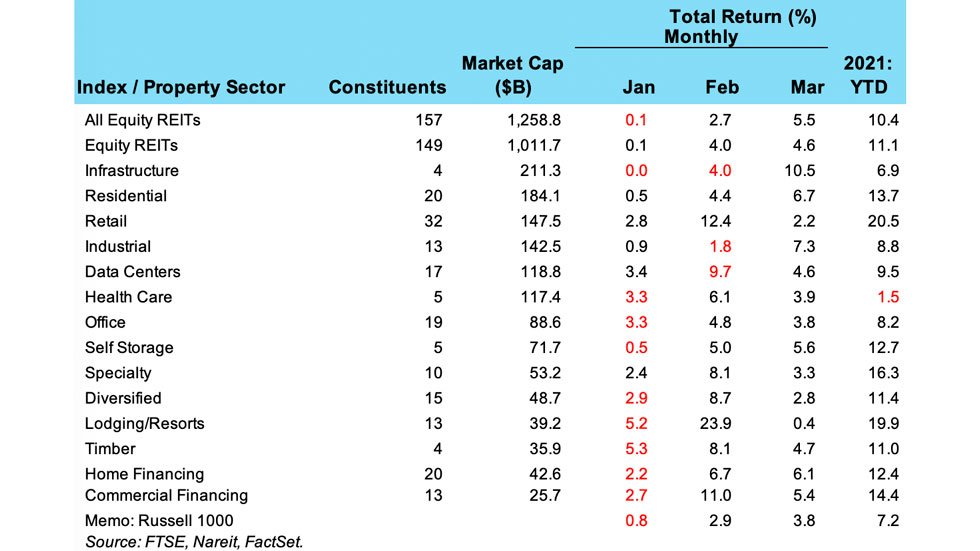

The recovery in REIT share prices gained momentum in March as the FTSE Nareit All Equity REITs index delivered a total return of 5.5%. This is more than twice the return the prior month, and outpaced the 3.8% return on the Russell 1000.

Every property sector posted increases last month. Returns ranged from the slight 0.4% for lodging/resorts (which came, however, on top of the 23.9% gain in February) to 10.5% for infrastructure. Both categories of mREITs had positive returns, with a 6.1% total return for home financing mREITs and a 5.4% return for commercial financing mREITs.

REITs had a total return of 10.4% for the first quarter (i.e. year-to-date). The sectors that had initially shown the most negative reaction to the shutdowns during the pandemic are having the strongest stock market performance this year. Retail REITs are up 20.5% so far in 2021, and lodging/resort REITs are not far behind with a 19.9% return. Most other sectors are also in the double-digits in 2021.