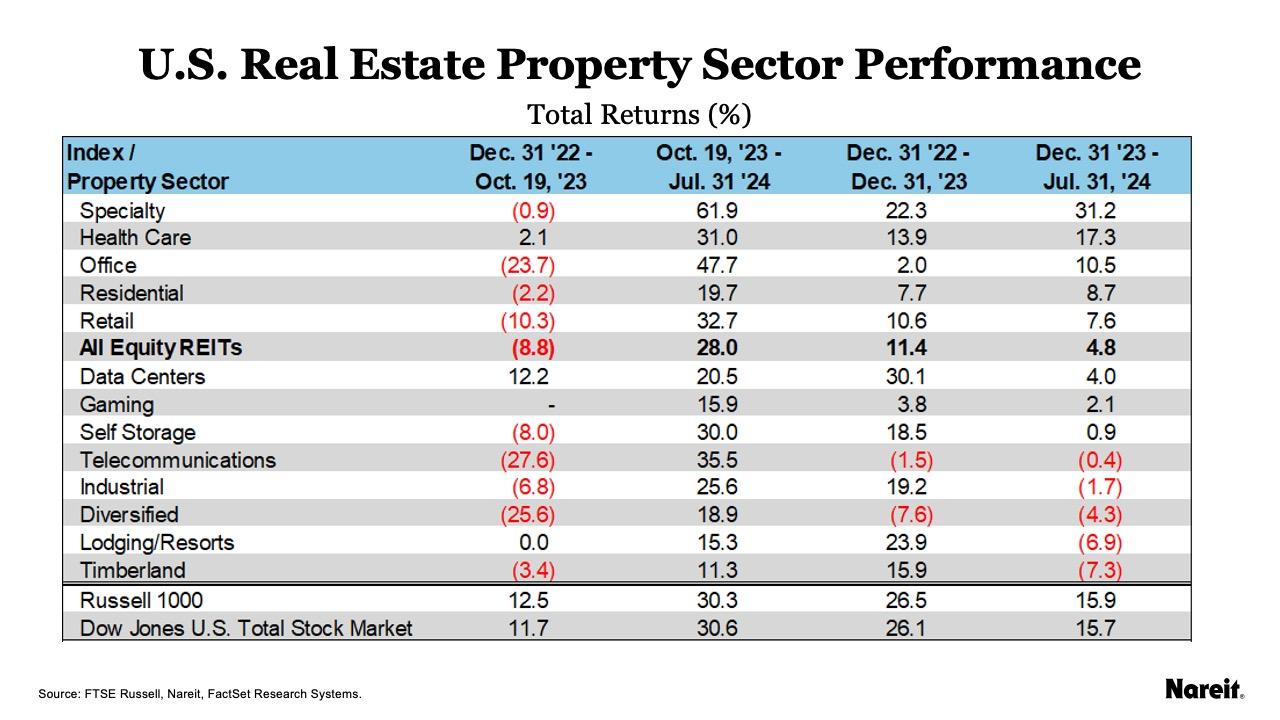

The All Equity REITs index is up 28.0% since Oct. 19, 2023, when the yield on the 10-Year Treasury hit 4.98%. On a year-to-date basis, the index has returned 4.8%. Since October 2023, the Dow Jones U.S. Total Stock Market is up 30.6% and the Russell 1000 is up 30.3%. In 2024, the Russell 1000 is up 15.9% and the Dow Jones U.S. Total Stock Market is up 15.7%.

By sector, July was a broadly positive month, as office led with a total return of 17.0%, followed by telecommunications at 13.1% and industrial at 12.7%. At the subsector level, shopping centers led with a return of 10.7%. Lodging/resorts was essentially flat for the month, posting a return of -0.7%. On a year-to-date basis, specialty continues to outperform with a total return of 32.2%, followed by health care at 17.3%, and office at 10.5%.

The FTSE Nareit Mortgage REITs Index performed well in July as well, rising 5.9%, and it is now positive on a year-to-date basis with a return of 3.2%. Home financing rose 6.1% in July and commercial financing was up 5.6%. Year-to-date, home financing is up 8.8% and commercial financing is down 4.4%.